Way back in 2007, I narrated this video to explain why tax competition is very desirable because politicians are likely to overtax and overspend (“Goldfish Government“) if they think taxpayers have no ability to escape.

The good news is that tax competition has been working.

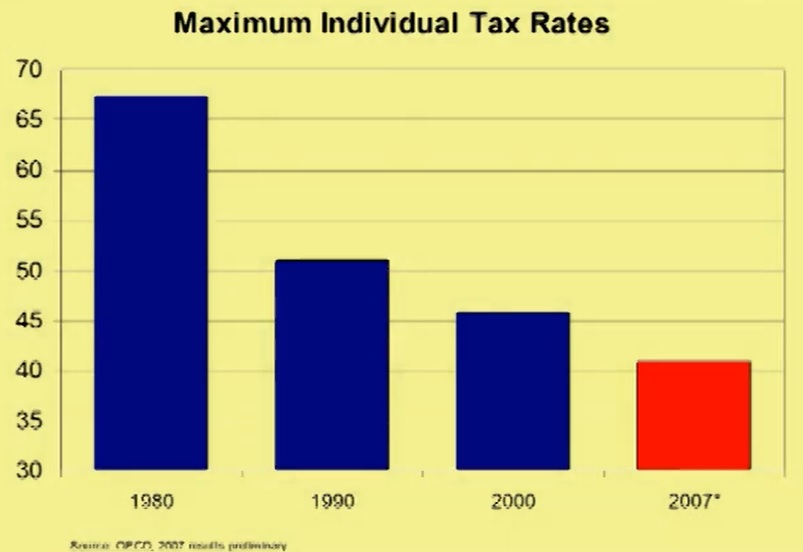

As explained in the above video, there have been big reductions in personal tax rates and corporate tax rates. Just as important, governments have reduced various forms of double taxation, meaning lower tax rates on dividends and capital gains.

Many governments have also reduced – or even eliminated – death taxes and wealth taxes.

These pro-growth tax reforms didn’t happen because politicians read my columns (I wish!). Instead, they adopted better tax policy because they were afraid of losing jobs and investment to countries with better fiscal policy.

Now for the bad news.

There’s been an ongoing campaign by high-tax governments to replace tax competition with tax harmonization. They’ve even conscripted international bureaucracies such as the Organization for Economic Cooperation and Development (OECD) to launch attacks against low-tax jurisdictions.

And now the United States is definitely on the wrong side of this issue.

Here’s some of what the Biden Administration wants.

The United States can lead the world to end the race to the bottom on corporate tax rates. A minimum tax on U.S. corporations alone is insufficient. …President Biden is also proposing to encourage other countries to adopt strong minimum taxes on corporations, just like the United States, so that foreign corporations aren’t advantaged and foreign countries can’t try to get a competitive edge by serving as tax havens. This plan also denies deductions to foreign corporations…if they are based in a country that does not adopt a strong minimum tax. …The United States is now seeking a global agreement on a strong minimum tax through multilateral negotiations. This provision makes our commitment to a global minimum tax clear. The time has come to level the playing field and no longer allow countries to gain a competitive edge by slashing corporate tax rates.

As Charlie Brown would say, “good grief.” Those passages sound like they were written by someone in France, not America

And Heaven forbid that countries “gain a competitive edge by slashing corporate tax rates.” Quelle horreur!

There are three things to understand about this reprehensible initiative from the Biden Administration.

- Tax harmonization means ever-increasing tax rates – It goes without saying that if politicians are able to create a tax cartel, it will merely be a matter of time before they ratchet up the tax rate. Simply stated, they won’t have to worry about an exodus of jobs and investment because all countries will be obliged to have the same bad approach.

- Corporate tax harmonization will be followed by harmonization of other taxes – If the scheme for a harmonized corporate tax is imposed, the next step will be harmonized (and higher) tax rates on personal income, dividends, capital gains, and other forms of work, saving, investment, and entrepreneurship.

- Tax harmonization denies poor countries the best path to prosperity – The western world became rich in the 1800s and early 1900s when there was very small government and no income taxes. That’s the path a few sensible jurisdictions want to copy today so they can bring prosperity to their people, but that won’t be possible in a world of tax harmonization.

P.S. If you want more information, here’s a three-part video series on tax havens, and even a video debunking some of Obama’s demagoguery on the topic.