Thanks to globalization (as opposed to globalism), jobs and investment are now very mobile. This means the costs of bad policy are higher than ever before, and it also means the benefits of good policy are higher than ever before.

Which is why it’s very useful to look at various competitiveness rankings, most notably the ones that are comprehensive (most notably Economic Freedom of the World and the Index of Economic Freedom).

But since my specialty is public finance, I’m also interested in measures of fiscal competitiveness (best tax system, worst tax system, costliest welfare state, etc).

Today, let’s narrow our focus and look at business tax competitiveness. This is an area where the United States traditionally has lagged, both because we used to have one of the world’s highest corporate tax rates and because onerous tax rules put U.S.-based companies at an added disadvantage.

Trump lowered the federal corporate tax rate from 35 percent to 21 percent, which definitely helped, but now Biden wants to push the rate back up to 28 percent.

What will that mean for U.S. competitiveness?

It’s not good news.

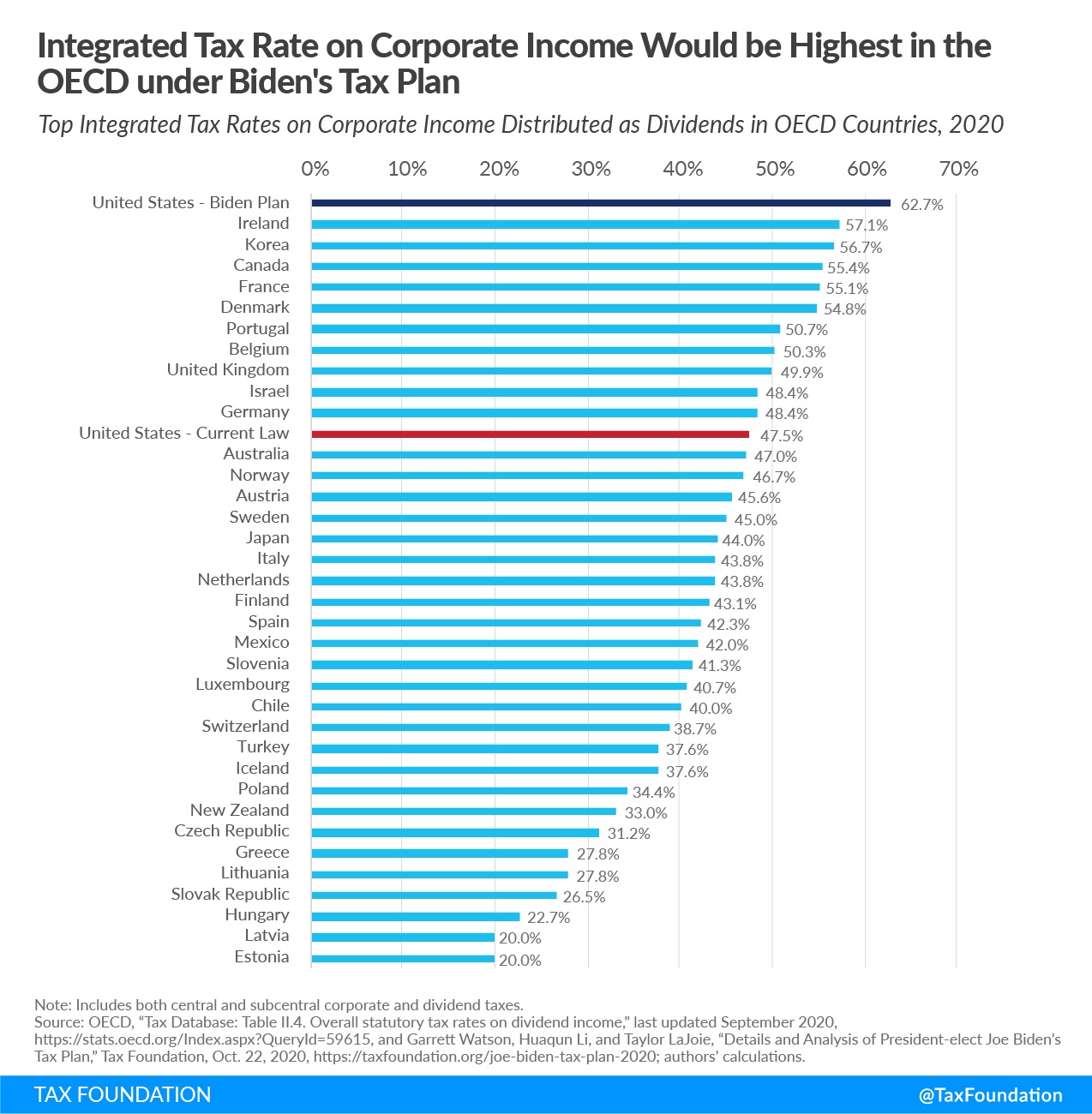

The Tax Foundation calculated the combined tax rate on business income (including the double tax on dividends) for various developed nations.

As you can see, America will have the most onerous tax regime if Biden is successful.

What if we look only at the corporate tax rate? And what if we consider every jurisdiction in the world?

