I have a four-part series (here, here, here, and here) about the conceptual downsides of Joe Biden’s class-warfare approach to tax policy.

Now it’s time to focus on the component parts of his agenda. Today’s column will review his plan for a big increase in the corporate tax rate. But since I’ve written about corporate tax rates over and over and over again, we’re going to approach this issue is a new way.

I’m going to share five visuals that (hopefully) make a compelling case why higher tax rates on companies would be a big mistake.

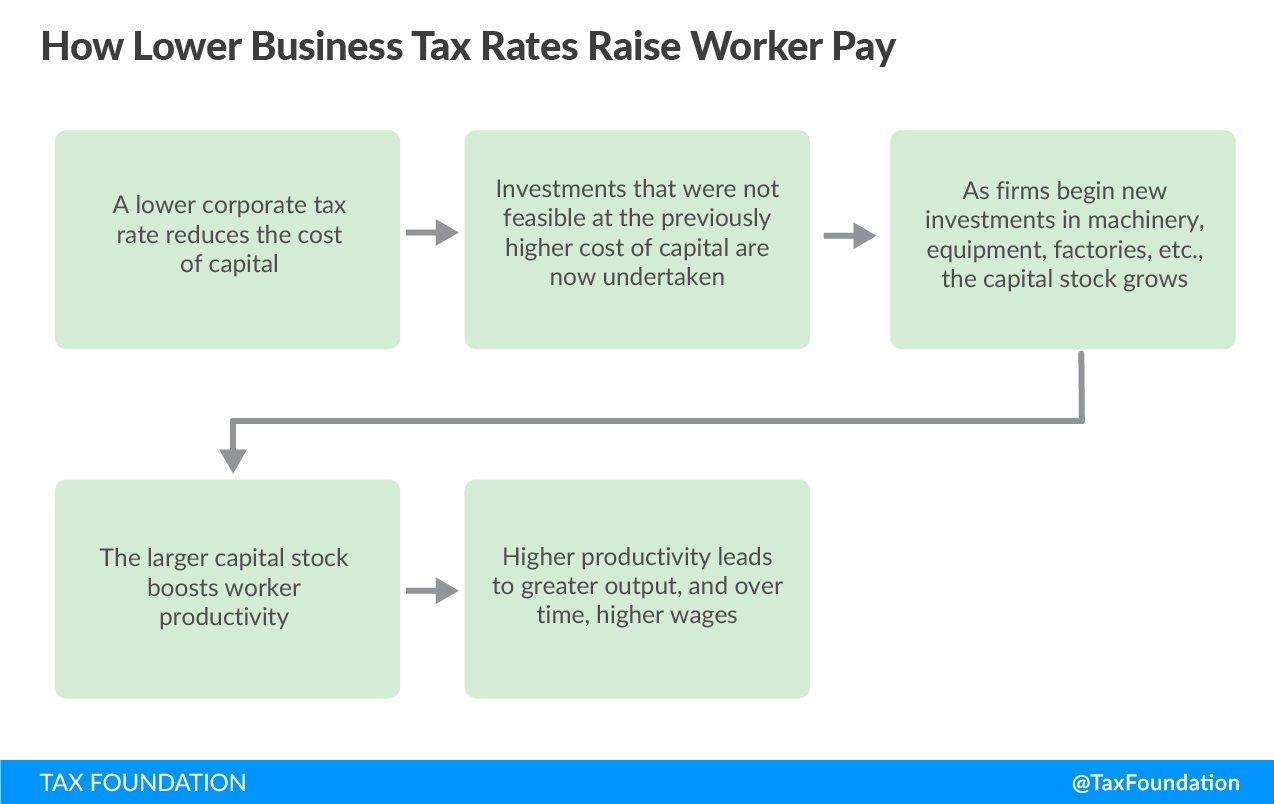

Visual #1

One thing every student should learn from an introductory economics class is that corporations don’t actually pay tax. Instead, businesses collect taxes that are actually borne by workers, consumers, and investors.

There’s lots of debate in the profession, of course, about which group bears what share of the tax. But there’s universal agreement that higher taxes lead to less investment, which leads to less productivity, which leads to lower pay.

Here’s a depiction of the relationship of corporate taxes and worker pay.

