Almost everybody (even, apparently, Paul Krugman) agrees that you don’t want to be on the downward-sloping part of the Laffer Curve.

That’s where higher tax rates do so much economic damage that government collects even less revenue.

But I would argue that tax increases that produce more revenue also are a bad idea.

Sometimes they are even a terrible idea. For instance, there are tax increases that would destroy $5 of private income for every $1 of revenue they collect.

That would not be a good deal, at least for those of us who aren’t D.C. insiders.

Heck, according to research from economists at the University of Chicago and Federal Reserve, there are some tax increases that would destroy even greater levels of private income for every additional dollar that politicians got to spend.

The simple way of thinking about this is that you don’t want to be at the revenue-maximizing point of the Laffer Curve.

Because the closer you get to that point, the greater the damage to the private sector compared to any revenue collected.

To help understand this key point, let’s review a new study from Spain’s central bank. Authored by Nezih Guner, Javier López-Segovia and Roberto Ramos, it investigates the impact of higher tax rates.

They first look at what happens when progressivity (τ) is increased.

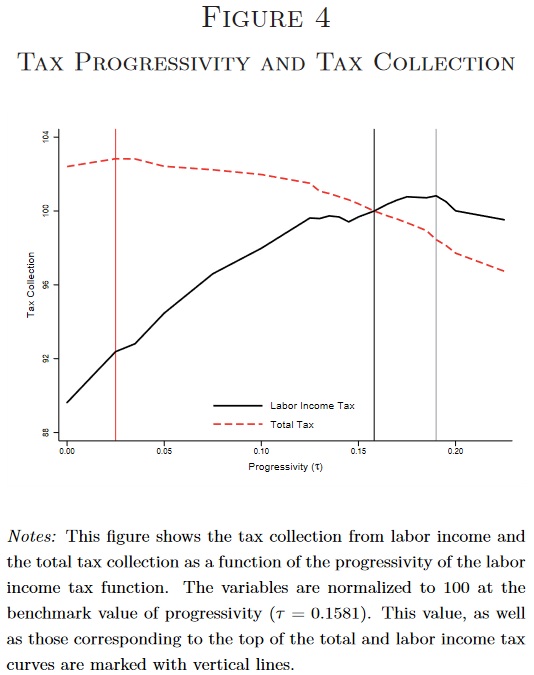

In the first experiment, we…change…the entire tax schedule, so that all households below the mean labor income face lower average taxes, while those above the mean income face higher average taxes. Since…richer individuals face higher taxes, all else equal, the government collects more taxes. All else, however, is not equal since more progressive taxes lower incentives to work and save. As a result, a higher τ might result in lower, not higher, revenue. The question is where the top of the Laffer curve is. We find that the tax revenue from labor income is maximized with τ = 0 .19. The increase in tax collection is, however, very small: the tax revenue from labor income increases only by 0.82% (or about 0.28% of the GDP). The tax revenue from labor income is, however, only one part of the total tax collection. There are also taxes on capital and consumption. With τ = 0 .19, while the tax collection from labor income is maximized, the total tax collection declines by 1.55%. This happens since with a higher τ, the aggregate labor, capital and output decline significantly. Indeed, the total tax collection falls for any increase in τ, and the level of τ that maximizes total tax revenue is much lower, τ = 0 .025, than its benchmark value.

The key takeaway is that more progressivity puts Spain on the wrong (downward-sloping) side of the Laffer Curve.

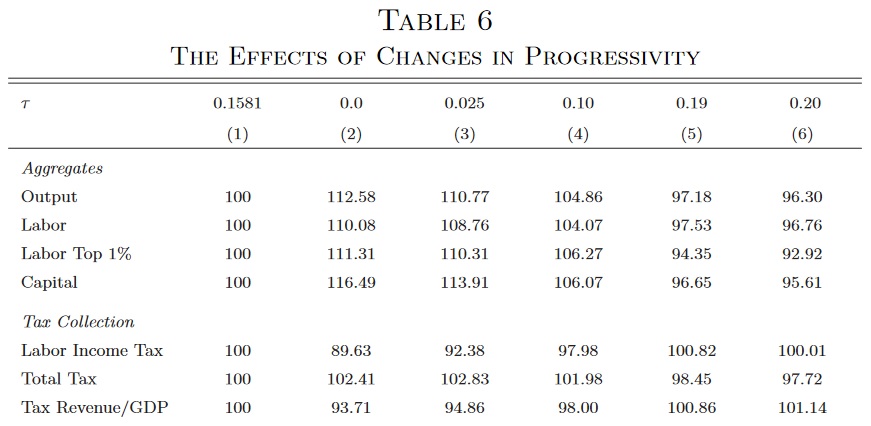

Here’s Table 6, which shows big declines in output, labor supply, and investment as progressivity increases.

Here’s some of the accompanying explanation.

The upper panel of Table 6 shows that capital, effective labor and output decline monotonically with τ. Hence, as the economy moves from τ = 0 .1581 to τ = 0 .19, the government is collecting higher taxes from labor, but the aggregate labor supply and output decline. For τ higher than 0.19, the decline in labor supply dominates and tax collection from labor income is lower. …The level of τ that maximizes the total tax collection is 0.025, which implies significantly less progressive taxes than in the benchmark economy. …In the economy with τ = 0 .025, the aggregate capital, labor and output increase significantly. The steady state output, for example, is almost 11 percentage points higher than the benchmark economy. As a result, the government is able to collect higher taxes despite lowering taxes on the top earners.

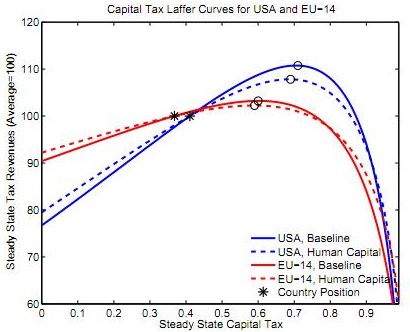

The authors also put together an estimate of Spain’s Laffer Curve, with the red-dashed line showing total tax revenue.

The authors also looked at what happens if politicians simply increase top tax rates.

They found that there are scenarios that would enable the Spanish government to collect more revenue.

We find that it is possible to generate higher total tax revenue by increasing taxes on the top earners. …The main message of our quantitative exercises is that…the extra revenue is not substantial. Higher progressivity has significant adverse effects on output and labor supply, which limits the room for collecting higher taxes. As a result, the only way to generate substantial revenue is with significant increases in marginal tax rates for a large group

But notice that those higher taxes would have “significant adverse effects on output and labor supply.”

Which brings us back to the earlier discussion about the desirability of causing a lot of damage to the private economy in order to give politicians a bit more money to spend.

The authors have a neutral tone, but the rest of should be able to draw the logical conclusion that higher taxes would be a big mistake for Spain.

And since the underlying economic principles apply in all nations, we also should conclude that higher taxes would be a big mistake for the United States.

P.S. We conducted a very successful experiment in the 1980s involving lower tax rates. Biden now wants to see what happens if we try the opposite approach.

———

Image credit: Max Pixel | CC0 Public Domain.