When I compare the United States and Europe, it’s usually because I want to make the point that people on the other side of the Atlantic have lower living standards in large part because there is a more onerous fiscal burden of government.

Simply stated, America’s medium-sized welfare state doesn’t do as much damage as the large-sized welfare states in Europe.

But I also use US-vs.-Europe comparisons to make another point, namely that big welfare states mean big tax burdens for lower-income and middle-class households.

To be more specific, most of Europe’s redistribution spending is financed by high tax burdens on regular people.

Yes, European politicians impose onerous burdens on upper-income taxpayers, but there simply are not nearly enough rich people to finance big government.

So those politicians have responded by pillaging everyone else as well (onerous payroll taxes, harsh value-added taxes, high income tax rates on modest incomes, etc).

The United States takes a different approach. We also impose onerous burdens on upper-income taxpayers (as confirmed by IRS data), but we impose comparatively modest taxes on everyone else.

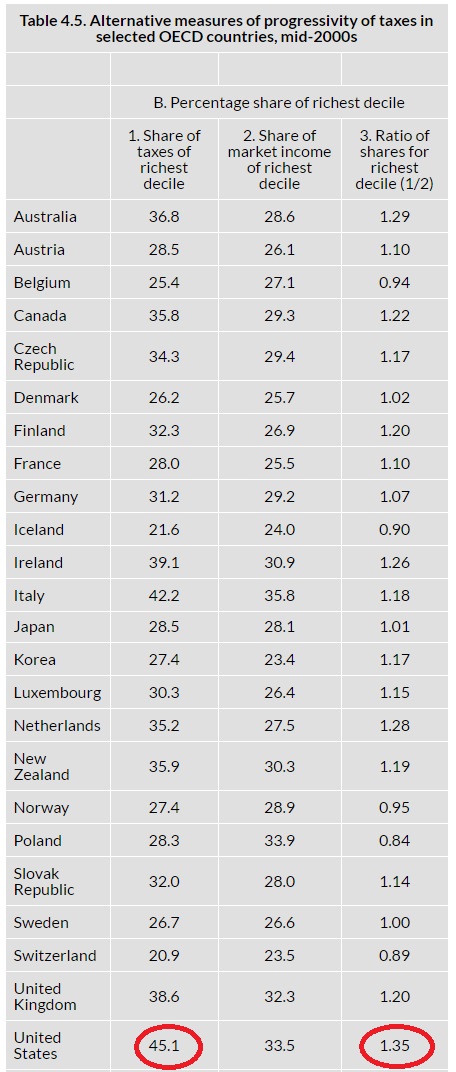

Indeed, the net result, as shown in the table, is that the United States actually has the most “progressive” tax system among OECD nations.

Today, let’s look at some research that makes similar points.

Three academics at the Paris School of Economics authored a study for the World Inequality Lab that uses a new database to measure redistribution and inequality.

Their main conclusion is that there are differences between the United States and Europe, but redistribution policies don’t have a big impact on inequality.

This article addresses…substantive and methodological issues by constructing distributional national accounts for twenty-six European countries from 1980 to 2017. To our knowledge, this is the first attempt at doing so. …our series are fully comparable with recently produced US distributional national accounts, allowing us to compare the dynamics of inequality and redistribution in the two regions in great detail. Two key findings emerge from the analysis of our new database. First, we show that, over the past four decades, inequality has increased in nearly all European countries as well as in Europe as a whole, both before and after taxes, but much less than in the United States. …Second, the main reason for Europe’s relative resistance to the rise of inequality has little to do with the direct impact of taxes and transfers. While Western and Northern European countries redistribute a larger fraction of output than the US (about 47% of national income is taxed and redistributed in Europe versus 35% in the US), the distribution of taxes and transfers does not explain the large gap between Europe and US posttax inequality levels. Quite the contrary: after accounting for all taxes and transfers, the US appears to redistribute a greater fraction of its national income to the poorest 50% than any European country.

What drives these results?

Simply stated, the most salient feature of European fiscal policy is that nations tax the middle class and have programs that benefit the middle class.

The United States, by contrast, focuses more on taxing the rich and giving benefits to the poor.

