The 1930s arguably was America’s worst decade for economic policy and economic results.

Herbert Hoover and Franklin Roosevelt both increased the burden of government and the net result was a decade-long depression.

The insult to injury was that some people then blamed free enterprise. Indeed, there are still people who think government actually saved the economy.

Sort of like applauding an arsonist after a fire is extinguished.

Whenever I deal with people who harbor these illusions, I ask them a series of questions, none of which have good answers (at least if the goal if to maintain the illusion).

- Was it the fault of capitalism that the Fed pursued bad monetary policy?

- Was it the fault of capitalism that Hoover imposed protectionism?

- Was it the fault of capitalism that Hoover and FDR expanded intervention?

- Was it the fault of capitalism that Hoover and FDR increased spending?

Today, let’s look at the role of tax policy in the 1930s. Chris Edwards wrote on this topic last week, citing a new book by Art Laffer, Brian Domitrovic, and Jeanne Cairns Sinquefield.

Here are some excerpts from Chris’ article.

Many economists would point to monetary policy mistakes for causing the initial slide into the Great Depression. …But Laffer and coauthors argue that the “chief cause of the Great Depression was taxation.” That is a bold claim because policymakers made many mistakes during the 1930s. …Let’s explore the major tax increases of the 1930s… Herbert Hoover signed the first two laws listed here and Franklin Roosevelt the others.

Smoot‐Hawley Tariff Act of 1930.

Revenue Act of 1932.

Gold Confiscation.

Agricultural Adjustment Act.

National Industrial Recovery Act.

Alcohol.

Revenue Act of 1934.

Revenue Act of 1935.

Social Security Act of 1935.

Revenue Act of 1936.

Revenue Act of 1937.

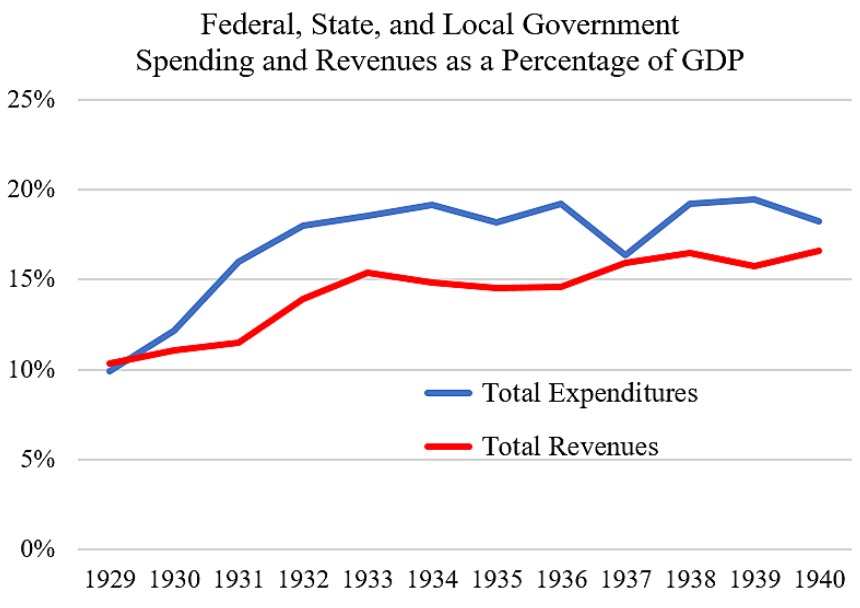

Revenue Act of 1938.State and local governments jacked up taxes during the 1930s. …high earners responded strongly to the income tax increases of the 1930s… the reported incomes of high earners got slugged in the early 1930s and remained low the rest of the decade. This suggests major economic damage. …Despite these taxpayer responses to higher tax rates, …governments did manage to squeeze substantially more money out of the public during the 1930s. Tax revenues as a percentage of GDP rose from 10.3 percent in 1929, to 15.4 percent in 1933, and then to 16.6 percent in 1940. Meanwhile, government spending soared from 9.9 percent of GDP in 1929 to 18.0 percent in 1932, and then remained near the higher level the rest of the decade.

Here’s a chart that accompanied the article showing the aggregate increases in the fiscal burden of government.

You’ll notice that aggregate tax revenues increased by about 60 percent during the 1930s.

Yet tax rates increased by a far greater amount. There’s a lesson to be learned, as I explained last year, about the Laffer Curve.

P.S. Our friends on the left like class-warfare tax increases because they hurt the rich, but they don’t seem to care that everyone else suffers collateral damage.