When studying the economic of taxation, one of the most important lessons is that there should be low marginal tax rates on work, saving, investment, and entrepreneurship.

That’s also the core message of this video from Prof. John Cochrane.

I wrote a primer on marginal tax rates back in 2018. I wanted to help people understand that the incentive to engage in additional productive behavior is impacted by how much people get to keep if they earn additional income.

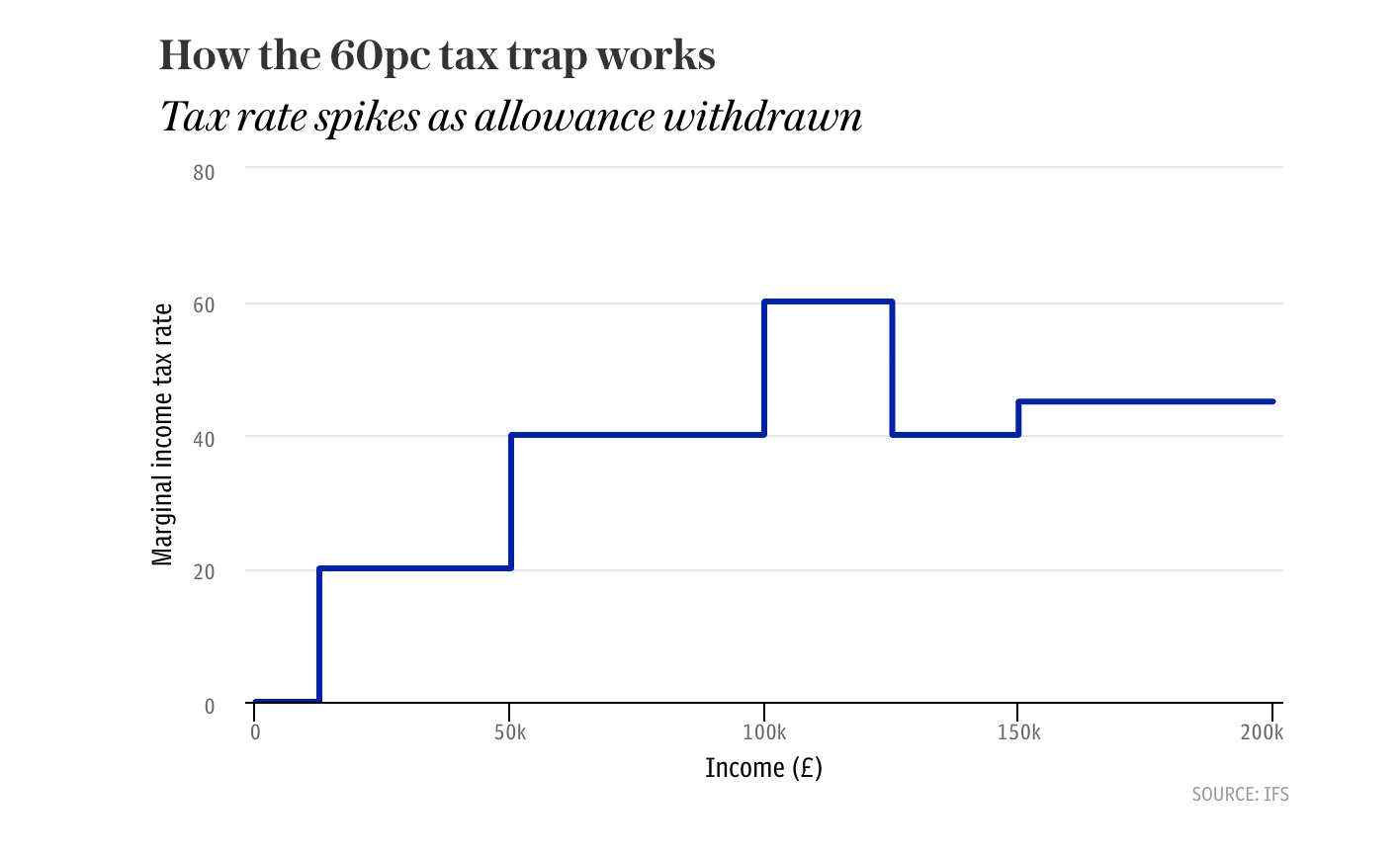

So what matters isn’t the tax on income that’s already been generated. The key variable is the marginal tax on the additional increment of income. As illustrated by the accompanying visual.

I’ve shared real-life examples of how the American tax system can result in very high marginal tax rates, especially when you include the extra layers of tax on income that is saved and invested (producing extremely high effective marginal tax rates).

For today’s column, let’s look at a real-world example from the other side of the Atlantic Ocean.

The U.K.-based Telegraph has a story illustrating how marginal tax rates often can be much higher than the official statutory tax rate.

More than a third of a million people now face paying income tax at a rate of 60pc because of government stealth tax policies… 336,000 people earned between £100,000 and £125,000 in 2018-19, the last year for which data was available. …This group is meant to pay income tax at a rate of 40pc, but risks falling foul of a costly trap which results in their earnings being subject to effective income tax rates that are far higher. The trap is sprung once someone starts to earn more than £100,000, as this is the point at which the Government begins to withdraw the £12,570 tax-free personal allowance. For every £1 earned over £100,000, the state reduces the allowance by 50p. The result is that each additional £1 of income effectively incurs 60p of income tax… Once National Insurance is factored in, the true rate is even higher.

Here’s a chart that was part of the article.

It shows that anyone earning £50,000 or above is losing at least 40 percent to the tax authorities. That statutory rate is both punitive and excessive.

But you also can see how the marginal tax rate jumps to 60 percent once taxpayers hit £100,000 on income.

At the risk of understatement, high marginal tax rates are bad news for the economy.

That’s true in the United Kingdom, the United States, and everyplace else in the world.

To use economic jargon, “deadweight losses” grow exponentially as tax rates are increased.

In regular English, this simply means that class-warfare tax policy (ever-higher tax rates on the so-called rich) causes the most economic damage. Even the left-leaning OECD agrees with this analysis.

You may be wondering why a supposedly conservative government in the United Kingdom allows such a destructive policy.

Sadly, there is no good answer. As you can see from this excerpt, Boris Johnson’s government sounds a lot like what the U.K. would have experienced if Jeremy Corbyn won the last election.

The Government said it was aware of the effect of the 60pc tax trap but said it had to take a “balanced approach”. “We want to keep taxes low to support working people to keep more of what they earn, but it’s only fair that those with the broadest shoulders bear the biggest burden as we rebuild the public finances and fund public services,” a spokesman said.

P.S. If President Biden’s tax plan is any indication, our friends on the left seem to be motivated by spite and envy, so they don’t care that high tax rates have negative consequences.

P.P.S. A wealth tax could easily result in marginal tax rates of more than 100 percent.

P.P.P.S. The politicians in Washington also believe in very high implicit tax rates on low-income people.

P.P.P.P.S. The various plans for per-child handouts would create another big spike in marginal tax rates for a large cohort of American taxpayers.

———

Image credit: 401(K) 2012 | CC BY-SA 2.0.