The Economic Effects Of Proposed Changes to the Tax Treatment of Capital Gains

August 2021

John W. Diamond

Director, Center for Public Finance

Edward A. and Hermena Hancock Kelly Fellow in Public Finance

Rice University’s Baker Institute for Public Policy

Executive Summary

In this paper, we examine how rising inflation would exacerbate the economic effects of enacting a proposal by the Biden Administration and various legislators to tax long term capital gains at ordinary income tax rates for those with taxable income above $1 million and tax unrealized gains at the time of death (i.e., repealing step up of basis) for single (joint) filers with more than $1 million ($2 million) in unrealized gains.

First, rising inflation would exacerbate the negative economic effects associated with taxing capital gains income at a higher rate and repealing step up in basis. If inflation were to increase by just one percentage point—i.e., the inflation rate in the economy is on average ~3% instead of 2% (2% is roughly the U.S. average over the past two decades.)—then the negative economic effects associated with taxing capital gains at a higher rate and repealing step up in basis would be 1.5 times higher than the announced projections of models already in the public debate that do not account for the effects of worse than expected inflation.[1]

Second, rising inflation makes it more likely that this proposal would result in the government taxing real losses as if they were gains. Even non-exotic assets that are commonly assumed to be profitable—like the S&P 500 over the last 20 years—would be reduced to just barely breakeven after-tax if this proposal were to become law. And this breakeven result assumes actual inflation levels in the economy over the past two decades. If, however, inflation were to increase by even just 1% as many expect, an investment in the S&P500 would deliver a real after-tax loss if the proposal were to become law.

Third, higher inflation would exacerbate existing distortions in the allocation of capital across sectors, such as pushing investments into owner-occupied housing and out of other corporate and non-corporate investments.

Finally, this proposal is the wrong prescription for the ails of the current economy. The cure for the slow growth economy that existed before the pandemic was increased innovation and diffusion of new technologies. Higher capital gains taxes would reduce innovation and slow the diffusion of new technology. Higher inflation would make this approach more detrimental to the future growth of the economy.

I. Introduction

In this paper, we examine the economic effects of enacting proposals to increase the taxation of long-term capital gains. The proposals would tax long-term capital gains at ordinary income tax rates for those with taxable income above $1 million and tax unrealized gains at the time of death (i.e., repealing step up of basis) for single (joint) filers with more than $1 million ($2 million) in unrealized gains. As under current law, capital gains from the sale of a primary residence would receive an exclusion of up to $250,000 ($500,000) for single (joint) filers.

We begin by discussing the structure of capital gains taxes. We then describe how inflation will likely exacerbate the negative economic effects of these policy changes. We present simulation results of the proposal analyzed in this study, and examine how inflation may affect the negative economic effects of the policy changes. In the final section, we offer some general conclusions.

II. Capital Gains Taxation

A capital gain is the difference between an estimate of the fair market value and the adjusted basis of an asset. The adjusted basis is the original cost of the asset (cost-basis) adjusted for changes in the asset’s value due to depreciation (which would decrease the value of an asset) or improvements to the asset (which would increase the value of the asset). If an asset is transferred to another person or entity as a gift, then the value of the asset for calculating the capital gain is the carryover basis, which is equal to the adjusted basis at the time of the transfer of the asset. If a person or entity inherits an asset at the time of the donor’s death, then the value of the asset is equal to an estimate of the fair market value of the asset at the time of donor’s death (referred to as a step up in basis or stepped-up basis).

A tax on capital gains is due at the time an asset is sold. Thus, under current law, capital gains taxes are deferred until realization instead of being taxed on an annual basis similar to many other types of income. Taxation at the time of realization and the treatment of inherited assets implies that when an asset is inherited, and the value of the asset is stepped-up due to tax paid pursuant to the estate tax regime, there is no tax on the existing capital gain (i.e., the difference in the fair market value and the adjusted basis at time of death). Repealing step up in basis would subject the existing capital gain to taxation at the time of death if the capital gains tax is imposed immediately regardless of whether the inheritor sold the asset. An alternative is to tax the asset at the time of sale with the value of the asset equal to the adjusted basis. The proposal examined in this paper assumes the tax occurs at the time of death regardless of whether the asset is sold. Note that in this case determining the value of many assets is difficult and liquidity issues can arise if the inheritor cannot afford to pay the tax from liquid assets. However, one of the most important issues is that capital gains are not adjusted for inflation and thus much of the taxable gains are not reflective of a real increase in wealth. Taxing nominal gains will reduce the after-tax rate of return and lead to less investment, especially in periods of higher inflation.

III. Inflation And Investment

Inflation increases nominal capital gains but these gains do not represent a real gain in wealth. The fact that the United States does not index capital gains for inflation implies that taxing the nominal value will reduce the real rate of return on investment, and may do so by enough to result in negative rates of return in periods of moderate to high inflation. Lower real rates of return reduce investment, the size of the capital stock, productivity, growth in wage rates, and labor supply.

