When I ask my left-leaning friends what they think about the flight of investors, entrepreneurs, and business owners from high-tax states, I tend to get three responses.

- It isn’t actually happening (these are my friends who apparently don’t know how to read).

- It’s happening, but it doesn’t matter (data from the IRS suggests it actually is significant).

- It’s happening, but high-tax states will be better off without these selfish and greedy people.

The folks making the third point actually have a decent argument, at least in terms of short-run political outcomes. Democrats rarely have to worry about retaining control of states like California, New York, Illinois, and New Jersey now that many Republican-leaning voters have moved away.

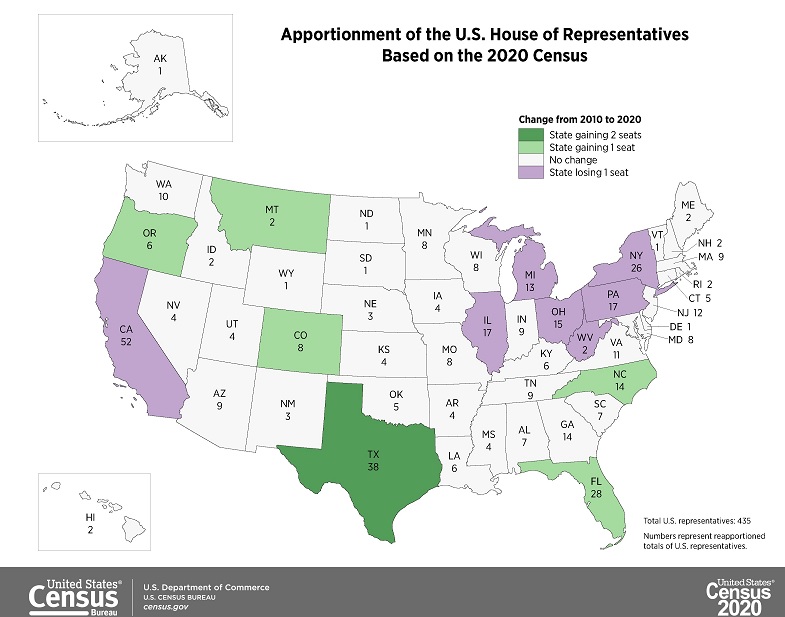

But sometimes short-run benefits are exceeded by long-run costs, and the recent data on congressional redistricting from the Census Bureau is a good example.

As you can see, there’s a continuing shift of political power – as measured by seats in Congress – from blue states to red states.

Patrick Gleason of Americans for Tax Reform explains what this means in a column for Forbes.

Over the past decade Americans have been voting with their feet in favor of states with lower overall tax burdens… As a result, high tax states…are set to lose congressional clout for the next decade, to the benefit of low tax states… the seven states that will lose congressional seats due to stagnant population growth have higher top income tax rates and greater overall tax burdens, on average, than do the six states gaining seats. In fact, the average top personal income tax rate for states losing seats in congress is 6.5%, which is 46% greater than the 4.45% average top income tax rate for states gaining seats.

Some people may want to dismiss Mr. Gleason’s column since he works for a group that supports smaller government.

But you can find the same analysis in this column in the Washington Post by Aaron Blake.

…what does the new breakdown mean from a partisan perspective? All told, five seats will migrate from blue states to red ones — owing to population shifts from the Rust Belt, the Northeast and California to the South and other portions of the West. Five of the seven seats being added also go to states under complete GOP control of redistricting, with three of seven being taken away coming from states in which Democrats have some measure of control over the maps. …That should help Republicans… The Cook Political Report estimates the shifts are worth about 3.5 seats… As for the electoral college in future presidential elections, …Michigan and Pennsylvania…are states Democrats probably need to win in the near future, meaning it’s probably a bigger loss for them. …If we reran the 2020 electoral college with the new electoral votes by state, Biden’s margin would shrink from 306-232 to 303-235. That seems negligible. But if you overlay the 2000 presidential results — three reapportionments ago — on the current electoral vote totals, George W. Bush’s narrow win with 271 electoral votes becomes a much more decisive win with 290. That gives you a sense where things have trended.

Let’s now return to the hypothesis that tax-motivated migration is playing a role.

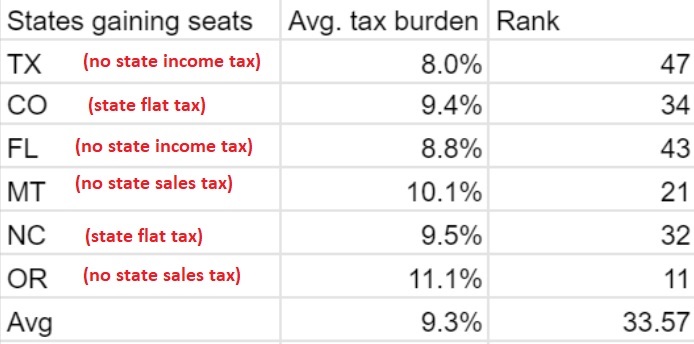

Here’s an instructive tweet from Andrew Wilford of the National Taxpayers Union.

I’ll wrap up today’s column by augmenting the data in Mr. Wilford’s tweet.

Because not only are there, on average, lower tax burdens in the states gaining congressional seats, but every one of them has some very desirable feature of its tax code.

To be sure, not all of the state-to-state migration is due to tax policy. There are all sorts of other policies that determine whether a state is an attractive place for people looking to relocate.

And there are other factors (family, climate, etc) that have nothing to do with public policy.

All things considered, however, being a low-tax state means more jobs, growth, and people, at least when compared with being a high-tax state.

P.S. If you’re interested in seeing how states rank in various indices, click here, here, and here.