Back in 2015, I joked that my life would be simpler if I had an “automatic fill-in-the-blanks system” for columns dealing with the Organization for Economic Cooperation and Development.

Here’s what I proposed.

We can use this shortcut today because the OECD has just churned out a report embracing the death tax. So all we need to do is fill in the blanks and we have an appropriate intro:

The bureaucrats at the Paris-based OECD, working in cooperation with greedy politicians, have released a new study urging more power for governments in order to increase death taxes.

But the purpose of this column is not to mock the OECD, even though its reflexive statism makes it an easy target. Let’s actually dig into this new report and explain why it is so misguided.

This paragraph is a summary of the bureaucracy’s main argument, which is basically an envy-driven cry for more tax revenue.

The report explores the role that inheritance taxation could play in raising revenues, addressing inequalities and improving efficiency in the future. …taxes on wealth transfers – including inheritance, estate, and gift taxes – are levied in 24 of the 36 OECD countries… In 2018, only 0.5% of total tax revenues were sourced from those taxes on average across the countries that levied them. …Overall, the report finds that there is a good case for making greater use of well-designed inheritance and gift taxation… There are strong equity arguments in favour of inheritance taxation..

Here’s some more of the OECD’s dirigiste analaysis.

The report finds that well-designed inheritance taxes can raise revenue and enhance equity… There are strong equity arguments in favour of inheritance taxation… From an equality of opportunity perspective, inheritances and gifts can create a divide between the opportunities that people face. Wealth transfers might give recipients a head start… By breaking down the concentration of wealth…, inheritance and gift taxation can contribute to levelling the playing field… ‘The recent progress made on international tax transparency…is greatly increasing countries’ ability to tax capital… Progressive tax rates have several advantages compared to flat tax rates. …Taxing unrealised gains at death may be the most efficient and equitable approach.

As you can see, the OECD’s argument revolves around class warfare. They think it’s unfair that some parents want to help their children.

By contrast, the argument against the OECD revolves around economics. More specifically, the death tax is a terrible idea because it directly and unambiguously reduces private savings and investment, thus undermining productivity and putting a damper on wages.

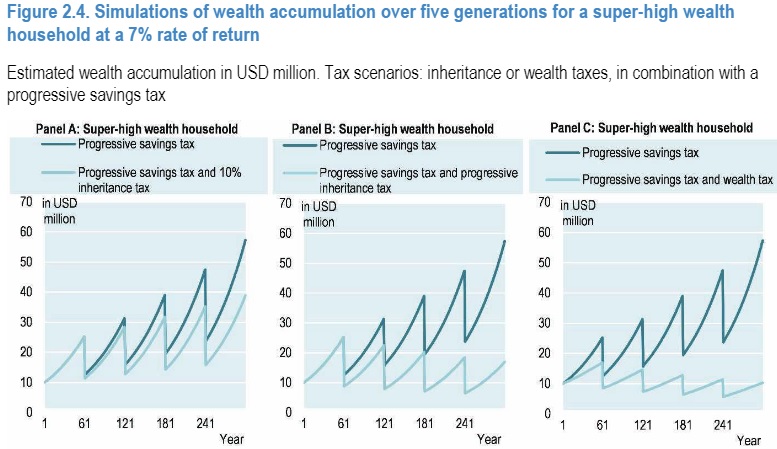

Interestingly, the OECD admits this happens. Here’s Figure 2.4 from the OECD report, showing how death taxes (combined with annual income taxes) reduce saving and investment over five generations.

And the above charts don’t even show the true impact because there’s no line showing how much saving and investment would exist with no death tax and no double taxation.

For what it’s worth, the OECD report does acknowledge some practical and economic problems with death taxes.

An inheritance tax directly reduces wealth accumulation over generations. …inheritance taxes may also affect wealth accumulation prior to being levied by encouraging changes in donors’ behaviours. …Susceptibility to tax planning is one of the most common criticisms levelled against inheritance taxes. …There is evidence of widespread inheritance tax planning… Inheritance taxes might lower entrepreneurship by heirs… Inheritance taxes may also jeopardise existing businesses when they are transferred if business owners do not have enough liquid assets to pay the tax. …Double taxation is a popular objection to inheritance taxes…wage earnings, savings, or personal business income…will have in many cases already been taxed. …There might be challenges associated with estimating fair market value for some assets.

If you wade through the report, you’ll notice that the OECD doesn’t have good answers for these problems.

Instead, the basic message is, “yeah, there are a bunch of downsides, but we want to finance bigger government and we resent successful people.”

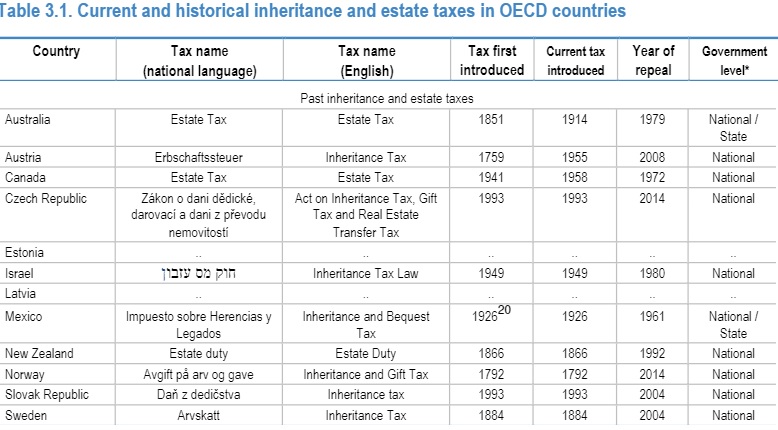

The only good news is that the report gives us a list of nations that have eliminated (or never adopted) death taxes.

Among the OECD countries that do not levy inheritance or estate taxes, nine have abolished them since the early 1970s. …Austria, Czech Republic, Norway, Slovak Republic, ans Sweden have abolished their inheritance or estate taxes since 2000. Israel and New Zealand abolished these taxes between 1980 and 2000. Australia, Canada, and Mexico abolished these taxes before 1980, and Estonia and Latvia have never levied inheritance or estate taxes. …This is consistent with evidence that inheritance and estate taxes tend to be unpopular.

Here’s the part of Table 3.1 that shows when these taxes were implemented and when they were repealed.

Needless to say, I’d like to see the United States on this list at some point (we were there for one year!).

The OECD closed with some cheerleading and strategizing on how to overcome popular opposition.

…this section considers ways in which governments may enhance the public acceptability of inheritance tax reform… Reframing reforms aiming to raise more revenue.around notions of equality of opportunity and inequality reduction may help increase their public acceptability. …packaging may also be helpful. …If the introduction of an inheritance tax or an increase in existing inheritance or estate taxes…goes hand-in-hand with a decrease in other taxes, especially in labour taxes, which a majority of people are subject to, it may be more acceptable politically.

I can’t resist pointing out that it’s utter nonsense to think that governments would use revenue from a death tax to lower other taxes.

The goal of politicians is always to finance bigger government. That’s true with the death tax. It’s true with the carbon tax. It’s true with the value-added tax. It’s true with the financial transactions tax.

Which is why I wrote four years ago that, “Some people say the most important rule to remember is to never feed gremlins after midnight, but I think it’s even more important not to give politicians a new source of revenue.”