The bad news is that federalism has declined in the United States as politicians in Washington have expanded the size and scope of the national government.

The good news is that some federalism still exists and this means Americans have some ability to choose the type of government they prefer by “voting with their feet.”

- They can choose states that tax a lot and spend a lot.

- They can choose states with lower fiscal burdens.

You won’t be surprised to learn that people generally prefer option #2.

Researchers have found a significant correlation between state fiscal policy and migration patterns.

And it’s still happening.

In a column for the Wall Street Journal a few days ago, Allysia Finley and Kate LaVoie discuss some research based on IRS data about taxpayer migration patterns.

Here’s some of what they wrote.

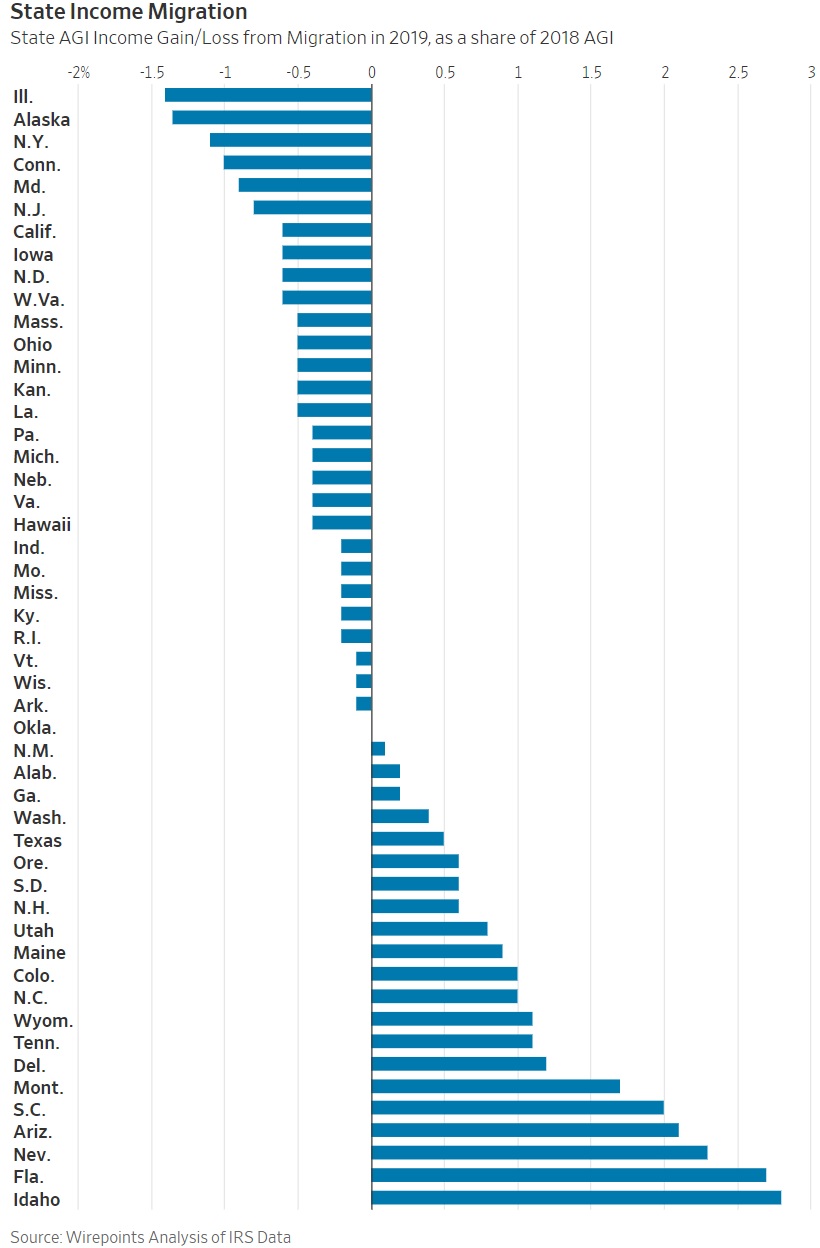

New IRS data compiled by research outfit Wirepoints illustrate the flight from high- to low-tax states. …Retirees in the Midwest and Northeast are flocking to sunnier climes. But notably, states with no income tax (Florida, Nevada, Tennessee and Wyoming) made up four of the 10 states with the largest income gains. On the other hand, five of the 10 states with the greatest income losses (NY, Connecticut, New Jersey, Minnesota, California) ranked among the top 10 states with the highest top marginal income tax rates. …Florida gained a whopping $17.7 billion in AGI including $3.4 billion from New York, $1.2 billion from California, $1.9 billion from Illinois, $1.7 billion from New Jersey and $1 billion from Connecticut. California, on the other hand, lost $8.8 billion including $1.6 billion to Texas, $1.5 billion to Nevada, $1.2 billion to Arizona and $700 million to Washington.

Here’s a very informative visual, showing the share of income that either left a state (top half of the chart) or entered a state (bottom half of the chart).

Our friends on the left say that this data merely shows that retirees move to states with nicer climates.

That is surely a partial explanation, but it doesn’t explain why California – the state with the nation’s best climate – is losing people and businesses.

Heck, I even have a seven-part series (March 2010, February 2013, April 2013, October 2018, June 2019, December 2020, and February 2021) on the exodus from California to Texas.

Let’s return to the Finley-LaVoie column, because there’s some additional data that deserves attention. They point out that states with better policy are big net winners when you look at the average income of migrants.

The average taxpayer who moved to Florida from the other 49 states had an AGI of $110,000… By contrast, the average taxpayer who left Florida had an AGI of just $66,000. In sum, high-tax states aren’t just losing more taxpayers—they are losing higher-income ones. Similarly, low and no income states are generally gaining more taxpayers who also earn more. …When blue states lose high earners, their tax base shrinks, but their cost base continues to grow due to rich government employee pay, pensions and other benefits. …The result is that low-tax states are getting richer while those that impose higher taxes are getting poorer.

As you can see, Florida is a big beneficiary.

And I shared data a few years ago showing that states such as Illinois are big net losers.

Let’s conclude by asking why some politicians, such as the hypocritical governor of Illinois, don’t care when they’re on the losing side of these trends?

I don’t actually know what they’re thinking, of course, but I suspect the answer has something to do with the fact that departing taxpayers probably are more libertarian and conservative. So if you’re a big-spending politician, you probably are not very upset when migration patterns mean your state becomes more left-leaning over time.

That’s a smart political approach.

Until, of course, those states no longer have enough productive people to finance big government.

In other words, every government is limited by Margaret Thatcher’s famous warning.

———

Image credit: Pixnio | Public Domain.