I’ve written many times about terrible economic policy in Argentina, most recently two days ago while in that benighted country for a conference on fiscal policy.

Now that I’m heading back to the United States, I’m contemplating whether it is realistic to imagine an economic turnaround for Argentina.

We’ll start with some good news. Argentina has miserably low scores in Economic Freedom of the World and the Index of Economic Freedom.

So it would not be that difficult for economic policy to improve.

But the bad news is that Argentina needs to go way beyond incremental reform. The country has dropped precipitously since Peronism began after World War II. Rejuvenating the economy will require radical Chilean-style reform.

Given the current government’s statist orientation (and given the timidity of the opposition), there’s very little short-run hope.

But I am vaguely hopeful that things may get better. More specifically, Argentina almost surely will suffer a major collapse at some point in the future.

When that happens, the only option will be liberalization. Simply stated, politicians no longer will have any ability to pillage the private sector (sort of like the Soviet Union and Eastern Europe when communism collapsed).

Naomi Klein views this scenario as “disaster capitalism,” but it’s the only hope for Argentina.

But there’s a catch. Politicians in Buenos Aires will only be forced to reform if they don’t get another bailout from the International Monetary Fund.

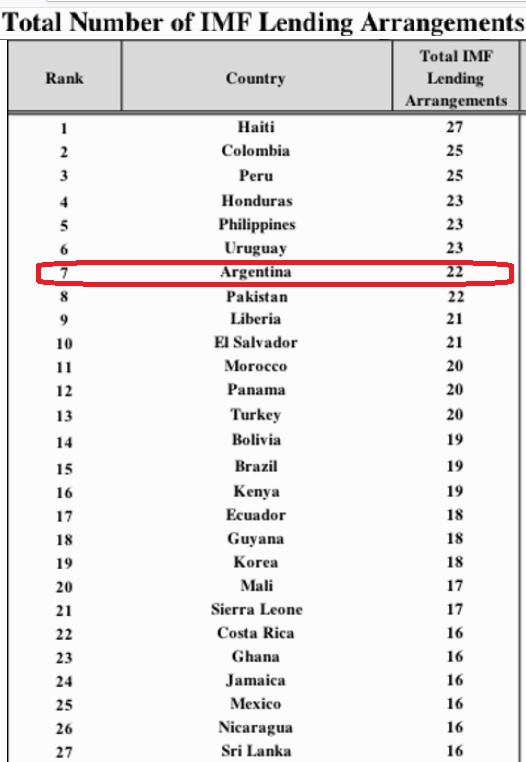

Unfortunately, there are (according to Professor Steve Hanke) 22 reasons to expect the IMF to do the wrong thing.

The bureaucrats at that international bureaucracy have a terrible track record of rewarding Argentina when it gets in fiscal trouble.

Not just Argentina, by the way.

The IMF’s bureaucrats seem to think “moral hazard” is a good thing rather than a bad thing.

I wrote just last month that Italy is getting closer and closer to a fiscal crisis and I warned that the IMF may intervene to prop up that country’s bad policy. And when other European countries get in trouble, IMF bureaucrats will probably try to make a bad situation even worse with further bailouts.

And don’t forget what already happened in Greece (and almost surely will happen again).

The bottom line is that the IMF needs to be shut down (or at least cut off from US backing) if we want nations to do the right thing after taxing and spending themselves into a fiscal crisis.

P.S. If the US ever gets in deep trouble, at least the IMF won’t have the ability to do a bailout.