Domestic programs are the main reason that the burden of government spending is expanding, with so-called entitlement outlays deserving the lion’s share of the blame.

But this does not mean that advocates of limited government should give the Pentagon a free pass.

As with all types of spending, there should be a cost-benefit assessment of whether a particular program or activity makes sense.

One of the costs (of military spending and every other type of spending) is that resources are diverted from the productive sector of the economy.

That means that reducing the Pentagon’s budget – holding everything else equal – will boost growth.

By how much? Anthony Mayberry of the University of Oklahoma has some new research that measures the economic impact of lower military expenditures.

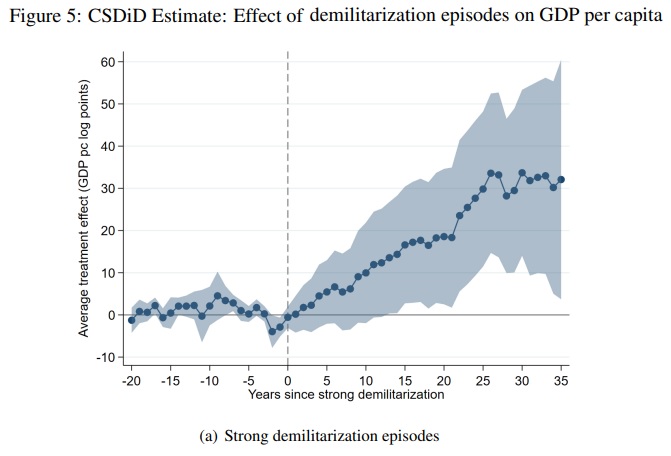

This paper analyzes the implications of demilitarization on economic growth. I create a new dataset of military transitions since 1960 and measure the effect of demilitarization in countries that reduced their military capabilities and subsided aggressive or violent behavior. Semiparametric difference-in-difference and instrumental variable estimates predict that on average, demilitarization is associated with a 1% higher annual GDP per capita than if the country had remained militarized. Dynamic analysis shows that on average, GDP per capita is 15-20% higher 20 years after transition. Increases in foreign direct investment and international trade flows, as well as a reallocation of resources to more economically productive outlets, following demilitarization are found to contribute to growth. These findings provide empirical evidence in support of a Peace Dividend.

And if the reduction in military spending is significant, as seen in Figure 5 from the study, the economic gains can be remarkably significant.

To be sure, there are caveats, some of which are discussed in the study.

One obvious complication is that a country may be able to lower military outlays because some external threat has dissipated.

In that scenario, how much of the subsequent growth is because the threat has diminished and how much is because there is a lower burden of government spending?

The answer presumably is different for every real-world case study. But the bottom line is that it is good to lower military spending just like it is good to reduce domestic spending.

I’ll close by acknowledging that advocates of military spending should base their arguments on cost-benefit analysis.

Don’t make silly Keynesian arguments about multiplier effects. Don’t make exaggerated claims about spin-off benefits. Instead, make a clear-headed case that the cost of military spending can be justified because it provides a national security benefit (against an imperialist Soviet Union forty years ago, or perhaps an expansionist China today).

P.S. It would be helpful if supporters of a strong military opposed some of the many ways that politicians insert waste, fraud, inefficiency, and pork in the Pentagon’s budget.

P.P.S. The U.S. experience after World War II is a good example of how lower military spending triggers more growth.

P.P.P.S. My three-part series on the economics of war can be read here, here, and here.

———

Image credit: David B. Gleason | CC BY-SA 2.0.