As part of a video debate last year (where I also discussed wealth taxation, poverty reduction, and the inadvisability of tax increases), I pontificated on the negative economic impact of class-warfare taxation.

To elaborate, I’m trying to help people understand why it is a mistake to impose class-warfare taxes on high-income taxpayers.

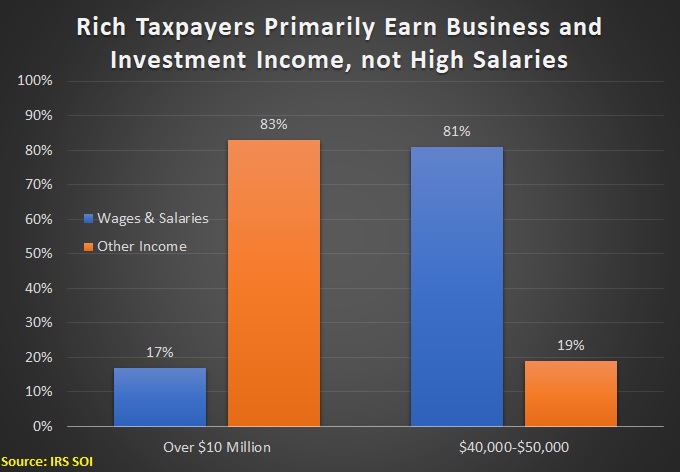

Back in 2019, I shared data from the Internal Revenue Service confirming that rich taxpayers get the vast majority of their income from business activity and investments.

And since it’s comparatively easy to control the timing, level, and composition of that income, class-warfare taxes generally backfire.

Heck, well-to-do taxpayers can simply shift all their investments into tax-free municipal bonds (that’s bad for the rest of us, by the way, since it’s better for growth if they invest in private businesses rather than buying bonds from state and local governments).

Or, they can simply buy growth stocks rather than dividend stocks because politicians (thankfully) haven’t figured out how to tax unrealized capital gains.

Some of my left-leaning readers probably think that my analysis can be ignored or dismissed because I’m a curmudgeonly libertarian.

But I’m simply recycling conventional economic thinking on these issues.

And to confirm that point, let’s review a study on taxes and growth that the International Monetary Fund published last December. Written by Khaled Abdel-Kader and Ruud de Mooij, there are passages that sound like they could have been written by yours truly.

Such as the observation that taxes hinder prosperity by reducing economic output (what economist refer to as deadweight loss).

…public finance…theories teach us some important lessons about efficient tax design. By transferring resources from the private to the public sector, taxes inescapably impose a loss on society that goes beyond the revenue generated. …deadweight loss (or excess burden) is what determines a tax distortion. Efficient tax design aims to minimize the total deadweight loss of taxes. The size of this loss depends on two main factors. First, losses are bigger the more responsive the tax base is to taxation. Second, the loss increases more than proportionately with the tax rate: adding a distortion to an already high tax rate is more harmful than adding it to a low tax rate. Two prescriptions for efficient tax policy follow: (i) it is efficient to impose taxes at a higher rate if things are in inelastic demand or supply; and (ii) it is best to tax as many things as possible to keep rates low. …empirical studies on the growth impact of taxes…generally find that income taxes are more distortive for economic growth than taxes on consumption.

There are several parts of the above passage that deserve extra attention, such as the observation about elasticity (similar to the point I made in the video about why higher tax rates on upper-income taxpayers are so destructive).

But the most important thing to understand is what the authors wrote about how “the [deadweight] loss increases more than proportionately with the tax rate.”

In other words, it’s more damaging to increase top tax rates.

This observation, which is almost certainly universally recognized in the economics profession, tells us why class-warfare taxes do the most economic damage, on a per-dollar-collected basis.

The IMF study also has worthwhile observations on different types of taxes, such as why it’s a good idea to have low income tax rates on people.

Optimal tax theory emphasizes the trade-off between equity and efficiency. …This requires balancing the revenue gain from a higher marginal top PIT rate at the initial base against the revenue loss induced by behavioral responses that a higher tax rate would induce—such as reduced labor effort, avoidance or evasion—measured by the elasticity of taxable income. …high marginal rates cause other adverse economic effects, e.g. on innovation and entrepreneurship, and thus create larger economic costs than is sometimes assumed.

Very similar to what I’ve written.

And low income tax rates on companies.

Capital income—interest, dividends and capital gains—is used for future consumption so that taxes on it correspond to a differentiated consumption tax on present versus future consumption—one that compounds if the time horizon expands. Prudent people who prefer to postpone consumption to later in life (or transfer it to their heirs) will thus be taxed more than those who do not, even though they have the same life-time earnings. This violates horizontal equity principles. Moreover, it causes a distortion by encouraging individuals to substitute future with current consumption, i.e. they reduce savings. The tax is therefore also inefficient. A classical result, formalized by Chamley (1986) and Judd (1985), is that the optimal tax on capital is zero.

Once again, very similar to what I’ve written.

Indeed, the study even asks whether there should be a corporate income tax when the same income already is subject to dividend taxation when distributed to shareholders.

…capital income taxes can be levied directly on the people that ultimately receive that income, i.e. shareholders and creditors. So: why is there a need for a CIT? It is hard to justify a CIT on efficiency grounds. As explained before, the incidence of the CIT in a small open economy falls largely on workers, not on the firm or its shareholders. Since it is more efficient to tax labor directly than indirectly, the optimal CIT is found to be zero. …CIT systems…in most countries…create two major economic distortions. First, by raising the cost of capital on equity they distort investment decisions. This hurts economic growth and adversely affects efficiency. Second, by differentiating between debt and equity, they induce a bias toward debt finance. This not only creates an additional direct welfare loss, but also threatens financial stability. Both distortions can be eliminated by…cash-flow taxes, which allow for full expensing of investment instead of deductions for tax depreciation

Also similar to what I’ve written.

And I like the fact that the study makes very sensible points about why there should not be a pro-debt bias in tax codes and why there should be “expensing” of business investment costs.

I’ll close by noting that the IMF study is not a libertarian document.

The authors are simply describing the economic costs of taxation and acknowledging the tradeoffs that exist when politicians impose various types of taxes (and the rates at which those taxes are imposed).

But that doesn’t mean the IMF is arguing for low taxes.

There are plenty of sections that make the (awful) argument that it’s okay to impose higher tax rates and sacrifice growth in order to achieve more equality.

And there are also sections that regurgitate the IMF’s anti-empirical argument that higher taxes can be good for growth if politicians wisely allocate the money so it is spent on genuine public goods.

Politicians doing what’s best for their countries rather than what’s best for themselves? Yeah, good luck with that.

———

Image credit: Max Pixel | CC0 Public Domain.