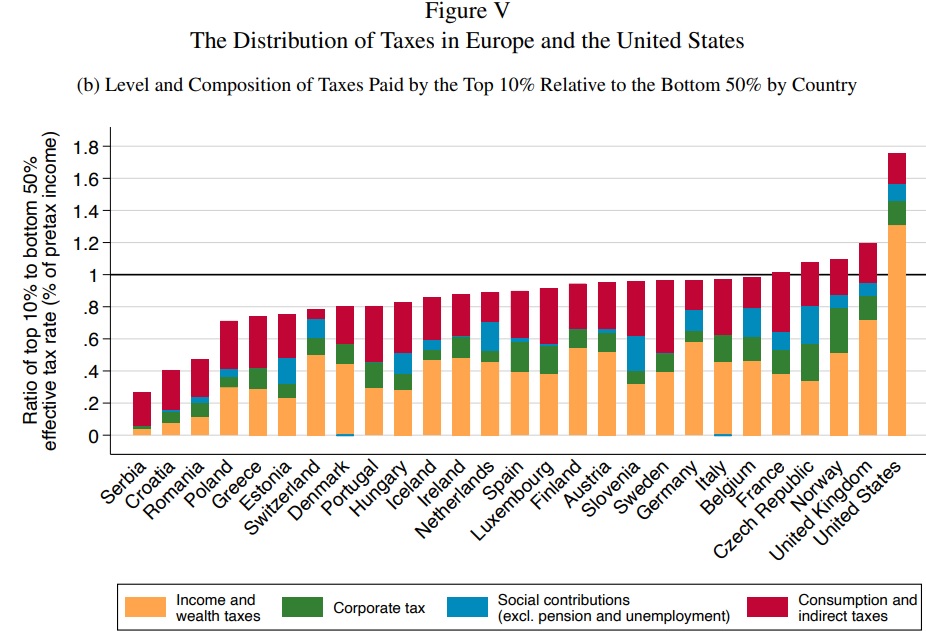

Look at what the study says about tax progressivity.

Figure Vb ranks European countries and the United States according to a simple measure of tax progressivity: the ratio of the total tax rate faced by the top 10% to that of the bottom 50%. The composition of bars correspond to the composition of taxes paid by the top 10%. The US stands out as the country with the highest level of tax progressivity: the top decile faces a tax rate that is more than 70% higher than that of the poorest half of the population. By this measure, the European country with the most progressive tax system is the United Kingdom, followed by Norway, the Czech Republic, and France. Many European countries have values close to 1 on this indicator, corresponding to relatively flat tax systems, in which top income groups face a tax rate approximately equal to that of the bottom 50%. …the US also stands out as one of the countries where the top 10% pay the largest share of their pretax income in the form of income and wealth taxes.

And here’s Figure V, which shows how the U.S. has (far and away) the most “progressive” tax system.

Again, I want to emphasize that this is not because the U.S. imposes higher taxes on the rich. The so-called progressivity of the American system is driven by the fact that there are low taxes on everyone else.

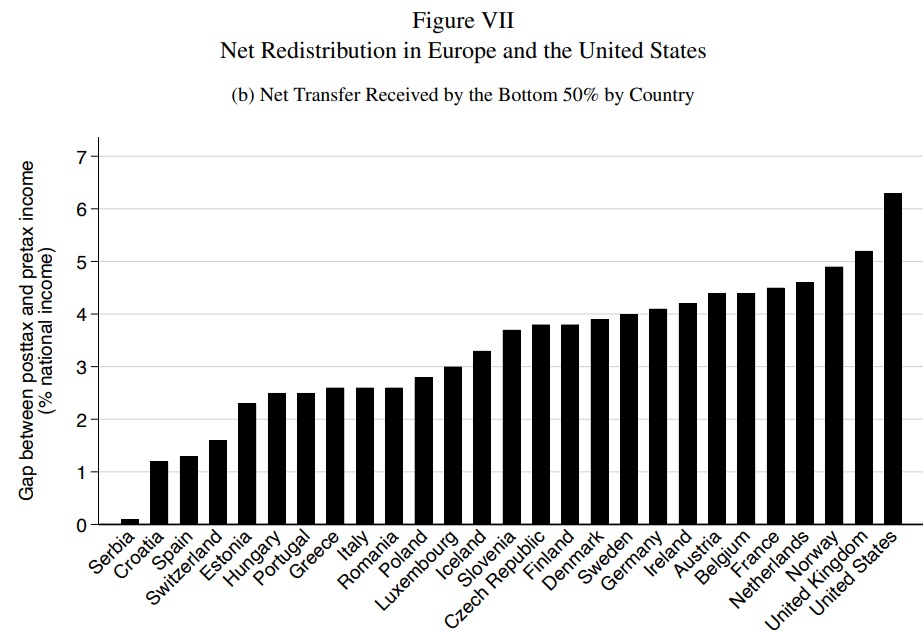

What about on the spending side of the fiscal ledger?

The study finds that the the United States has the most redistribution to lower-income people.

…the US tax-and-transfer system appears to be unequivocally more progressive. The bottom 50% in the US received a positive net transfer of 6% of national income in 2017, compared to about 4% in Western and Northern Europe and less than 3% in Eastern Europe. Meanwhile, the top 10% saw their average income decrease by 8% of national income in the US after taxes and transfers, compared to about 4% in Western and Northern Europe and 3% in Eastern Europe. …Figure VIIb represents the net transfer received by the bottom 50% in all European countries and the United States in 2017. Again, the US stands out as the country that redistributes the greatest fraction of national income to the bottom 50%.

Here’s the aforementioned Figure VII.

I’ll close by observing that there are multiple interpretations of this data. I suspect that authors want readers to conclude that there should be higher taxes and more redistribution. Both in Europe and the United States.

My big takeaway is that this research confirms why people with modest incomes in the United States have a better life than their counterparts in Europe.

Not only do they enjoy higher levels of income, but they also pay much lower tax burdens.

P.S. One other point to emphasize is that it’s wrong to fixate on inequality. In part, that’s because there’s nothing wrong with rich people getting richer (assuming they earn their money rather than getting special favors from politicians). But also because ethical people should be concerned about improving the lives of the less fortunate rather than tearing down the successful.