I wrote a few days ago about Biden’s plan to impose punitive double taxation on dividends.

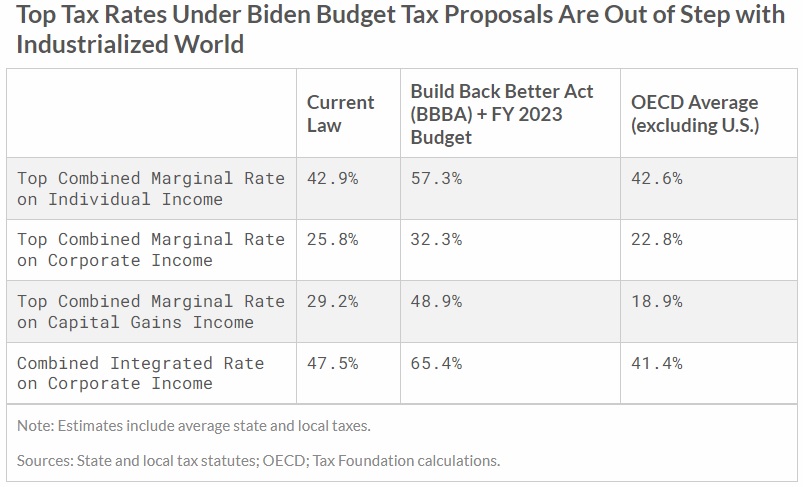

But that’s not an outlier in his budget. As you can see from this table from the Tax Foundation, he wants to violate the principles of sensible fiscal policy by having high tax rates on all types of income.

What’s especially disappointing is that he wants tax rates in the United States to be much higher than in other developed nations.

At the risk of understatement, that’s not a recipe for jobs and investment.

The Wall Street Journal editorialized about Biden’s taxaholic preferences.

Mr. Biden…is proposing $2.5 trillion in new taxes that would give the U.S. the highest or near-highest tax rates in the developed world. …The biggest jump is in taxes on capital gains, as the top combined rate would rise to 48.9% from 29.2% today. That’s a 67% increase in the government’s take on long-term capital investments. The new top rate would be more than 2.5 times the OECD average of 18.9%. Nothing like reducing the U.S. return on capital to get people to invest elsewhere. Mr. Biden would also lift the top combined tax rate on corporate income to 32.3% from 25.8%. That would leap over Australia and Germany, which have top rates of 30% and 29.9% respectively, and it would crush the 22.8% OECD average. …Mr. Biden would also put the U.S. at the top of the noncompetitive list for personal income taxes, with multiple increases that would put the combined American rate at 57.3%. Compare that with 42.9% today and an average of 42.6% across the OECD.

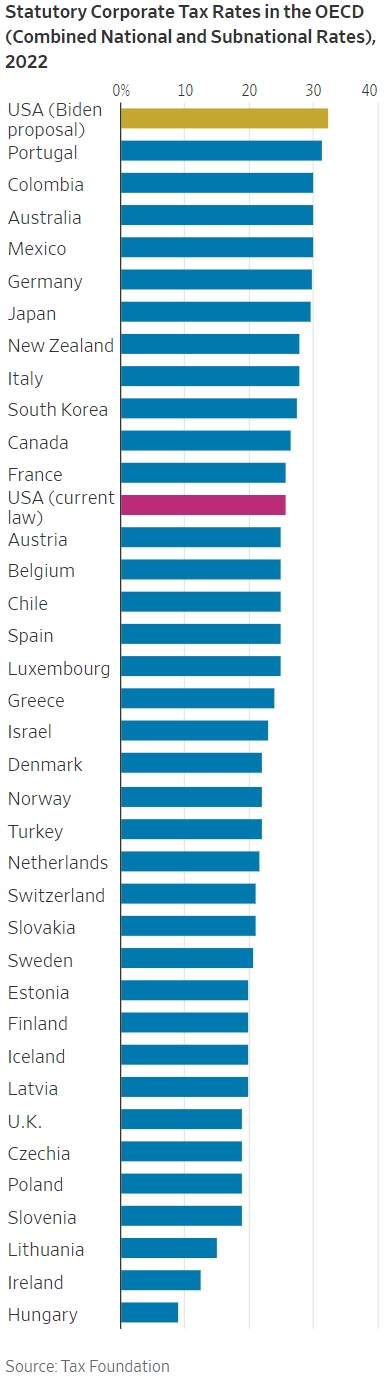

The WSJ‘s editorial contained this chart.

The United States would be on top for corporate tax rates if Biden’s plan is adopted (which actually means on the bottom for competitiveness).

The bottom line is that Biden wants the U.S. to have the highest corporate rate, highest double taxation of dividends, and highest double taxation of capital gains.

To reiterate, not a smart way of trying to get more jobs and investment.

P.S. The “good news” is that the United States would not be at the absolute bottom for international tax competitiveness.

———

Image credit: pixelcreatures | Pixabay License.