There’s a political party in the United States – the Democrats – that represents rich people and it is trying very hard to cut taxes for those rich people.

Since I don’t resent rich people (indeed, I applaud them if they earn their money honestly), I generally want lower taxes for upper-income taxpayers. But I don’t want special tax breaks for rich people. Instead, I want to cut their taxes in ways that promote greater national prosperity so that I’ll benefit as well.

- Lower top income tax rates.

- Lower tax rates on capital gains.

- Lower tax rates on dividends.

- Lower death taxes.

Sadly, those aren’t the options the Democrats are choosing.

They are putting all their energy into a dramatic expansion of the state and local tax deduction. This is the tax break that rich people get when they use state and local tax payments to reduce the amount of taxable income they report to the IRS.

It was curtailed as part of the 2017 tax law and now Democrats want to expand it.

The restored tax break would be available to everyone, they say, but let’s look at who really benefits.

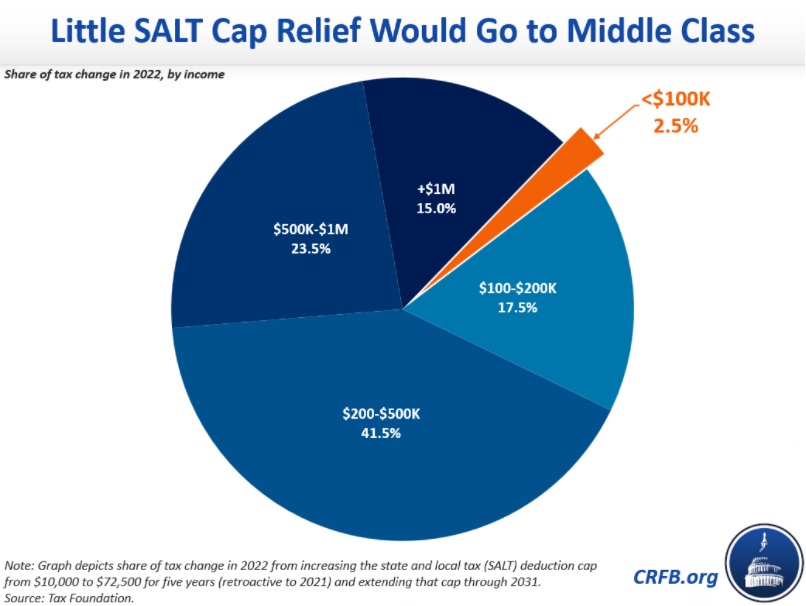

The Committee for a Responsible Federal Budget is a middle-of-the-road group, and it points out that more only 2.5 percent of the tax cut would go to people making less than $100K per year.

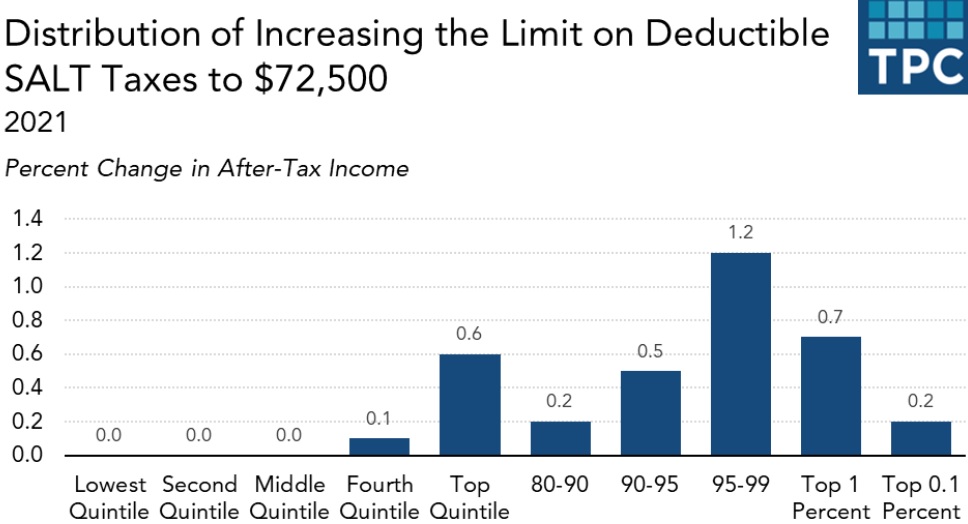

The Tax Policy Center is a left-of-center organization and it also points out that expanding the deduction for state and local taxes means a windfall for the rich.

Here’s TPC’s chart showing that almost all the gains go to those in the top quintile.

While Democrats in Congress are pushing this big tax cut for the rich, some folks on the left are not very happy about what’s happening.

I often disagree with Catherine Rampell of the Washington Post, but she makes some excellent points in her recent column on the SALT deduction.

Wrong. A disaster. Obscene. These are among the ways liberal budget wonks have described Democrats’ determination to give a huge windfall to the rich by repealing the cap on state and local tax (SALT) deductions. …Households making $1 million or more a year would receive roughly half the benefit of this policy, according to estimates from the Tax Policy Center. About 70 percent of the benefit would go to households making at least $500,000. …Nearly every millionaire (93 percent)…would get a tax cut, with an average size of $48,000. …As a result, the top 5 percent of households would still likely see their taxes go down on net, after accounting for all tax provisions in the budget bill.

The New York Times made similar points about Democrats in an editorial earlier this year.

…the party is flirting with a major change in tax policy that would allow the wealthiest Americans to pay lower taxes. …Proponents of an unlimited SALT deduction say they are seeking to help middle-class taxpayers. If so, they should go back to the drawing board. The top 20 percent of American households, ranked by income, would receive 96 percent of the benefits of the change… The primary beneficiaries would be an even smaller group of the very wealthiest Americans. The 1 percent of households with the highest incomes would receive 54 percent of the benefit, on average paying about $36,000 less per year in federal income taxes.

Honest folks on the left aren’t just upset that congressional Democrats are pushing a big tax cut for rich people.

They’re also upset that this big tax cut is crowding out some other priorities for the left – such as additional spending.

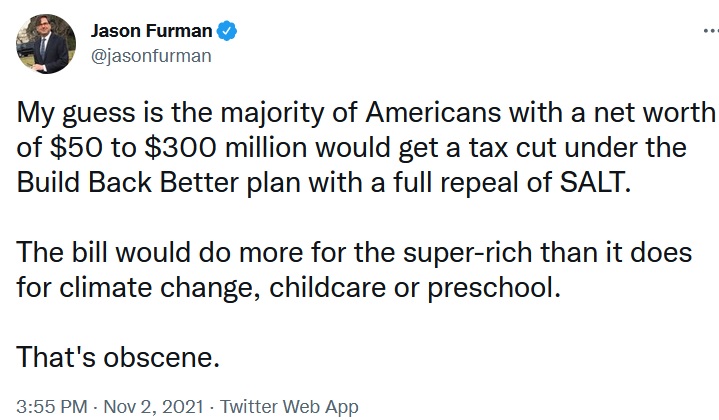

This tweet from Jason Furman (a former top economist for Obama) captures this sentiment.

The bottom line is that the most important constituency for many elected Democrats is not poor people.

It’s rich people and the politicians at the state and local level who represent those rich people.

I’ll close by observing that I don’t want more spending and I also don’t want a special tax break that subsidizes bad policy by state and local politicians, so I’m obviously not in full agreement with Mr. Furman.

So the best result is for Biden’s entire agenda to implode. That would be a win for American taxpayers, a win for the American economy, and a win for long-suffering residents of blue states.

P.S. Yes, resentment against success motivates many people on the left, but elected Democrats are not the same as left-wing activists.