Like most libertarians, I favor drug legalization for the simple reason that people should have control over their own bodies, even if they’re doing something stupid.

But I’ve never claimed legalization is a zero-cost policy. Instead, as I wrote in 2018, “I think the social harm of prohibition is greater than the social harm of legalization.”

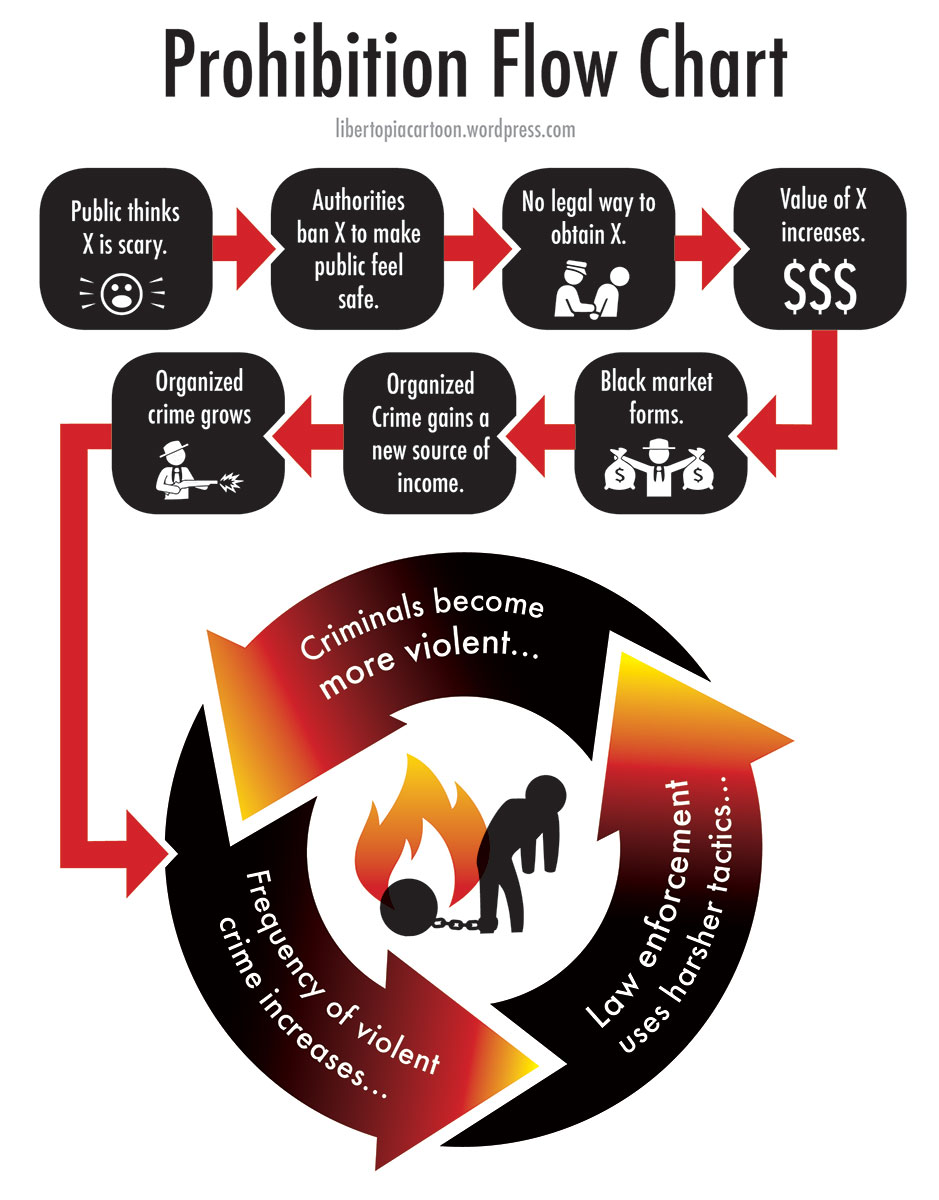

This flowchart makes the point about why the War on Drugs is foolish.

Apparently, voters and politicians are beginning to get the message. More and more states have moved in the direction of legalization.

Have the results been positive?

In an article for National Review, Aron Ravin has a very critical assessment of legalization.

…the old-fashioned, party-pooper folk with whom I find myself sympathizing tend to fall back on one point: Weed is unhealthy. Since 2002, the proportion of Americans twelve and older who reported having used marijuana in the last year has increased by over 60 percent. …Pot smoke can cause lung cancer in the same way tobacco can, and secondhand marijuana smoke may have even more carcinogens than cigarettes. Marijuana smoke can also compromise the immune system, and there’s a growing amount of scientific literature indicating a significant correlation between any form of cannabis consumption and psychosis.