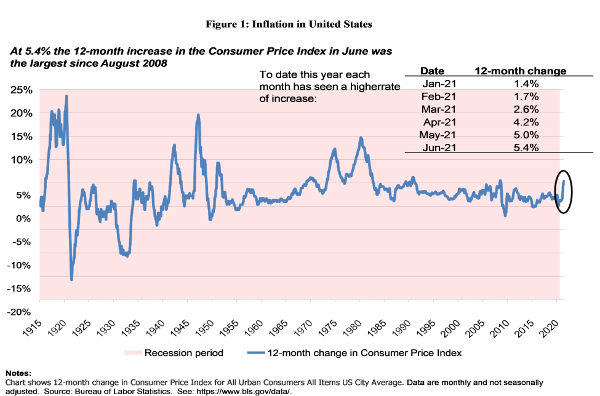

Figure 1 shows inflation data from 1915 to 2021. In the first six months of this year, inflation has increased in each month. The latest data in June of 2021 shows that prices are increasing at the highest rate since August 2008. While a return to the runaway inflation of the 1970s is unlikely, risks of significant inflationary pressures in the short and medium term seem imminent. The risks include sizable new fiscal stimulus in the form of an infrastructure bill and more social spending in an omnibus budget bill, continued bottlenecks in production, massive budget deficits, the inability to adopt sustainable budget reforms, reduced labor force participation rates, and increases in inflation expectations. In addition, the Federal Reserve’s new policy of average inflation targeting may lead to higher price inflation in the short and medium term. It is likely that the United States will experience higher levels of inflation than in the past two decades on average (which averaged 2.2 percent). The negative macroeconomic effects of repealing step up of basis and raising capital gains tax rates are likely to be larger than expected because of this issue. Models used to simulate the economic effects of increasing capital gains tax rates understate the decline in investment because they do not account for the effects of inflation.

As an example of the impact of inflation, consider an investment of $1000 in year 2000, the $1000 investment would have to grow to $1577.79 in 2021 to maintain the same buying power as in 2000 given the actual price level increases over the 21-year period.[2] The nominal gain of $577.79 offsets the loss in purchasing power that occurs as prices increase. This implies a zero real before-tax rate of return on the investment from 2000 to 2021. Imposing a 43.4 percent tax on nominal capital gains in year 2021 would reduce the nominal gain from $577.79 to $327.03, and thus the real after-tax rate of return on the investment is -5.2 percent. In this specific case, indexing nominal capital gains for inflation and allowing for stepped-up basis in year 2021 yields an after-tax real return equal to zero.

The same general conclusion holds using actual investment data. For example, a $100 investment in the S&P 500 in 2000 would have yielded a nominal return of $294.90 ($394.90 – $100) by 2021. This implies an average before-tax nominal return of 6.8 percent from 2000 to 2021. Given that inflation averaged 2.2 percent from 2000 to 2021, the inflation-adjusted before-tax real return would be $150.29, or a 2 percent average before-tax real return. Imposing a capital gains tax of 43.4 percent in 2021 yields an after-capital-gains-tax real return of only 0.7 percent. Note the S&P returns also include dividend payments that are subject to tax each year if held in taxable accounts, thus it is likely that the after-tax real return in this example would be negative or close to zero given that dividends account for a significant fraction of total returns on the S&P 500.[3] This provides a solid case for allowing step up in basis and for preferential tax rates for capital gains since the tax code does not index capital gains for inflation. The potential for rising inflationary pressures makes the case stronger.

Accounting for inflation in the model would exacerbate other existing distortions as well. For example, higher inflation would increase existing distortions in the allocation of capital across sectors. An increase in the capital gains tax rate or repealing step up of basis will make investments in owner-occupied housing more attractive relative to other corporate and non-corporate investments. This occurs because the first $250,000 ($500,000) of capital gains in owner-occupied housing are exempt from taxation, and current proposals extend this preferential treatment. Poterba (1980) shows that higher levels of inflation lowered the cost of housing services given the tax treatment of mortgage interest and capital gains in the 1970s. Feldstein (1980) argues that higher inflation increases the real price of land relative to corporate capital. In addition, the use of debt to buy housing assets acts as a potentially important hedge to expected inflation, since house prices increase with inflation but the value of nominal debt is constant (while the dollars used to pay off that debt can purchase less goods and services). Thus, models that only look at relative price effects (e.g., real models that do not explicitly include inflation) are likely to understate the negative economic effects related to the level of investment as well as the misallocation of investment across assets during periods of increasing inflation.