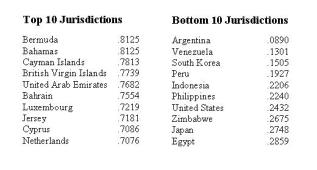

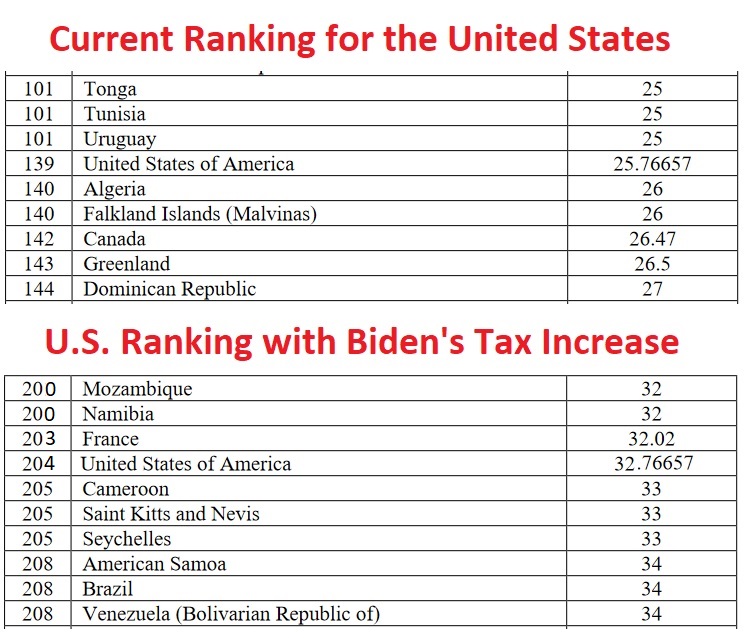

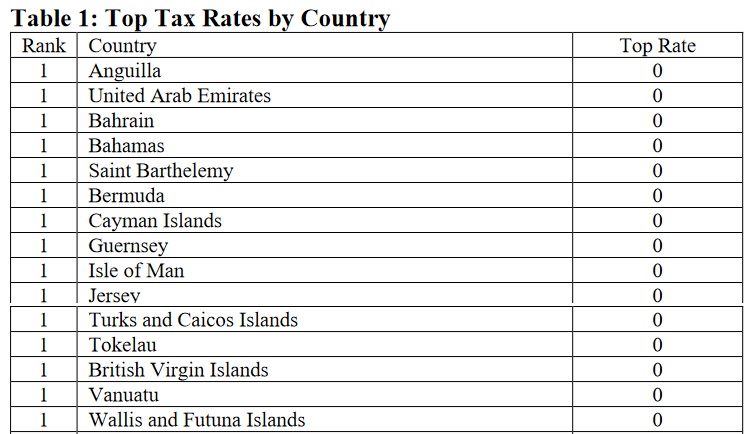

Professor Robert McGee pulled together all the numbers and ranked nations from #1 to #223.

The United States currently is in the bottom half, which isn’t good since we’re below average. But you can see from these two tables that Biden will drop America to the bottom 10 percent.

Needless to say, it’s not good to rank below France.

But let’s think of the glass as being 1/10th full rather than 9/10ths empty. At least the U.S. beats Venezuela!

The bottom line is that it will not be good news if Biden’s plan is enacted.

P.S. From Professor McGee’s study, here are the jurisdictions tied for 1st place.

P.P.S. Needless to say, politicians from high-tax nations resent the 15 jurisdictions that don’t have a corporate income tax.

Indeed, that’s why many of those politicians are pushing the “global minimum tax” that I wrote about yesterday.

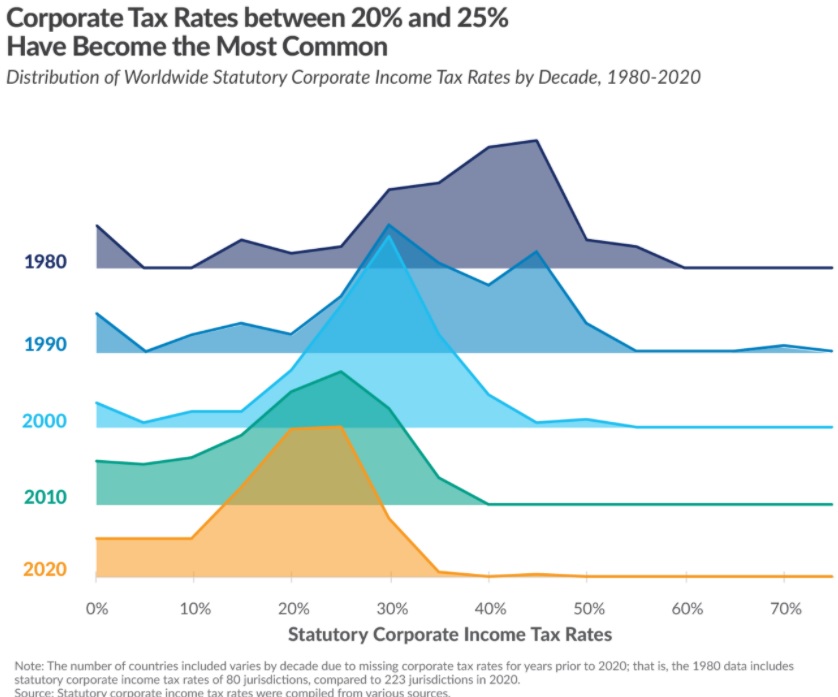

Those politicians basically want to turn back the clock and reverse the progress depicted in this set of charts from the Tax Foundation.

P.P.S. This is why it’s important to defend the liberalizing process of tax competition.

———

Image credit: Gage Skidmore | CC BY-SA 2.0.