Even though they ostensibly exist to promote economic growth, the International Monetary Fund (IMF) and Organization for Economic Cooperation and Development (OECD) have an unfortunate track record of promoting higher taxes and bigger government.

Not that we should be surprised. IMF and OECD officials get very comfortable (and tax-free!) salaries, so they have a “public choice” incentive to reflect the wishes of the politicians who control their purse strings.

But understanding the incentives of international bureaucrats definitely does not mean we should give them a free pass when they push bad policy.

And that’s exactly what the IMF and OECD are doing in Latin America.

Consider, for instance, the new IMF report on “Tax Policy for Inclusive Growth in Latin America and the Caribbean.” The authors (Santiago Acosta-Ormaechea, Samuel Pienknagura, and Carlo Pizzinelli) apparently think those struggling nations will grow faster if there is a bigger burden of government.

…fiscal policy…is not progressive enough… This paper presents a detailed assessment of tax structures in LAC and outlines reform options to improve collection… Specific tax design features are then assessed, inspecting how the taxation of capital and labor can be improved…to both increase revenue and provide a more equitable tax structure… Evidence for LA7 countries shows that better PIT design could bring significant gains in collection and equity. … Potentially adverse growth impacts could be mitigated by providing well-targeted incentives to labor force participation of low-wage earners through an earned income tax credit… Increasing the tax burden on certain non-labor income sources (e.g., capital gains) would also raise PIT revenue and improve equity… Other untapped revenue sources should be considered more forcefully, including the taxation of immovable property, inheritance taxes, and environmental taxes.

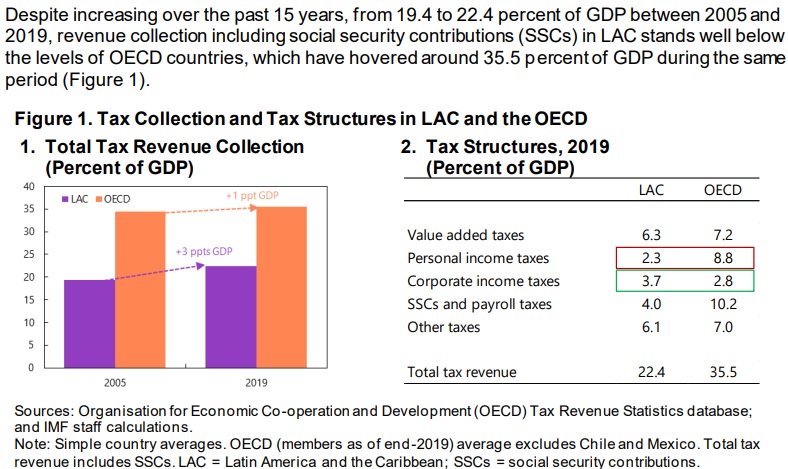

As illustrated by Figure 1 from the report, one of the clear messages is that Latin American countries should be more like high-tax countries in Western Europe.

What the authors overlook, however, is that the (relatively) rich countries in Western Europe became rich when the burden of government was very small.

There’s never been a nation, anywhere in the world, or at any point in world history, that became rich by adopting big government.

Now let’s look at what the OECD recommends, as part of “Latin American Economic Outlook 2021: Working Together for a Better Recovery.”

The LEO 2021 provides tailored policy messages to help stakeholders take action and build forward better. …it highlights the need to learn from the pandemic and mainstream some of the social policy innovations adopted throughout the crisis to strengthen social protection systems and improve quality and accessibility of public services. …a set of tax policy options could increase revenues… there needs to be greater resource mobilisation…in most LAC countries, which in turn implies greater progressivity of the taxation system… the average tax-to-GDP ratio in the LAC region was 22.9% in 2019, considerably below the OECD average of 33.8%… Countries may need to consider additional ways of raising revenues… PIT is the principal factor behind the tax gap between LAC and the OECD, limiting not only potential revenues but also the redistributive power of the tax system… taxation of immovable property…and of individuals’ capital gains, should contribute to increasing revenues to finance the recovery and improve the progressivity of the taxation system. Other measures include wealth and inheritance taxes.

Table 1 from the report summarizes the “new social contract” that the OECD is advocating.

All you need to understand is that “strengthening social protection systems and public services” is bureaucrat-speak for more government spending and “developing fairer and stronger tax systems” is bureaucrat-speak for higher taxes and class warfare.

I’ll close by calling your attention to this video explaining the ideal fiscal policy for nations in the developing world.

But remember that fiscal policy is just one piece of the puzzle, so I also recommend this video and this video if you want a full understanding of the policies that are needed to create broadly shared prosperity.