I’ve already written that massive spending increases for various bureaucracies is the most offensive part of Biden’s new budget.

But I explicitly noted that these huge budgetary increases (well above the rate of inflation, unlike what’s happening to incomes for American families) were not the most economically harmful feature of Biden’s plan.

That dubious honor belongs to either his massive expansion of the welfare state or his big tax increases.

In today’s column, we’re going to focus on his tax plan.

The Wall Street Journal editorialized a couple of days ago about what the president is proposing.

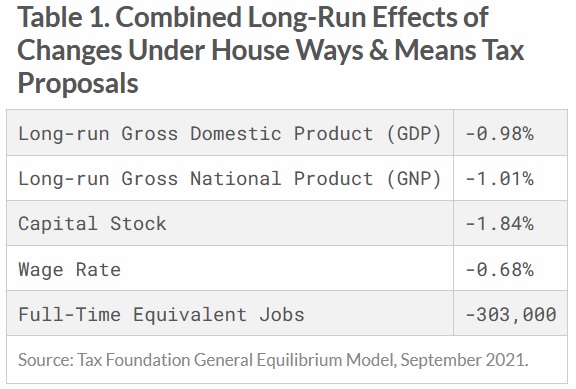

A President’s budget is a declaration of priorities, so it’s worth underscoring that President Biden’s new budget for fiscal 2023 proposes $2.5 trillion in tax increases over 10 years. His priority is taking money from the private economy and giving it to politicians to spend. …Raising the top income-tax rate to 39.6% from 37% would raise $187 billion. Raising capital-gains taxes, including taxing gains like ordinary income for taxpayers earning more than $1 million would snatch $174 billion. Raising the top corporate tax rate to 28% from 21%—a tax on workers and shareholders—would raise $1.3 trillion. Fossil fuels are hit up for $45 billion. We could go on… Let’s hope none of these tax-increases pass, but the Democratic appetite for your money really is insatiable.

That’s a damning indictment.

But the WSJ actually understates the problems with Biden’s tax agenda.

That’s because the White House also is being dishonest, as explained by Alex Brill of the American Enterprise Institute.

The budget proposes $2.5 trillion in net tax hikes, almost entirely from businesses and high-income households, and touts policies that would “reduce deficits by more than $1 trillion” over the next decade. But a short note in the preamble to the Treasury Department’s report on the budget reveals a sleight of hand: “The revenue proposals are estimated relative to a baseline that incorporates all revenue provisions of Title XIII of H.R. 5376 (as passed by the House of Representatives on November 19, 2021), except Sec. 137601.” In other words, the budget pretends that the failed effort to enact President Biden’s Build Back Better Act was a success and considers new budget proposals in addition to those policies. But you won’t find the price of the Build Back Better (BBB) Act (including its roughly $1 trillion in net tax hikes) in the budget tables.

I’m going to use this trick during my next softball tournament. I’m going to assume at the start that I’ve already had 20 at-bats and that I got an extra-base hit each time.

So even if I have a crummy performance during my real at-bats, my overall average and slugging percentage will still seem impressive.

Needless to say, my teammates would laugh at me, just as serious budget people understand that Biden’s budget is a joke.

But there is some good news. Barring something completely unexpected, Congress is not going to approve the president’s farcical plan.

P.S. Don’t fully celebrate. As I noted in my “Hopes and Fears for 2022” column, there is a risk that some sort of tax-and-spend plan might get approved. The only silver lining to that dark cloud is that it wouldn’t be nearly as bad as Biden’s full budget.

P.P.S. If that prospect gets you depressed, here are a couple of humorous images depicting Biden’s fiscal agenda.

———

Image credit: Gage Skidmore | CC BY-SA 2.0.