Yesterday’s column included a map showing which states gained and lost the most population over the past year.

I speculated that some of America’s internal migration was driven by differences in tax policy.

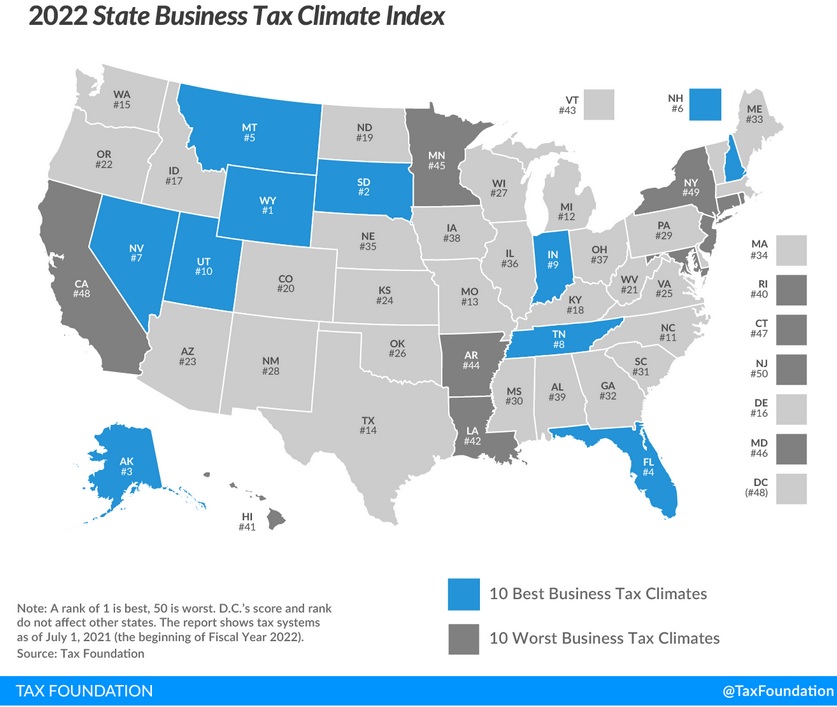

So it’s appropriate today that I share this map from the Tax Foundation’s annual State Business Tax Climate Index, showing Wyoming, South Dakota, Alaska, and Florida with the best scores and Connecticut, California, New York, and New Jersey with the worst scores.

Comparing today’s map with yesterday’s map, I immediately noticed that two states losing a lot of people – New York and California – also are states that have very bad tax systems.

And if you examine other states, you’ll confirm that there’s a relationship between tax policy and people “voting with their feet.”

Does that mean taxes are the only thing that matters? Of course not.

But as Janelle Cammenga and Jared Walczak explain in their report, they definitely have an effect on where money gets invested and where jobs get created.

Taxation is inevitable, but the specifics of a state’s tax structure matter greatly. The measure of total taxes paid is relevant, but other elements of a state tax system can also enhance or harm the competitiveness of a state’s business environment. …all types of businesses, small and large, tending to locate where they have the greatest competitive advantage. The evidence shows that states with the best tax systems will be the most competitive at attracting new businesses and most effective at generating economic and employment growth. …State lawmakers are right to be concerned about how their states rank in the global competition for jobs and capital, but they need to be more concerned with companies moving from Detroit, Michigan, to Dayton, Ohio, than from Detroit to New Delhi, India. …Tax competition is an unpleasant reality for state revenue and budget officials, but it is an effective restraint on state and local taxes.

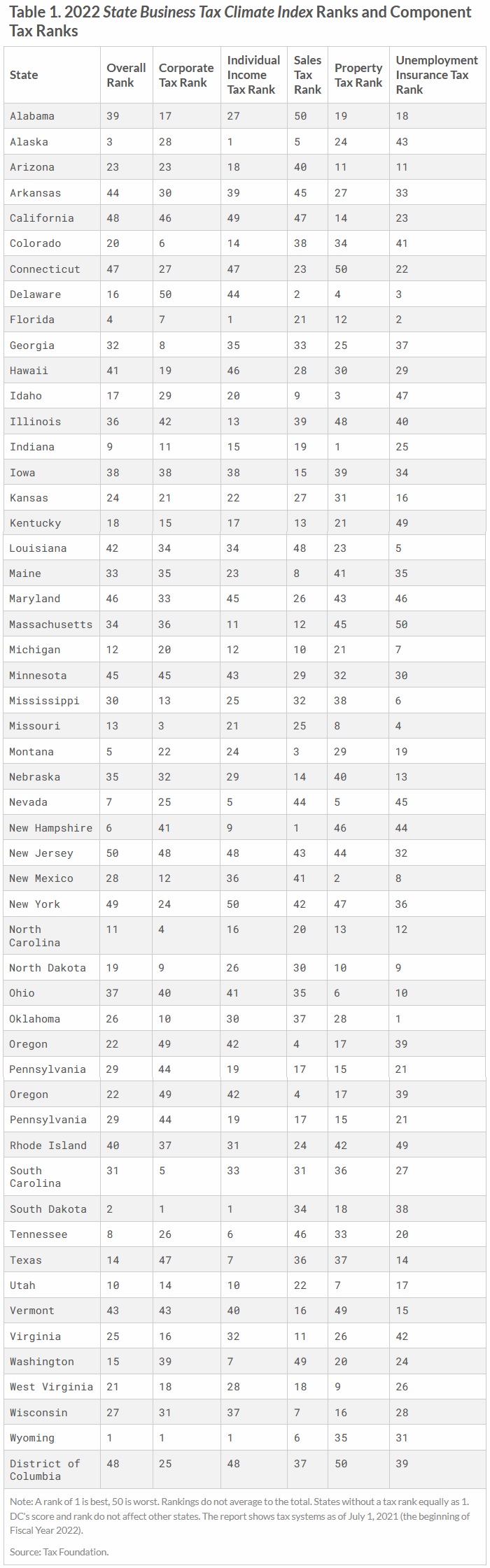

One of the more interesting parts of the report is that you get to see where states rank when considering different types of taxes.

Here’s Table 1, which has the overall ranking in the first column, followed by the rankings for the main revenue sources for states.

If you read the report’s methodology, you’ll notice that there are different weights.

The worst tax (assuming a state wants a competitive system) is the personal income tax, followed by the sales tax and corporate income tax.

No state ranks in the top 10 for all five categories, though Florida, North Carolina, and Utah have relatively good scores across the board.

P.S. One important caveat is that the report does not list energy severance taxes, which are major sources of revenue for states such as Alaska and Wyoming. To be sure, those taxes that largely are borne by out-of-state consumers, so there’s a reason for the omission. Nonetheless, those taxes enable excessive government spending, which is why I think South Dakota and Florida actually have the nation’s best fiscal systems.