Back in 2017, the Center for Freedom and Prosperity released this video to help explain why spending caps are the most sensible and sustainable fiscal rule.

Switzerland actually has a spending cap in its constitution, and similar fiscal rules also exist in Hong Kong and the state of Colorado.

These policies have produced very good results.

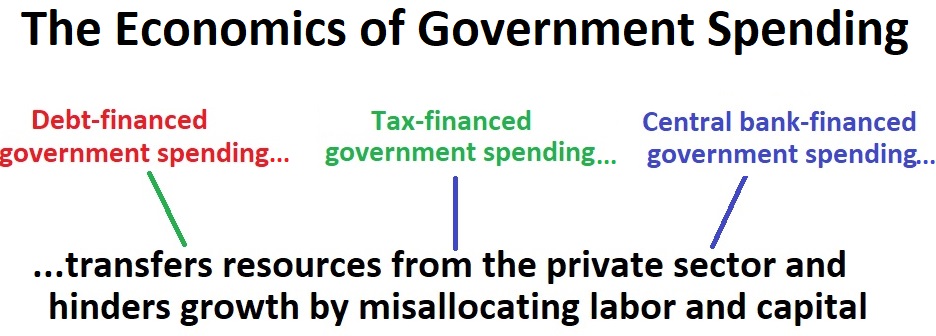

There are many reasons to support a spending cap, including the obvious observation that an expenditure limit (as it is sometimes called) directly addresses the actual problem of excessive government.

And addressing the underlying disease works better than rules that focus on symptoms, such as balanced budget requirements or anti-deficit mandates.

You’ll notice toward the end of the video that the narrator cites pro-spending cap research from international bureaucracies, which is remarkable since those institutions normally have a bias for bigger government.

I’ve also written about that research, citing studies by the International Monetary Fund (here and here), the Organization for Economic Cooperation and Development (here and here) and the European Central Bank (here).

Today, let’s look at more evidence from these bureaucracies.

We’ll start with a new study from the European Central Bank. Here’s some of what the authors (Nicholai Benalal, Maximilian Freier, Wim Melyn, Stefan Van Parys, and Lukas Reiss) found when comparing spending limits and anti-deficit rules.

…this paper provides an in-depth assessment of two alternative measures of fiscal consolidation and expansion: the change in the structural balance (dSB) and the expenditure benchmark (EB). Both the dSB and the EB are currently used to assess compliance with the fiscal rules under the Stability and Growth Pact (SGP). …The EB was introduced as an indicator in 2011, and has gained in importance relative to the dSB since the European Commission began to put more emphasis on it in 2016. …A comparison of the fiscal performance of euro area countries reveals significant differences depending on whether the assessment is based on the dSB or the EB. …this paper finds that the EB has advantages over the dSB as a fiscal performance indicator. …expenditure rules…provide more predictability in fiscal requirements. …Even more importantly, the EB can be shown to be less procyclical as a fiscal rule than the dSB.

Let’s also review some 2019 research from the International Monetary Fund.

This study (authored by Kodjovi Eklou and Marcelin Joanis) looks at whether fiscal rules can constrain vote-buying politicians.

In order to increase their chances of reelection, politicians are known to undertake fiscal manipulations, especially in election years. These fiscal manipulations typically take the form of increased public expenditure… Many countries, both developed and developing, have adopted fiscal rules in recent decades as an attempt to enforce fiscal discipline. …In this paper, we employ a cross-country panel dataset in order to test whether fiscal rules adopted in developing countries have been effective in constraining political budget cycles. The dataset covers 67 developing countries over the period 1985-2007. …Our dependent variable is the general government’s final consumption expenditure as a share of GDP.

Here’s what the authors concluded about the effectiveness of spending caps.

Our empirical evidence in a sample of 67 developing countries over the period 1985-2007, shows that fiscal rules cause fiscal discipline over the electoral cycle. More specifically, in election years with fiscal rules in place, public consumption is reduced by 1.65% point of GDP as compared to election years without these rules. Furthermore, the effectiveness of these rules depends on their type… In particular, expenditure rules, rules covering the general government and rules characterized by a monitoring body outside the government dampen political budget cycles in government consumption.

Indeed, footnote 12 of the paper specifically notes the superiority of expenditure limits.

…the results show that public consumption is reduced by 2.44% points during election years with expenditure rules in place. The findings on expenditure rules are consistent with Cordes et al. (2015) who show that the compliance rate for these rules are high.

Last but not least, the fiscal experts at the Office of Management and Budget included in Trump’s final budget some very encouraging language at the end of Chapter 10 of the Analytical Perspectives.

…additional efforts to control spending are needed. Several budget process reforms should be considered, including setting spending caps… Outlay caps that are consistent with the historical average as a share of gross domestic product (GDP), post-World War II levels could be enforced with sequestration across programs similar to other budget enforcement regimes. An outlay cap on mandatory spending would complement discretionary caps, which have been in place since 2013. The Budget proposes to continue discretionary caps through 2025 at declining levels and declining levels through 2030.

Trump was a big spender, of course, but at least there were people in his administration who realized there was a problem.

And they recognized the right solution.

P.S. It’s also interesting that the authors of the IMF study found that fiscal rules work better in democracies.

…estimates focusing on the subsample of democratic elections. The effect of fiscal rules on the political budget cycle is larger… More specifically, public consumption is reduced by 2.46% point of GDP (while it is 1.65% point in the baseline).

This may not bode well for the durability of Hong Kong’s spending cap.

The authors also found that foreign aid makes it less likely that a government will follow sensible policy.

Foreign aid, which relaxes the budget constraint of the government, is negatively correlated with the probability of having fiscal rules.

Needless to say, nobody should be surprised to learn that foreign aid undermines good policy.