Programs such as Medicare and Medicaid, along with the tax code’s healthcare exclusion, have created a system where consumers directly pay for only about 10 percent of the care they receive.

We think it’s normal and appropriate for either the government or an insurance company to foot the bill.

Yet this system of “third-party payer” explains why the health care system in the United States is inefficient and expensive.

Is it possible, though, to put the toothpaste back in the tube? Can we unwind the bad government policies that have undermined market forces?

There are certainly big-picture reforms that would be helpful. Genuine entitlement reform could address the problems with Medicare and Medicaid, and fundamental tax reform could get rid of the healthcare exclusion.

But progress is possible even without major policy change.

Reason interviewed a doctor, Lee Gross, who decided to set up a practice based on “direct primary care,” which means no involvement from government or insurance companies. Just health consumers and health providers directly buying and selling.

Here’s some of what he said about this market-based approach.

When I was in the fee-for-service system, I felt like I was playing a game of Whac-A-Mole with Medicare. …Eventually we just said, “No more.” …the epiphany was “Why are we inserting so many people at the primary care level between the doctor and the patient? Why are we insuring primary care?” The more people that you insert between the doctor and patient, the more expensive it gets, the more cumbersome it gets…we created one of the first direct primary care practices in the country. …essentially it’s a membership-based primary care program. …Once a patient is a member of our practice, anything that we can do within the four walls of our office is included at no additional charge. …Insurance is good for the big stuff. It’s not good for the little stuff. It’s too complicated. What we do in direct primary care is we make the predictable things affordable for everybody. We take the stuff that you’re going to need on an everyday basis and we put affordable price tags on it, and we say you don’t need your insurance for this. In fact, the insurance makes it more expensive. …You need your homeowners insurance if your house burns down. You don’t need it to mow the lawn.

The good news is that Dr. Gross’ practice is part of a growing movement.

Direct primary care is absolutely a growing movement. …There’s well over 1,500 practices around the country… There are some regulatory barriers that get in the way of expanding this model. …if we’re looking for the ideal health care system, we want to see three pillars. We want to see lower cost, better quality, and more choices. You cannot have all three of those in a government-run system. You can only have those in a free market capitalist system.

Indeed, I’ve shared previous examples of this phenomenon from Maine and North Carolina.

And it even works for surgery, as you can see from this must-watch video from Reason.

Let’s now circle back to some analysis of what’s wrong with the current system.

John Stossel explained a few years ago how government-encouraged over-insurance causes problems.

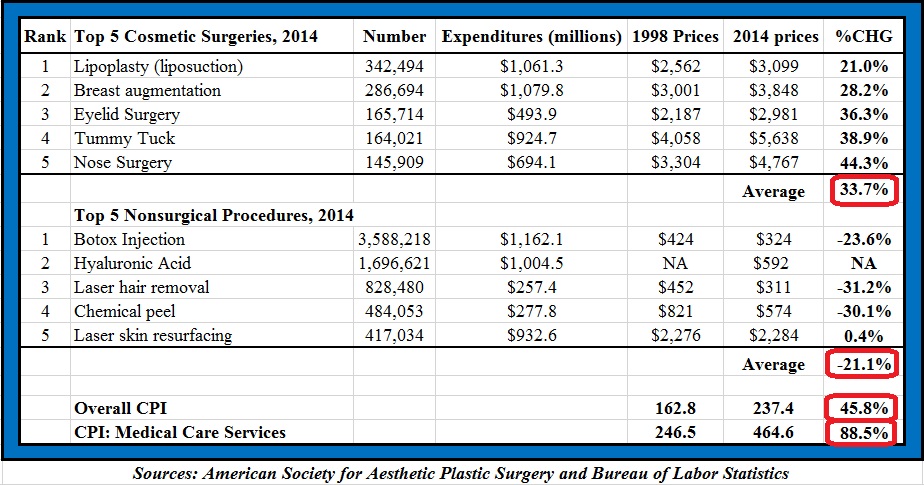

Someone else paying changes our behavior. We don’t shop around. We don’t ask, “Do I really need that test?” “Is there a place where it’s cheaper?” Hospitals and doctors don’t try very hard to do things cheaply. Imagine if you had “grocery insurance.” You’d buy expensive foods; supermarkets would never have sales. Everyone would spend more. Insurance coverage—third-party payment—is revered by the media and socialists (redundant?) but is a terrible way to pay for things. Today, 7 in 8 health care dollars are paid by Medicare, Medicaid or private insurance companies. Because there’s no real health care market, costs rose 467 percent over the last three decades. By contrast, prices fell in the few medical areas not covered by insurance, like plastic surgery and LASIK eye care. Patients shop around, forcing health providers to compete.

The final couple of sentences are extremely important.

As illustrated by this data from Mark Perry, there are a few parts of the health care system where there’s little or no third-party payer.

And what do we find? Prices go down rather than up.

For all intents and purposes, the goal should be to make health insurance more like homeowners insurance or auto insurance.

Speaking of the latter, David Graham compared market-driven auto insurance and government-subsidized health insurance.

There are…similarities between health care and car ownership… We can go for many years with predictable spending on both cars and medical care until — out of the blue — something terrible happens. For that reason, we value insurance for both. But there’s a key difference… Car insurance, while not a trivial expense, is a relatively small share of the total cost of owning a car. According to the AAA, the average premium was $1,023, just under 12 percent of the total cost of ownership. Even excluding depreciation, insurance is just one-fifth of the total cost. In other words, we do not expect auto insurers to pay claims for most of the cost of operating and maintaining a car. Health care is completely the opposite. …Insurance adds administrative costs and bureaucratic interference. …Left to our own devices, we would never buy coverage for every single medical expense.

The moral of the story is that government intervention has made America’s health system a mess.

Unsurprisingly, many politicians say the answer it to have even more government (which is how we got Obamacare).

P.S. In less than eight minutes, I explain the economics of third-party payer in this speech.

P.P.S. Government-created third-party payer also has led to higher costs and widespread inefficiency in higher education.

———

Image credit: Department of Foreign Affairs and Trade | CC BY 2.0.