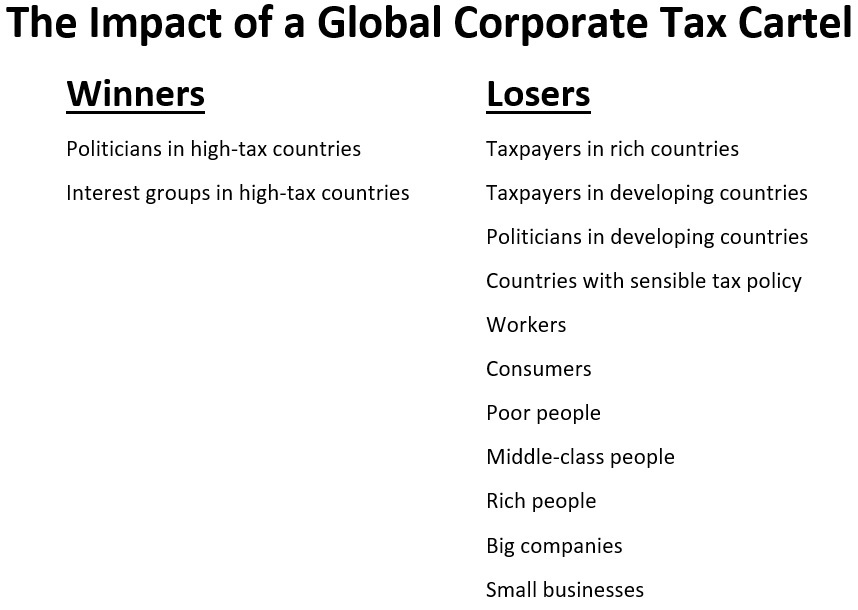

When President Biden first proposed a global minimum tax on companies, I immediately warned that creating a corporate tax cartel would be very bad news for workers, consumers, and shareholders.

I also warned a BBC audience that proponents would use the agreement as a stepping stone for other statist initiatives to increase the power of politicians.

Simply stated, I’ve been ringing the alarm bells that a tax cartel will lead to ever-higher corporate tax rates. And it will serve as a model for other forms of harmonization.

Well, now that Ireland has capitulated and governments formally adopted the scheme, this is my “I told you so” column.

In a column for the Washington Post, Larry Summers, a former top adviser for Bill Clinton and Barack Obama, celebrates the creation of a global tax cartel.

His column has a laughably inaccurate title, but he starts with some accurate observations about the importance of the agreement.

This agreement is arguably the most significant international economic pact of the 21st century so far. It is built around a profoundly important principle: Countries should cooperate to raise corporate taxation, not compete to reduce it. …It also demonstrates the power of ideas to shape economic policy, as tax scholars have for years been pondering the conundrums of taxing global companies.

I also think the agreement is important, albeit in a very bad way.

And it does show the power of ideas, albeit very bad ideas (though politicians instinctively want more money and power and merely rely on left-leaning academics and policy wonks for after-the-fact rationalizations of statism).

As you might expect, Summers veers from reality to fantasy when discussing the implications of the new tax cartel.

Countries have come together to make sure that the global economy can create widely shared prosperity, rather than lower tax burdens for those at the top. By providing a more durable and robust revenue base, the new minimum tax will help pay for the sorts of public investments that are fundamental to economic success in all countries.

For all intents and purposes, he’s embracing the absurd notion that more growth will materialize if politicians impose higher tax rates and use the money to expand the burden of government.

Proponents of this view conveniently never offer any evidence.

Why? Because there isn’t any.

The scholarly research shows the opposite is true. Free markets and small government are the recipe for growth and prosperity.

I’ll now shift back to a part of the column that is unfortunately accurate.

It is also a template for much more that needs to be done to tackle the adverse side effects of our modern, global capitalism.

What’s accurate about that sentence isn’t the jibe about “adverse side effects” of capitalism (unless, of course, he thinks mass prosperity is a bad thing).

But he’s right about the statists using the global tax cartel as “a template” for further schemes to empower politicians and their cronies.

Summers mentions issues such as public health (I guess he wants to reward the World Health Organization’s corruption and incompetence).

Since I’m a public-finance economist, I’m more worried about cartels that will be created for personal income tax, capital gains tax, dividend tax, wealth tax, etc.

P.S. The corporate tax cartel will lead to higher tax rates, but OECD and IMF data (and U.S. data) show that this doesn’t necessarily mean higher revenue.