To finance a bigger welfare state and create more dependency, President Biden and his congressional allies have been contemplating all sorts of tax increases.

- Higher corporate tax rates

- Higher capital gains tax rates

- Higher personal income tax rates

- More double taxation of dividends

- Taxes on so-called book income

- Taxes on unrealized capital gains

- A new form of death tax

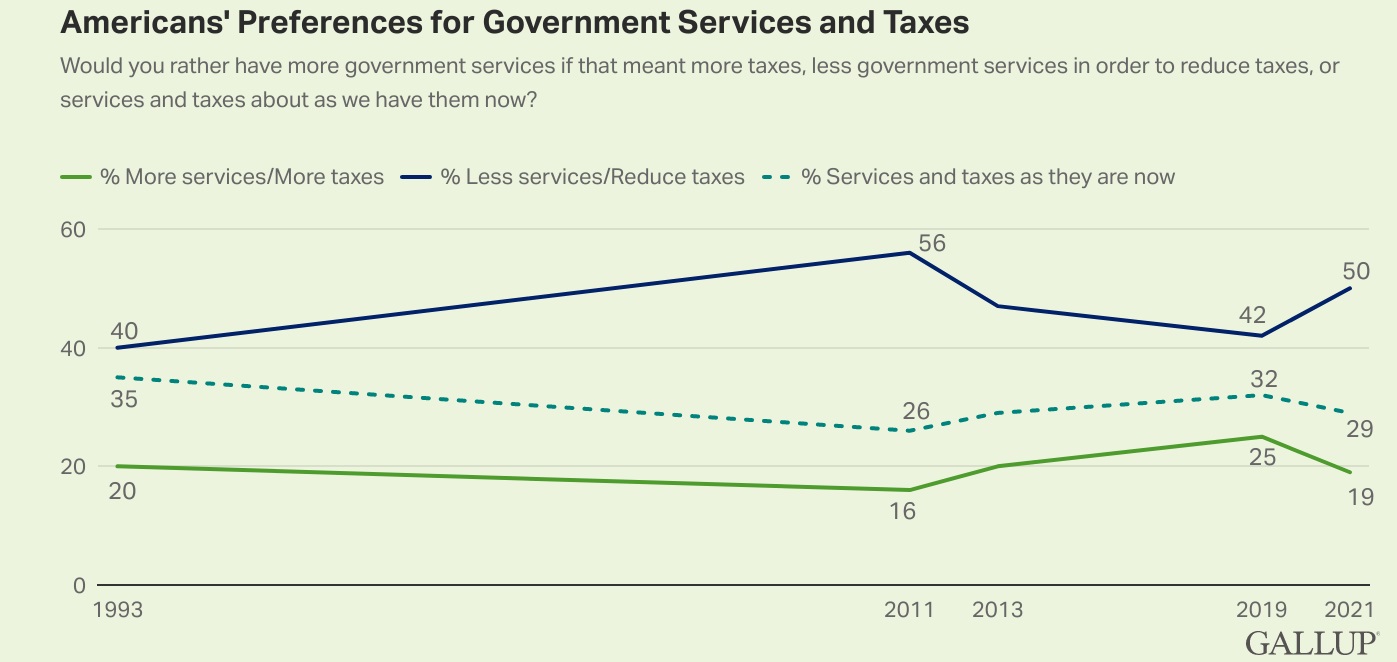

The common theme is “soak the rich.” Our friends on the left seem to think class-warfare taxation is politically popular, and it’s easy to understand their political calculus – win votes by pillaging a tiny group and distributing goodies to a much bigger group.

But if that’s the case, they may want to look at the results of a referendum that was decided earlier this week. It took place in the blue state of Washington, where voters had the chance to register their approval or disapproval of a capital gains tax imposed earlier in the year by the state’s politicians.

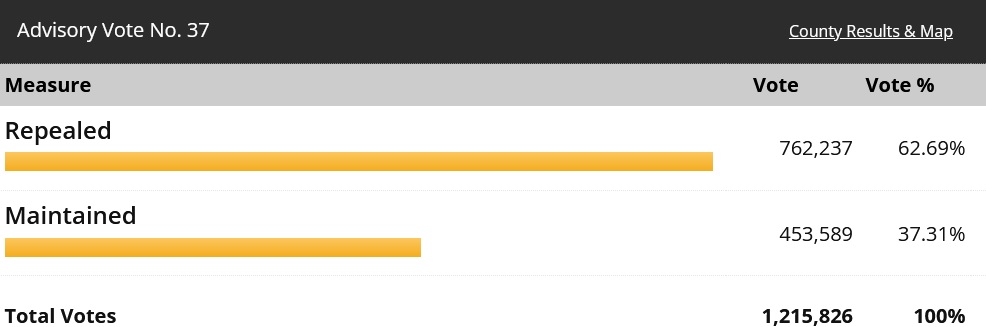

Here are the official results, which show a landslide rejection of the class-warfare levy. And it happened in a state that Biden won by nearly 20 percentage points.

Now for the bad news.

The referendum does not repeal the capital gains tax. It’s simply an “advisory vote.”

If you want to know more details, Jared Walczak wrote about the issue last month for the Tax Foundation.

On May 4th, Gov. Jay Inslee (D) signed legislation creating a 7 percent capital gains tax, to take effect next year. On November 2nd, Washington lawmakers will learn what voters think about it. Although the ballot measure asking voters to recommend on retaining or repealing the new tax is purely advisory, this gauge of voter sentiment could be particularly illuminating as Washington barrels forward on the implementation of a highly volatile, constitutionally suspect tax that breaches the state’s historic barrier against income taxation. …Legal challenges to the tax are already pending and may ultimately do more to stop it in its tracks than can a nonbinding advisory vote. Nevertheless, the fate of Advisory Question 37 is an important one, not only because the capital gains tax itself would be economically harmful, or because it shows an irreverence for the state constitution, a concern in its own right. It’s also important because if voters signal their opposition to taxing this specific class of income, that sends a strong message that they are decidedly uninterested in efforts to scrap the state’s ban on a broader income tax.

Well, the voters did send a “strong message” that they want to preserve the state’s zero-income-tax status.

Whether the courts listen (or, more important, whether they uphold the state’s constitution) is yet to be determined.

For purposes of today’s column, however, I’ll simply observe that the election results may have an impact on whether Biden’s awful fiscal proposals get enacted.

Most observers are focused on the upset victory for Republicans in Virginia and the huge vote gains for the GOP in New Jersey. And I won’t be upset if those remarkable election results lead my Democratic friends in DC to back away from Biden’s big-government agenda.

But I think what happened in the state of Washington also indicates that voters don’t want big government, even when politicians tell them “the rich” will pick up the tab. Maybe, just maybe, ordinary people realize that they’ll be collateral damage if we make the United States more like Europe.