As a non-user, I’m very sympathetic to the health argument.

Regularly drawing any kind of smoke into one’s lungs simply can’t be healthy.

That being said, regularly eating big mounds of french fries also can’t be healthy, but that’s not an argument for criminalization.

Ravin then asserts that legalization is a failure because there are still black markets.

Advocates claimed that legalization would cripple the black market and weaken Mexican cartels. They argued that legalizing weed would reduce children’s access to it, as licensed distributors would have a greater incentive to card than criminal dealers, and that users would actually be healthier, as the government would be better able to regulate and inspect the stuff they were smoking. …Top that all off with the Cato Institute’s promises of billions of dollars in new tax revenue and billions more in law-enforcement expenses saved, and you’d have to be silly to disagree. But the libertarians got it wrong.

And he has some good evidence about the continued presence of illegal sales.

…the predicted benefits rested on one assumption: that legal weed would render criminal dealers obsolete much in the same way that repealing prohibition weakened bootlegging mobsters. But that has not happened. It has been nearly a decade since Colorado became the first state to legalize recreational marijuana, and the state is dealing with a larger black market than ever before. …Upwards of 80 percent of all of California’s marijuana sales go through the black market. Massachusetts (70 percent) isn’t faring much better, and Nevada is growing desperate. …Legal dispensaries simply cannot match the low prices offered by their criminal competition when they’re being stifled by so much regulation and taxation, legalization advocates say. Yet weren’t generating tax revenue and protecting users major arguments for legalization in the first place?

I will admit that Ravin makes one very strong point. If libertarians were arguing that legalization would simultaneously deliver lots of tax revenue and also eliminate the black market, that doesn’t make sense.

Simply stated, excessive taxation means illegal sellers will stay in business because their prices will be much lower than their legal (but highly taxed) competitors.

That being said, at least one libertarian (ahem, me) explicitly pointed out that generating additional tax revenue was actually an argument against legalization (I included this issue in my collection of Libertarian Quandaries).

Let’s look at another perspective on legalization.

Jacob Sullum has a largely upbeat assessment of what’s happened, though he agrees that excessive taxation is a problem.

Here are some excerpts from his Reason column.

…when it comes to taxes, New York legislators do not seem very keen on helping the industry—or consumers. …The THC levy may amount to a tax as high as 30 percent, depending on costs, THC content, and product type. That’s on top of a 13 percent marijuana sales tax, which is in addition to general state and local sales taxes that can run as high as 8.9 percent. New Jersey plans to impose an excise tax ranging from less than 3 percent to more than 30 percent, depending on the average retail price per ounce… The state also will allow local governments to collect multiple taxes from growers, manufacturers, wholesalers, and retailers… New Mexico’s marijuana sales tax is simple and modest by comparison: 12 percent initially, rising gradually to 18 percent by July 2030. States such as Alaska, Illinois, Maine, Massachusetts, and Michigan tax marijuana even more lightly. These states seem to recognize that heavy taxes make it harder for licensed retailers to compete with black-market dealers. It’s a lesson that some politicians will have to learn all over again.

A 2018 Bloomberg article is a good primer on the issue of pot taxation.

What’s the optimal tax rate on legal marijuana if the goal is to eliminate the black market? …There are signs that California, with its longstanding pot culture and thriving black market, is taxing weed too much, while Washington state has already moved to lower its rate. …Lawmakers debating the issue are typically trying to balance two goals: generating revenue to boost state coffers while also creating a legal market that will put street dealers out of business. …The economics of elastic demand hold that consumers will buy less of a product as it gets more expensive, and the theory is being tested in the various legal markets around the U.S. …Oregon and California…have struggled to eliminate the black market, in part because high tax rates and regulatory red tape have made it attractive for some producers, sellers and customers to stay underground. …Light taxation and liberal licensing under Colorado’s adult-use law slashed the black market to 33 percent of cannabis sales last year, Adams said. In contrast, illicit sales were 78 percent of California cannabis sales and were even higher this year under adult-use laws that imposed extraordinary taxes and regulatory hurdles.

For those interested, I’ve written a few times (here, here, here, and here) about California’s over-taxation of marijuana.

I also have two columns (here and here) about Colorado’s experience.

So what’s the bottom line?

I fully expect that politicians in most states will continue to set tax rates to high, which means black market sales of marijuana will remain strong.

Why will they make this mistake? For the same reason they have excessively high tax rates on income, on sales, on property, on booze, and everything else.

Greedy politicians can’t resist the temptation to over-tax anything and everything in hopes of getting their hands on more money to buy more votes.

That’s America’s real (and bipartisan) addiction problem.