Yesterday’s column cited new scholarly research about the negative economic impact of Biden’s plans to increase capital gains taxation.

In today’s column, let’s start with a refresher on why this tax shouldn’t exist.

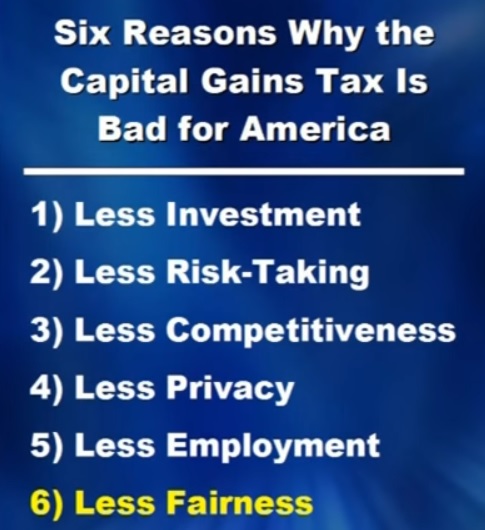

But if you don’t want to spend a few minutes watching the video, here are the six reasons why the tax shouldn’t exist.

I highlighted the final reason – fairness – because this is not simply an economic argument.

Yes, it’s foolish to penalize jobs and investment, but I also think it’s morally wrong to impose discriminatory tax rates on people who are willing to defer consumption so that all of us can be richer in the long run.

By the way, I should have included “Less Common Sense” as a seventh reason. That’s because the capital gains tax will backfire on Biden and his class-warfare friends.

To be more specific, investors can choose not to sell assets if they think the tax rate is excessive, and this “lock-in effect” is a big reason why higher rates almost surely won’t produce higher revenues.

In a column earlier this year for the Wall Street Journal, former Federal Reserve Governor Lawrence Lindsey explained this “Laffer Curve” effect.

…43.4% is well above the rate that would generate the most revenue for the government. Congress’s Joint Committee on Taxation, which does the official scoring and is no den of supply siders, puts the revenue-maximizing rate at 28%. My work several decades ago puts it about 10 points lower than that. That means President Biden is willing to accept lower revenue as the price of higher tax rates. The implications for his administration’s economic thinking are mind-boggling. Even the revenue-maximizing rate is higher than would be optimal. As tax rates rise, the activity being taxed declines. The loss to the private side of society increases at a geometric rate (proportional to the square of the tax rate) as rates rise. … The Biden administration is blowing up one of the key concepts that has united the economics profession: maximizing social welfare. It now believes in taxation purely as a form of punishment and is even willing to sacrifice revenue to carry it out.

By the way, Biden’s not the first president with this spiteful mindset. Obama also said he wanted to raise the tax rate on capital gains even if the government didn’t get any more revenue.

Democrats used to be far more sensible on this issue. For instance, Bill Clinton signed into a law a cut in the tax rate on capital gains.

And, as noted in this Wall Street Journal editorial on the topic, another Democratic president also had very sensible views.

Even in the economically irrational 1970s the top capital-gains rate never broke 40%… A neutral revenue code would tax all income only once. But the U.S. also taxes business profits when they are earned, and President Biden wants to raise that tax rate by a third (to 28% from 21%). When a business distributes after-tax income in dividends, or an investor sells the shares that have risen in value due to higher earnings, the income is taxed a second time. …The most important reason to tax capital investment at low rates is to encourage saving and investment. …Tax something more and you get less of it. Tax capital income more, and you get less investment, which means less investment to improve worker productivity and thus smaller income gains over time. As a former U.S. President once put it: “The tax on capital gains directly affects investment decisions, the mobility and flow of risk capital from static to more dynamic situations, the ease or difficulty experienced by new ventures in obtaining capital, and thereby the strength and potential for growth of the economy.” That wasn’t Ronald Reagan. It was John F. Kennedy.

For what it’s worth, JFK wasn’t just sensible on capital gains taxation. He had a much better overall grasp of tax policy that many of his successors.

Especially the current occupant of the White House. The bottom line is that Biden’s agenda is bad news for American prosperity and American competitiveness.

P.S. If you’re skeptical about my competitiveness assertion, check out this data.

———

Image credit: geralt | Pixabay License.