The United States needs a constitutional spending cap, sort of like the “debt brake” that has been producing positive results in Switzerland for the past two decades.

Imposing a limit on annual spending increases would be a much-needed way of stopping politicians from saddling the nation with “Goldfish Government.”

The best-case scenario is that a spending cap is very stringent (say, limiting annual spending increases to 2 percent annually). This level of fiscal restraint reduces the burden of government spending compared to the private sector (i.e., it fulfills fiscal policy’s Golden Rule).

The avoid-harm scenario is that a spending cap prevents government from becoming a bigger burden. Given dismal long-run fiscal forecasts (a consequence of demographic change and poorly designed entitlement programs), this actually would be an impressive achievement.

There are also some auxiliary benefits of a spending cap.

A new working paper from Italy’s central bank, authored by Anna Laura Mancini and Pietro Tommasino, considers whether spending caps can mitigate the problem of dishonest budgeting by politicians.

…policy-makers have an incentive to “plan to cheat”. That is, they promise an amount of expenditures higher than what they will actually deliver, because this allows them to cater to the demands of the various groups of voters, and at the same time they present overoptimistic revenue forecasts, in order to preserve the appearance of fiscal discipline. Once the extra revenues hoped for by the government fail to materialize, budgeted investment expenditures are downsized or abandoned altogether. In this context, caps on realized spending can contribute to more realistic ex ante spending plans. Indeed, politicians have less room to inflate planned expenditures, once there is a legal ceiling in place.

The authors crunch the numbers and conclude that spending caps result in a greater level of fiscal honesty.

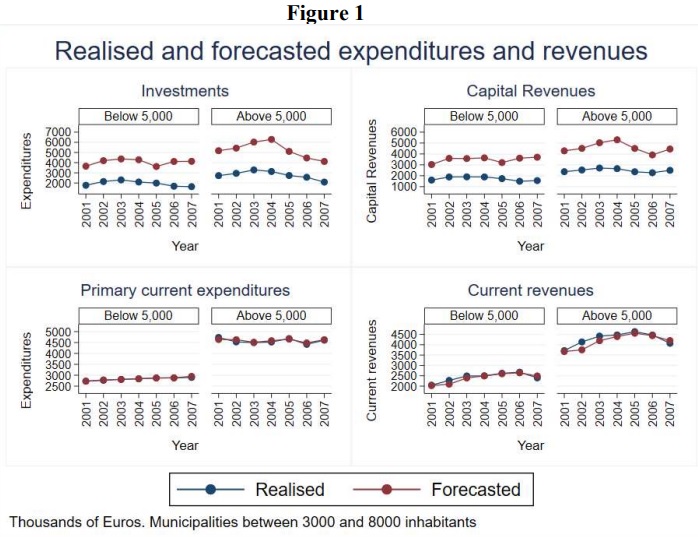

In this paper, we provide evidence in favour of this theoretical intuition, exploiting a unique dataset including the ex-ante budget plans as well as ex-post budget outcomes of…a rule that constrains capital expenditures in municipalities with more than 5,000 residents. …Our analysis show that the municipalities subject to the new capital-spending rule significantly reduced their over-optimism in expenditure projections… Furthermore, in the new regime revenue projections are also more accurate (less over-optimistic). …The reform reduced the forecast error concerning capital expenditures… The effects is significant both statistically and in economic terms. …the introduction of the cap on investment reduced the forecast error on investment expenditures by almost €1 mln, or 35% of the pre-reform average error.

For wonky readers, Figure 1 shows some of relevant data.

For what it’s worth, we seem to have a different problem in the United States.

Rather than exaggerate potential spending on so-called public investment, as seems to have been the case in Italy, American politicians generally low-ball cost estimates for infrastructure projects.

And then, once the projects get started, we get absurd cost overruns (with the high-speed rail project in California being an especially absurd example).

The good news is that a spending cap solves both the Italian version of the problem and the American version of the problem.

As the authors found in their research, it removes the incentive for dishonest budgeting in Italy. And, if adopted in the United States, politicians would learn that it doesn’t help to produce laughably low cost estimates if a spending cap means there is no way of financing cost overruns in the future.

P.S. There is a spending limit in Hong Kong’s constitution, and it has generated very positive results. Given China’s increasing control, it’s unclear how effective it will be in the future.

P.P.S. There’s also a spending limit in Colorado’s constitution, known as the Taxpayers Bill of Rights. It has been very successful.

P.P.P.S. Last month, I wrote about research from both the IMF and the ECB about the benefits of spending caps.

———

Image credit: QuoteInspector.com | CC BY-ND 2.0.