I’ve written many times about the importance of low tax rates, specifically low marginal tax rates on productive activity such as work, saving, investment, and entrepreneurship.

And I’ve explained that it is especially beneficial to have low tax burdens to attract people who play a big role in boosting economic growth.

The bottom line is that everyone should want their state or their country to be a magnet for the best and brightest.

Having more highly successful people is a great shortcut for boosting everyone’s income.

Today, we’re going to look at more evidence on this topic. In a working paper for the Harvard Business School, Sari Pekkala Kerr, Çağlar Özden, William Kerr, and Christopher Parsons examine the migratory patterns of highly skilled workers.

Highly skilled workers play a central and starring role in today’s knowledge economy. Talented individuals make exceptional direct contributions—including breakthrough innovations and scientific discoveries… The exceptional rise in the number of high-skilled migrants to OECD countries is the result of several forces, including increased efforts to attract them by policymakers as they recognize the central role of human capital in economic growth… For example, immigrants account for some 57 percent of scientists residing in Switzerland, 45 percent in Australia, and 38 percent in the United States (Franzoni et al. 2012). In the United States, 27 percent of all physicians and surgeons and over 35 percent of current medical residents were foreign born in 2010. …the global migration rate of inventors in 2000 stood at 8.6 percent, at least 50 percent greater in share terms than the average for high-skilled workers as a whole.

In the contest to attract skilled migrants, some nations do a better jobs than others.

…among OECD destinations, the distribution of talent remains skewed. Four Anglo-Saxon countries—the United States, the United Kingdom, Canada and Australia—constitute the destination for nearly 70 percent of high-skilled migrants (to the OECD) in 2010. The United States alone has historically hosted close to half of all high-skilled migrants to the OECD and one-third of high-skilled migrants worldwide.

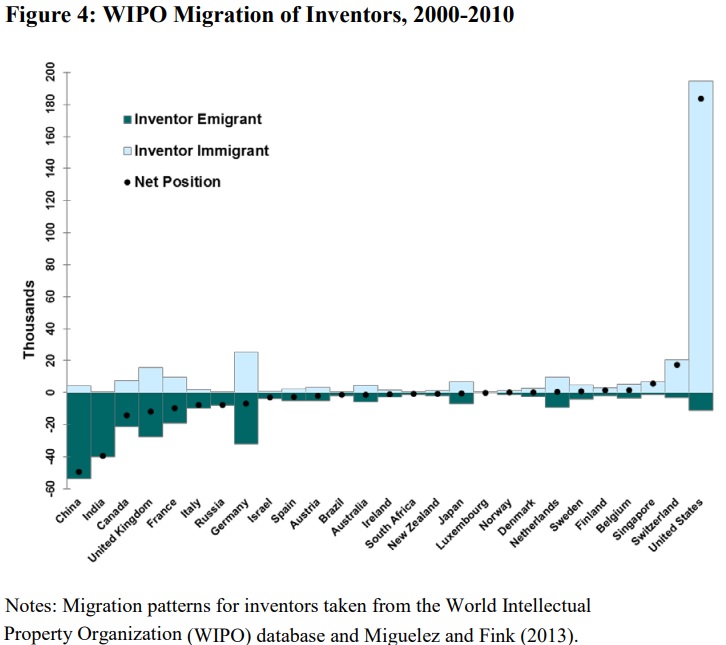

Here’s a chart looking specifically at inventors.

So why do some nations get disproportionate numbers of skilled migrants.

As you might suspect, these highly productive people want to earn more money. And keep more money.

The core theoretical framework for studying human capital flows dates back to at least John Hicks (1932), who noted that “differences in net economic advantages, chiefly differences in wages, are the main causes of migration.” …the United States has a very wide earnings distribution and low tax levels and progressivity, especially compared to most source countries, including many high-income European countries. As a result, we can see why the United States would attract more high-skilled migrants, relative to low-skilled migrants and relative to other high-income countries.

Notice, by the way, that low-tax Singapore and low-tax Switzerland also are big winners in the above chart. Indeed, they may be ahead of the United States after adjusting for population.

The obvious takeaway is that the United States should not throw away its competitive advantage. Yet another reason to reject Joe Biden’s class-warfare fiscal agenda.

———

Image credit: rawpixel.com | CC0 Public Domain.