Sadly, Joe Biden’s plan for a bigger IRS is becoming reality. As you might imagine, I’m not happy.

I’m motivated to share the above video, which was part of last week’s episode of The Square Circle, because it galls me to see some writers defend huge budget increases for the internal revenue service while simultaneously overlooking very serious problems.

Such as.

- Scandals at the IRS

- Criminal behavior at the IRS

- Corruption at the IRS

- The truth about the IRS budget

- Partisan behavior at the IRS

- Embracing dishonest numbers at the IRS

- Abuses of power at the IRS

The latest example of IRS sycophancy comes from Paul Waldman of the Washington Post.

Here’s some of what he wrote.

…with the pending passage of the Inflation Reduction Act, we may finally begin to turn the tide in a war only one side has been fighting…this is something all Americans should celebrate. …The bill contains nearly $80 billion for the Internal Revenue Service… With this bill, it would be able to hire as many as 87,000 new employees…the wealthy and corporations don’t pay their fair share. …Americans don’t mind paying taxes, as long as they believe the system is fair.

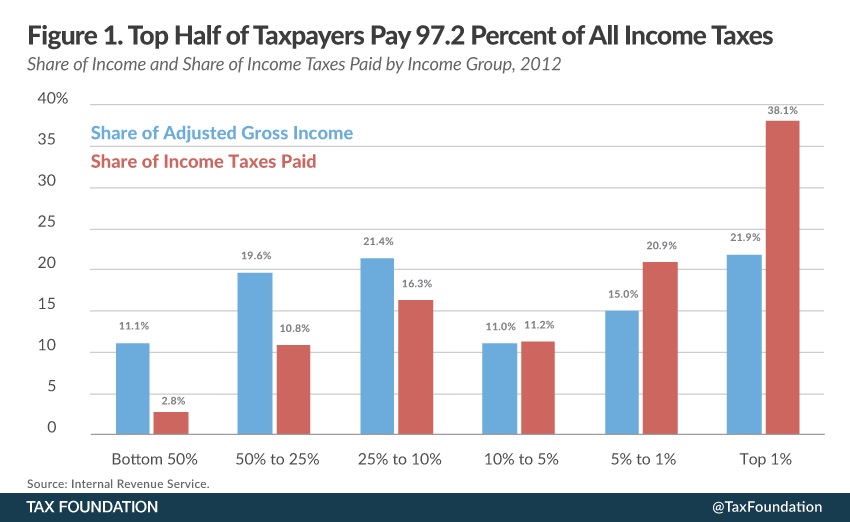

It’s not just that Waldman fails to address problems at the IRS. He also is either very misinformed or very dishonest about who pays the lion’s share of income taxes.

For instance, even the IRS freely admits that upper-income taxpayers finance a hugely disproportionate chunk of the income tax burden.

And if he didn’t want to accept data the objects of his affection at the IRS he could peruse numbers from the Tax Foundation. Or rely on data from the Congressional Budget Office.

Sadly, facts don’t matter to some of our friends on the left. Too many of them seem to think government should have first claim on anything taxpayers earn, particularly if they are successful.

The bottom line if that envy and spite should not be guiding principles for taxation.

Let’s close by revisiting Waldman’s column and reviewing his assertion about “three things we should all be able to agree on.”

We need a government. …In order to have a government, we need to collect taxes. …If we’re going to collect taxes, the agency that does it should operate as efficiently and effectively as possible.

To which I respond.

- We need a government, but not a bloated, ever-expanding leviathan.

- We need to collect taxes, but we did just fine for more than 100 years with no income tax.

- An efficient and effective IRS will be far more likely with a simple and honest tax system.

Needless to say, I won’t hold my breath waiting for #3 to happen.

P.S. If today’s topic is too depressing, here’s some IRS-themed humor to hopefully boost your mood.

P.P.S. Mr. Waldman is not the only IRS sycophant.

P.P.P.S. While readers will not be surprised that politicians such as Elizabeth Warren want a bigger and more intrusive IRS. But how many of them realize Trump and his team also were bad on this issue?

———

Image credit: TravelingOtter | CC BY-SA 2.0.