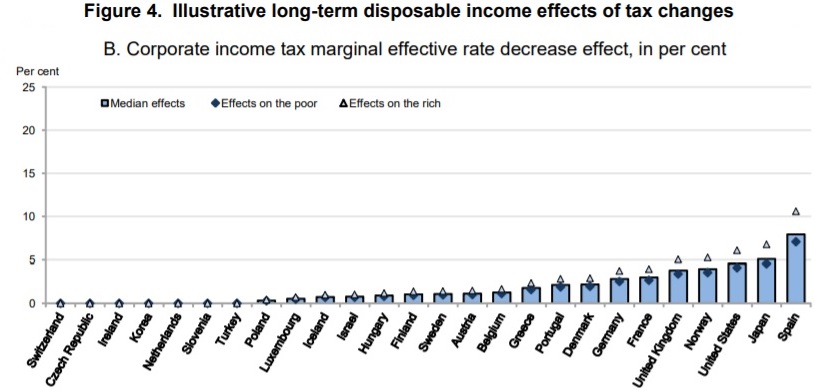

Visual #2

The previous image explains the theory. Now it’s time for some evidence.

Here’s a look at how much faster wages have grown in countries with low corporate tax rates compared to nations with high corporate tax rates.

Biden, for reasons beyond my comprehension, wants America on the red line.

And his staff economists apparently don’t understand (or don’t care about) the link between investment and wages.