Another argument in favor of continued preferential treatment of capital gains and other capital income taxes relates to the state of the economy since the Great Recession. Ramey (2020) discusses the state of the United States economy since the Great Recession and specifically examines the slow recovery and historically low interest rates. Ramey concludes that by late 2019 (prior to the pandemic[4]) unemployment was relatively low and investment was relatively high – which is inconsistent with a period of little or no economic growth due to a lack of investment because of increased saving (i.e., secular stagnation).

Thus, increasing aggregate demand to increase long run economic growth is unlikely to be a successful policy response in the pre-pandemic economy (although this was not the case immediately after the onset of the pandemic). Instead, Ramey argued that the economy was in a period of “technological lull” and that the policy response should focus on increasing innovation and faster diffusion of new technologies. Increasing taxes on the return to investment (and specifically capital gains) is unlikely to achieve either goal suggested by Ramey, even if tax increases target the very wealthy. While the pandemic justified the use of demand side stimulus in the short run, as the economy continues to recover, we will need to alter our fiscal policy response to focus on increasing innovation and faster diffusion of new technologies. Increasing capital gains taxes will do exactly the opposite by reducing investment and shifting investment into owner-occupied housing rather non-housing assets, which would reduce innovation and the diffusion of new technologies. These impacts will be even more damaging during periods of relatively high inflation.

IV. Simulation Results

We use a computable general equilibrium model of the U.S. economy to simulate the economic effects of these policy changes assuming that additional revenues increase non-social security transfers. This section provides a brief description of the model used in this analysis.[5] The model is a dynamic, overlapping generations, computable general equilibrium model of the U.S. economy that focuses on the macroeconomic and transitional effects of tax reforms.

The model is a general equilibrium model in which households act to maximize utility over their lifetimes, and firms act to maximize firm value, with behavioral responses dictated by parameter values taken from the literature; these responses include changes in consumption, labor supply, and changes in the time path of investment by firms that take into account the costs of adjusting their capital stocks. Households and firms are characterized by perfect foresight. By construction, the model tracks the responses to a tax policy change every year after its enactment and converges to a steady-state long-run equilibrium characterized by an exogenous growth rate. Thus, the model tracks both the short-run and long-run responses to a tax policy change. All values in the model are real values (i.e., only relative values matter) as there is no inflation in the model.

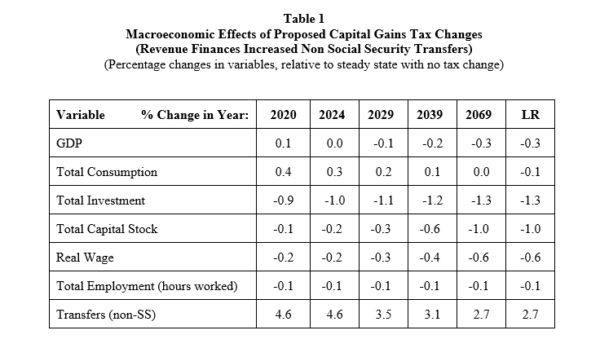

The conventional revenue effect of repealing step up in basis and raising capital gains tax rates on returns with over $1 million in earned income is assumed to be $212.8 billion over 10 years (Watson et al., 2021). The simulation results in Table 1 show that GDP falls by roughly 0.1 percent 10 years after reform and 0.3 percent 50 years after reform, which implies per household income declines by roughly $310 after 10 years and $1,200 after 50 years. The long run decline in GDP is due to a decline in the capital stock of 1.0 percent and a decline in total hours worked of 0.1 percent. Aggregate consumption falls by 0.1 percent in the long run. Initially hours worked declines by 0.1 percent in a full employment economy; if instead labor hours worked per individual were held constant, this would be roughly equivalent to a loss of approximately 209,000 jobs in that year. Real wages decrease initially by 0.2 percent and by 0.6 percent in the long run.

