I’ve been arguing against Biden’s proposed increase in business taxation by pointing out that higher corporate taxes will be bad news for workers, consumers, and shareholders.

Everyone agrees that shareholders get hurt. After all, they’re the owners of the businesses. Higher corporate taxes directly reduce the amount of money available to be paid as dividends.

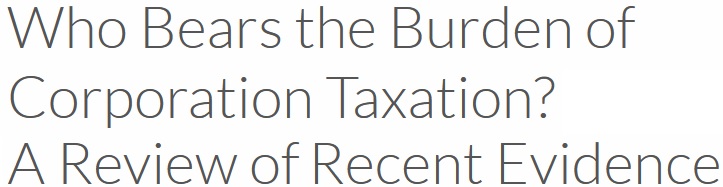

But we also should recognize that higher corporate taxes can be passed along to consumers, so they also lose. Even more important, we should recognize that higher tax burdens also reduce incentives for business investment, and this can have a negative impact on worker compensation.

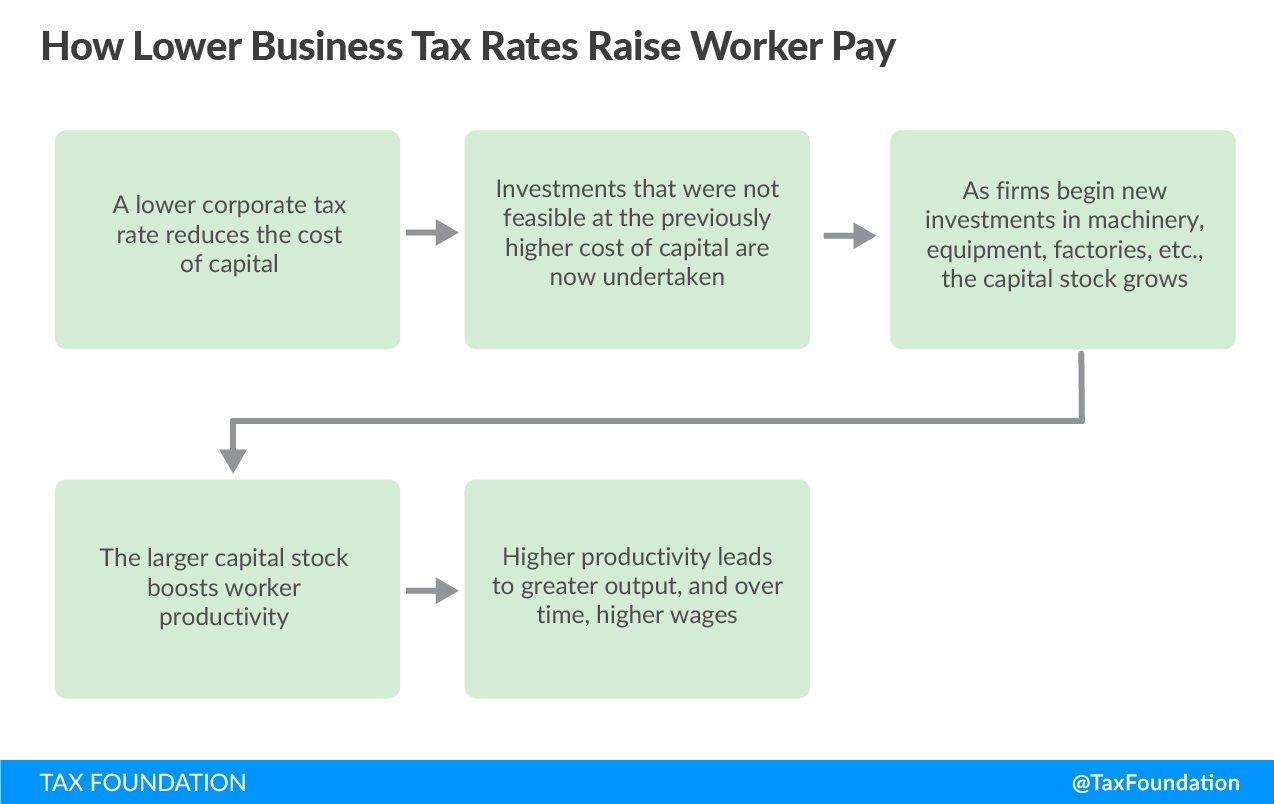

A 2017 study from the Tax Foundation, authored by Steve Entin, thoroughly explored this question and included a table summarizing the academic research.

Alex Durante updated the Tax Foundation’s summary of the research in a just-released report.

Here are the results of two new studies.

In a large study of German municipalities over a 20-year period, Fuest et al. (2018) find that slightly more than half of the corporate tax burden falls on workers. …Baker et al. (2020) find that consumers could also be impacted by corporate tax changes. Looking at specific product prices with linked survey and administrative data at the state level, the authors found that a 1 percentage-point increase in the corporate tax rate increased retail prices by 0.17 percent. Combining this estimate with the wage response estimated in Fuest et al., the authors calculated that 31 percent of the corporate tax incidence falls on consumers, 38 percent on workers, and 31 percent on shareholders.

If you want more information about the German study, I wrote about it a couple of years ago. Solid research.

Here’s my two cents on the issue: Shareholders pay 100 percent of the direct costs of the corporate tax. But we need to also consider the indirect costs, most notably who bears the burden when there’s less investment and slower wage growth.

If you ask five economists for their estimates of indirect costs, you’ll probably get nine different answers. So it’s no surprise that there’s no agreement about magnitudes in the academic research cited above.

But they all agree that workers lose when corporate rates increase, and that’s a big reason why we can confidently state that Biden’s class-warfare agenda is bad for ordinary people.

The bottom line is that the person (or business) writing a check to the IRS isn’t the only person who suffers because of a tax.

And the lesson to learn is that we should be lowering the corporate, not increasing it.

P.S. Here’s my primer on the overall issue of corporate taxation.

P.P.S. Here’s some research about the link between corporate tax and investment.

———

Image credit: geralt | Pixabay License.