Whenever I’m asked about the “tax gap,” I point to the academic evidence, from multiple sources, and explain that lower tax rates and tax reform are the best way to get higher levels of tax compliance.

Indeed, even the pro-tax International Monetary Fund has published research clearly identifying punitive tax policy as the leading cause of tax evasion and tax avoidance.

It’s time to take another look at this issue because the Biden Administration is trying to create a competing narrative.

The head of the IRS says that we need huge increases in the IRS’s budget in order to deal with a supposedly crisis of tax cheating.

Here are some excerpts from a story in the New York Times.

The United States is losing approximately $1 trillion in unpaid taxes every year, Charles Rettig, the Internal Revenue Service commissioner, estimated on Tuesday, arguing that the agency lacks the resources to catch tax cheats. …Most of the unpaid taxes are the result of evasion by the wealthy and large corporations, Mr. Rettig said. “We do get outgunned,” Mr. Rettig said during a Senate Finance Committee hearing… Senator Ron Wyden of Oregon, the Democratic chairman of the committee, called the $1 trillion tax gap a “jaw-dropping figure.” …The size of I.R.S.’s enforcement division has declined sharply in recent years, Mr. Rettig said, with its ranks falling by 17,000 over the last decade. The spending proposal that the Biden administration released last week asked for a 10.4 percent increase above current funding levels for the tax collection agency, to $13.2 billion.

There are a couple of points that cry out for correction.

First, the IRS is cherry picking data to make it seem like it is starved of resources. The bureaucrats got a record pile of money in 2010, so they use that year when making comparisons.

But if you look at long-run data, you can see that the IRS budget has almost doubled over the past four decades.

And that’s after adjusting for inflation.

Second, the $1 trillion figure is a make-believe number, more than twice as high as the IRS’s last official estimate.

Commissioner Rettig may as well have said $2 trillion. Or $5 trillion. After all, he’s simply pulling a number out of the air in an effort to convince Congress to give the IRS an even bigger budget.

By the way, since I mentioned the IRS’s official estimate, here’s a look at those numbers, which were published in September 2019. What deserves special attention is that there’s very little underpaying by corporations.

Indeed, it’s only 9 percent of the total (circled in red).

So where are the big sources of evasion?

It’s mostly small businesses. The IRS assumes modest-sized companies (especially family-owned firms) play lots of games so they can underreport income and overstate deductions.

So if the bureaucrats get a big budget increase, it basically means more IRS agents harassing lots of mom-and-pop businesses.

Can that approach shake loose some more money for the government? I’m sure the answer is yes, but I want to close by returning to my original point about why it would be better to instead focus on good tax policy.

Let’s take a look at a recent study from Mai Hassan and Friedrich Schneider (the world’s leading scholar on the underground economy). Here are some of their findings.

The shadow economy includes all of the economic activities that are deliberately hidden from official authorities for various reasons. …Monetary reasons include avoiding paying taxes and/or social security contributions… Given the purpose of our study, the shadow economy reflects mostly the legal economic and productive activities that, if recorded, should contribute to the national GDP. Therefore, the definition of the shadow economy in our study tries to avoid illegal or criminal activities …It is widely accepted in the literature that the most important cause leading to the proliferation of the shadow economy is the tax burden. The higher the overall tax burden, the stronger are the incentives to operate informally in order to avoid paying the taxes.

The study looks at all sorts of variables to see what else has an impact on tax evasion.

Considering the result of our MIMIC estimations…we clearly see that the tax burden has a positive (theoretically expected) sign and is statistically significant at the 5% confidence level. The regulatory burden variable (size of government) has also the theoretically expected sign and is highly statistically significant at the 1% confidence level. The estimated coefficient of the unemployment rate is also highly statistically significant and has the expected positive sign. The economic freedom index has the expected negative sign and is at the 10% confidence level statistically significant.

In other words, it’s not just tax policy, though that plays the biggest role.

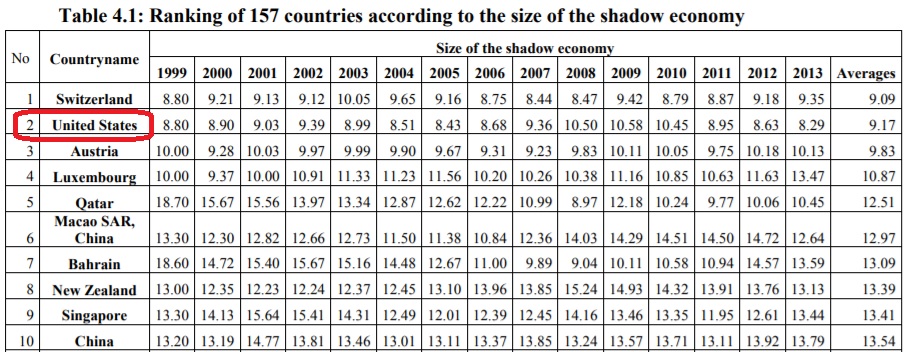

But the part of the study that is relevant for today is that the United States has the world’s 2nd-highest level of tax compliance, trailing only Switzerland.

Here are the top-10 nations.

The obvious takeaway is that there’s no crisis. Not even close.

By all means, we can try to jump Switzerland and move into first place. But let’s increase tax compliance the smart way – by lowering tax rates and reforming the tax code.

P.S. The Biden Administration and the IRS are feeding us garbage data for self-interested reasons (a classic case of “public choice” in action).

———

Image credit: TravelingOtter | CC BY-SA 2.0.