China is not going to surpass the United States as the world’s dominant economy.

As I first wrote back in 2010, China is a paper tiger. Yes, there was some pro-market reform last century, which helped reduce mass poverty, but China only took modest steps in the right direction.

According to the latest edition of Economic Freedom of the World, China scores just 6.21, which places it 124th out of 162 nations.

Is that better than a score of 3.69, which is where China was in 1990?

Yes, of course.

But does that score indicate that China will become richer than the United States, which has a current score of 8.22 (the world’s 6th-highest level of economic liberty)?

Of course not.

My answer might change of China engaged in more economic liberalization, as I have urged. But it seems the opposite is happening and China is backsliding toward more state control.

And that means the United States almost surely will remain far more prosperous.

(While Joe Biden is doing his best to drag economic policy in the wrong direction, but it would takes decades of far-worse policy to bring the U.S. down to the level of France (#58) or Greece (#92), much less all the way down to being on par with China).

But some people must not be very familiar with data about China and its economy.

For instance, President Trump’s former top trade official, Robert Lighthizer, wrote that the United States should copy China’s cronyism in a column in the New York Times.

I’m not joking. Mr. Lighthizer openly embraces industrial policy and protectionism.

…we need a multifaceted long-term strategy. …Our strategy must include…an industrial policy that includes subsidies to foster the development of the most advanced science and technology…and a robust plan to combat China’s unfair trade practices. …The Senate legislation would achieve some of what is needed. It calls for $200 billion to bolster scientific and technological innovation, $52 billion to rebuild our capacity to make semiconductors, and a supply-chain resiliency program… The House should perfect the provisions of the Senate bill that restructure and enhance federal support for science and innovation and strip out those that weaken our trade laws and encourage Chinese imports.

Geesh, no wonder Trump’s trade policy was such a disaster.

Lighthizer not only doesn’t understand economics, he also doesn’t know history.

Adam Thierer of the Mercatus Center points out that the current angst about China is a repeat verse of a song we heard over and over again in the late 1980s.

Back then, everyone thought Japan was on the verge of overtaking the United States, ostensibly because that nation had wise politicians and bureaucrats who knew how to pick winners and losers.

Thierer’s article tells us what really happened.

In 1949, the Japanese government created the Ministry of International Trade and Industry (MITI) to work with other government bodies (especially the Bank of Japan) to devise plans for industrial sectors in which they hoped to make advances. Although not as heavy-handed as Chinese planning authorities are today, MITI came to have enormous influence over private-sector research and investment decisions during the next five decades. The organization used a variety of the same policy levers that Chinese officials do today, with a particular focus on trade management and industrial policy investments in sectors perceived to be “strategic” for future economic advance. …By the late 1970s…, U.S. officials and market analysts came to view MITI with a combination of reverence and revulsion, believing that it had concocted an industrial policy cocktail that was fueling Japan’s success at the expense of American companies and interests. …By the end of the 1980s, fears about “Japan Inc.” had reached a fever pitch. …Just as Japan phobia was reaching its zenith in the early 1990s, Japan’s fortunes began taking a turn for the worse. The Japanese stock market crashed in 1990… Japan suffered a brutal economic downturn that became known as the Lost Decade, which really lasted almost two decades. …by the late 1990s many scholars came to view most Japanese industrial policy initiatives as a costly bust.

Amen.

I wrote that Japan was a “basket case” back in 2013. A bit of hyperbole, to be sure, but I was trying to drive home the point that the nation’s politicians have made some costly mistakes.

Not just industrial policy, but also tax increases, Keynesian spending, and other forms of intervention.

No wonder the country has gone downhill in terms of competitiveness.

But let’s not focus too much on Japan (which, despite all my grousing, still ranks #20 for economic liberty).

For purposes of today’s column, the main points are 1) that China is no threat to overtake the United States, and 2) that copying that nation’s industrial policy would be a mistake.

P.S. If China wants to pursue industrial policy and other forms of cronyism, that’s a mistake that mostly hurts the Chinese people. To the extent such policies are designed to subsidize exports (as Lighthizer argues), the best response is to utilize the World Trade Organization, not to copy China’s misguided interventionism.

———

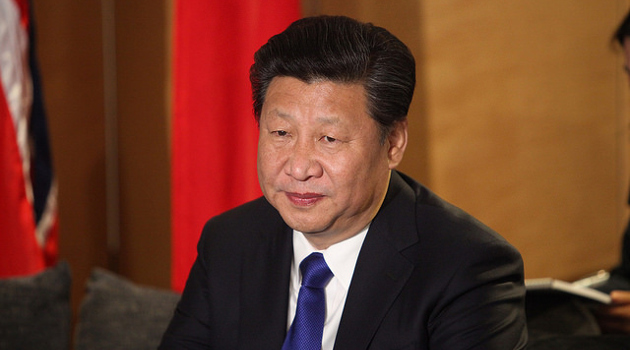

Image credit: Foreign and Commonwealth Office | CC BY 2.0.