Yesterday’s column explained why Biden’s proposed global cartel for corporate taxation was a bad idea.

In this clip from a recent panel hosted by the Austrian Economics Center in Vienna, I speculated on whether the plan would become reality.

I encourage you to watch the 4-minute video, but all you really need to know is that there are lots of obstacles to a cartel. Most notably, countries with pro-growth business tax regimes (such as Ireland, Estonia, and Switzerland in Europe) have big incentives to say no.

And if legislation is required in the United States, I assume that won’t be an easy sell, at least for GOP members.

But, as I warn in the video, the other side has hundreds of bureaucrats at the OECD and various finance ministries and treasury departments. And these taxpayer-financed mandarins have both the time and patience to chip away until they achieve their goals.

So it is critical that economists such as myself do a good job of educating policy makers about the adverse consequences of a tax cartel.

Which is why people should read this column by Veronique de Rugy of the Mercatus Center. Here are some key excerpts.

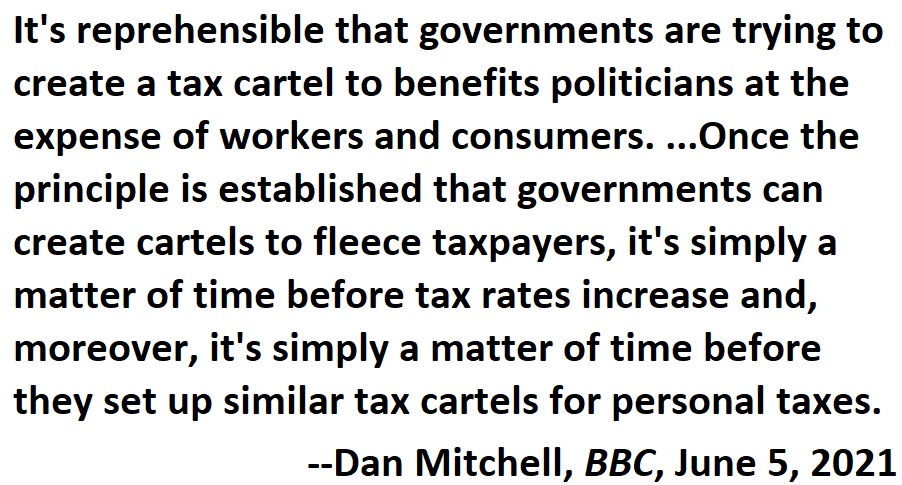

For several decades now, politicians around the world have tried to curtail tax competition to make it easier for them to increase the tax burdens on their citizens without them fleeing to other lower-tax jurisdictions. The best way to achieve their goal is to create a global high-tax cartel. …It’s no mystery why politicians don’t like tax competition. …The ability to shift residences and operations from country to country puts pressure on governments to keep taxes on income, investment, and wealth lower than politicians would like. Politicians in each country fear that raising taxes will prompt high-income earners and capital to move away. …Academic research shows that the imposition of higher corporate taxes is a highly destructive way to collect revenue because it lowers investment and, in turn, workers’ wages. It also increases consumer prices. Also, let’s face it, no nation has ever become wealthier and better through higher taxes and wealth redistribution.

This column for Prof. Bruce Yandle also is very informative. Here’s some of what he wrote.

It was with a feeling of deep disappointment…that I read Treasury Secretary Janet Yellen is…pushing to form an international cartel of governments that would implement a minimum corporate income tax rate across borders. …Efforts to cartelize taxation among nations will…, all else equal, lead to a higher-cost world economy. …Instead of searching high and low for ways to raise costs in the hope that more federal revenue and spending will follow, we should hope that our national leaders work harder to find better, more efficient ways to govern and serve the people. Doing so will give more people a much better chance at prosperity.

Amen. Tax harmonization was most accurately described by a former member of the European Parliament, who said it was a “thieves’ cartel.”

P.S. One of the worst aspects of the proposed tax cartel is that it will make it more difficult for poor countries to use good policy to improve living standards for their people.

P.P.S. Click here for my primer on tax competition.

———

Image credit: geralt | Pixabay License.