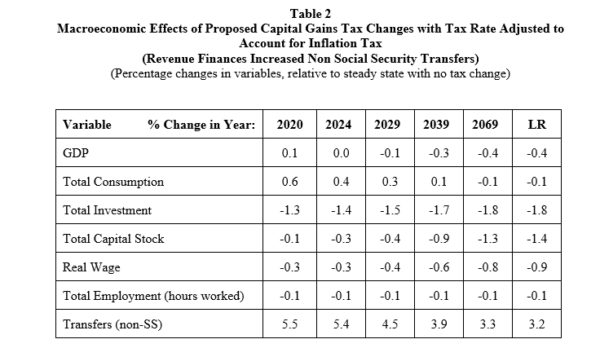

However, as noted above, the model fails to account for how inflation would affect the taxation of capital gains. Assuming the inflation rate is one percentage point higher on average (3.2 percent instead of 2.2 percent) implies that a rough estimate of the capital gains tax rate on nominal plus real returns would be 1.5 times higher than the real increase in the capital gains tax rate used in the standard model with no inflation. Table 2 shows the results of adjusting the capital gains tax rates by a factor of 1.5 to account for the effects of inflation. In this case, GDP falls by roughly 0.1 percent 10 years after reform and 0.4 percent 50 years after reform, which implies per household income declines by roughly $453 after 10 years and $1,700 after 50 years. The long run decline in GDP is due to a decline in the capital stock of 1.4 percent and a decline in total hours worked of 0.1 percent. Aggregate consumption falls by 0.1 percent in the long run. Initially hours worked decline by 0.1 percent in a full employment economy; if instead labor hours worked per individual were held constant, this would be roughly equivalent to a loss of approximately 296,000 jobs in that year. Real wages decrease initially by 0.3 percent, by 0.4 percent five years after enactment, and by 0.9 percent in the long run. Higher levels of inflation would lead to larger negative economic effects.

While these results are informative, current economic conditions in the US and the rest of the world imply additional analysis may add important insights. Particularly given the large debts and deficits in the United States and the rest of the world, the easy money stance of monetary authorities, and the recent data showing increases in inflationary pressures in the economy. Given the current inability of policymakers to deal with long-term structural budget deficits, it seems likely that monetary authorities will continue to target higher levels of inflation than otherwise necessary to stabilize and support the economy.

V. Conclusion

In this paper, we discuss the economic effects of enacting a proposal by the Biden Administration to tax long term gains at ordinary income tax rates for those with taxable income above $1 million and tax unrealized gains at the time of death (i.e., repeal step up of basis) for single (joint) filers with more than $1 million ($2 million) in unrealized gains. The current exclusion of $250,000 ($500,000) of the capital gain on the sale of a primary residence for single (joint) filers would remain. We discuss the importance of considering how current economic conditions may exacerbate the problems associated increasing the taxation of capital gains. In particular, rising inflation would exacerbate the negative economic effects associated with taxing capital gains income at a higher rate as well as repealing step up in basis, including the decrease in investment, the misallocation of capital between owner-occupied and other assets, and the portfolio of investors. It also exacerbates the differential treatment of current and future consumption, that is it discourages saving, that occurs under an income tax. Higher levels of inflation (above a one percentage point increase) would increase the negative economic effects of raising capital gains tax rates and repealing step up in basis by 1.5 times.

[1] For example, the projections in EY (2021) and Watson et al. (2021).

[2] All data on inflation and returns on the S&P 500 in this section is from “$1,000 in 2000 → 2021 | Inflation Calculator.” Official Inflation Data, Alioth Finance, 19 Jul. 2021, https://www.officialdata.org/us/inflation/2000?amount=1000.

[3] From 1990 to 2015 total returns on the S&P 500 were 988.8 percent while returns from stock price increases were 517 percent according to Bespoke (https://www.bespokepremium.com/think-big-blog/sp-500-total-return-vs-price/). This implies that dividends provided almost half of the total returns from 1990 to 2015.

[4] The pandemic led to increased unemployment and a decline in investment and justified increases in aggregate demand to support the economy. However, the economic effects of the pandemic are dissipating as shown by a reduction in the unemployment rate closer to pre-pandemic levels and a significant rebound in investment. Thus, the appropriate policy response is shifting back towards increasing innovation and the diffusion of new technology and away from supporting aggregate demand.

[5] Zodrow and Diamond (2013) provide details for the full model.

References

EY, 2021. “Repealing step-up of basis on inherited assets: Macroeconomic impacts and effects on illustrative family businesses.” https://www.fb.org/files/FBETC_Stepped-Up_Basis_Report_2021.

Feldstein, Martin, 1980. “Inflation, Tax Rules, and the Prices of Land and Gold.” Journal of Public Economics, Volume 14, Issue 3, 309-317.

Poterba, James M., 1980. “Inflation, Income Taxes, and Owner-Occupied Housing.” NBER Working Paper No. w0553. NBER, Boston, Massachusetts.

Ramey, Valerie, 2020. “Secular stagnation or technological lull?” Journal of Policy Modeling, 42, issue 4, 767-777.

Watson, Garrett, Huaqun Li, Alex Durante and Erika York, 2021 “Details and Analysis of Tax Proposals in President Biden’s American Families Plan.” Tax Foundation, May 6, 2021, https://taxfoundation.org/american-families-plan.

Zodrow, George R., and John W. Diamond, 2013. “Dynamic Overlapping Generations Computable General Equilibrium Models and the Analysis of Tax Policy.” In Dixon, Peter B., and Dale W. Jorgenson (eds.), Handbook of Computable General Equilibrium Modeling,743–813. Elsevier Publishing, Amsterdam, Netherlands.

———

Image credit: Nick Youngson | Pix4free | CC BY-SA 3.0.