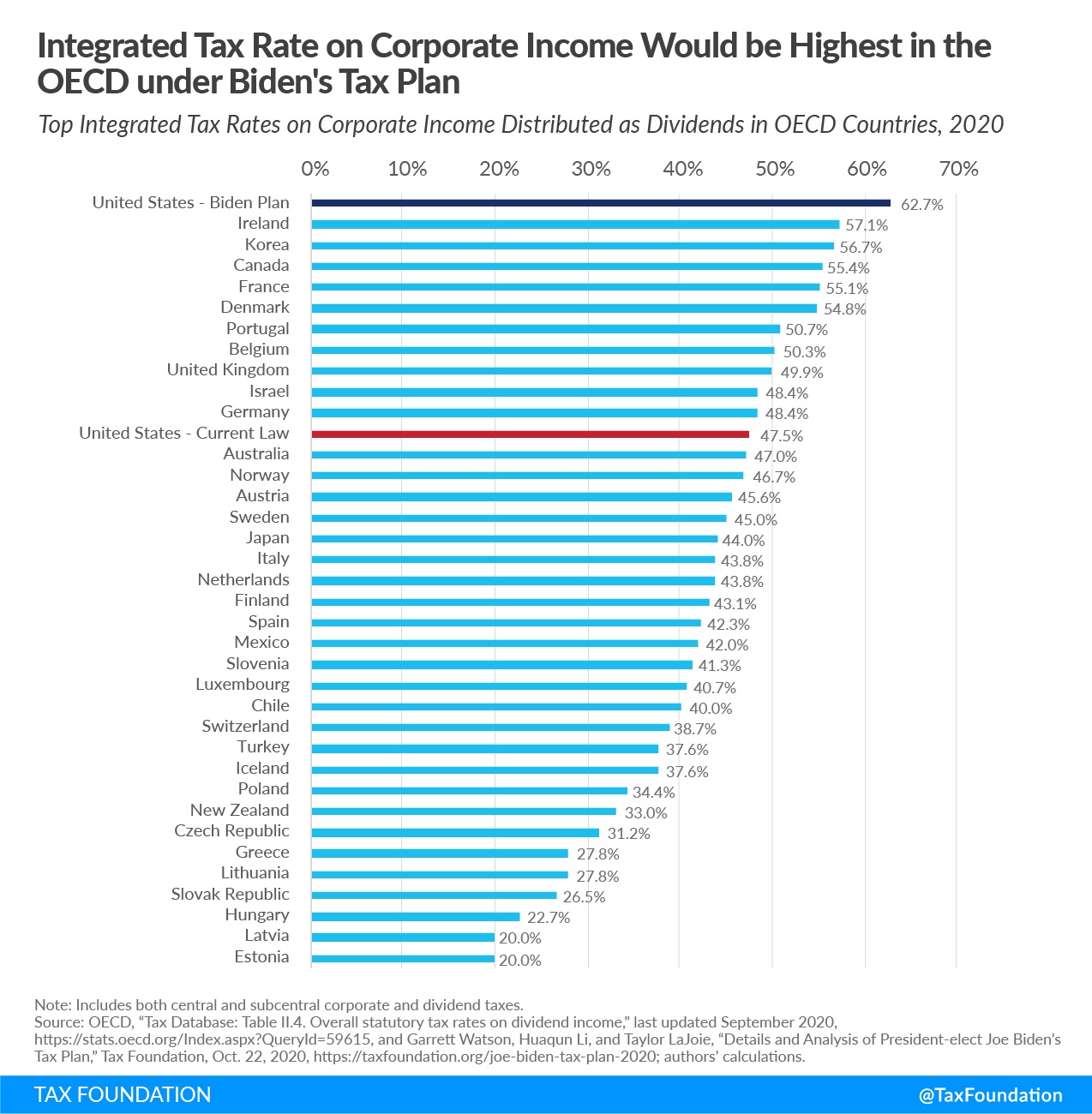

Visual #3

Here’s some more evidence.

And it comes from an unexpected source, the pro-tax Organization for Economic Cooperation and Development (OECD).

Even economists at that Paris-based bureaucracy have produced studies confirming that lower tax rates lead to higher disposable income for people.

Needless to say, if lower tax rates lead to more disposable income, then higher tax rates will lead to less disposable income.

We should have learned during the Obama years that ordinary people pay the price when politicians practice class warfare.

Visual #4

It’s very bad news that Biden wants a big increase in the corporate tax rate, but let’s not forget that the IRS double-taxes corporate income (i.e., that same income is subject to a second layer of tax when shareholders receive dividends).

The combined effect, as shown in this visual, is that the United States will have the dubious honor of having the highest effective corporate tax rate in the entire developed world.

Call me crazy, but I don’t think that’s a recipe for jobs and investment in America.

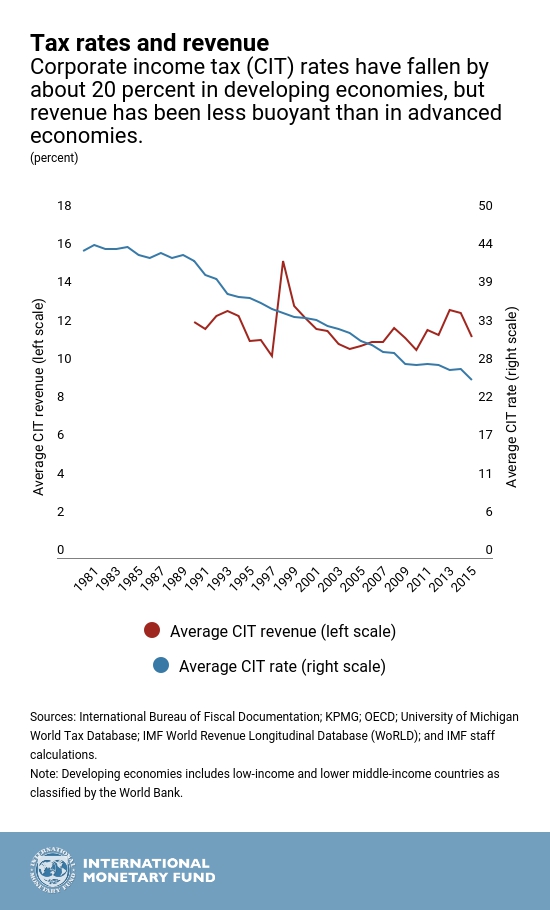

Visual #5

The economic damage of higher corporate tax rates means that there is less taxable income (i.e., we need to remember the Laffer Curve).

Will the damage be so extensive, causing taxable income to fall so much, that the IRS collects less revenue with a higher tax rate?

We’ll learn the answer to that question over time, but we have some very strong evidence from the IMF that lower corporate tax rates don’t lead to less revenue. As you can see from this chart, revenues held steady as tax rates plummeted over the past few decades.

In other words, lower rates led to enough additional economic activity that governments have collected just as much money with lower tax rates. But now Biden wants to run this experiment in reverse.

It’s possible the government will collect more revenue, of course, but only at a very high cost to workers, consumers, and shareholders.

By the way, there’s OECD data showing the exact same thing.

Those pictures probably tell you everything you need to know about this issue.

But let’s add some more analysis. The Wall Street Journal opined today on Biden’s class-warfare agenda. Here are some of the key passages from the editorial.

The bill for President Biden’s agenda is coming due, starting with Wednesday’s proposal for the largest corporate tax increase in decades. …Mr. Biden’s corporate increase amounts to the restoration of the Obama-era corporate tax burden, only much more so. …Mr. Biden wants to raise the corporate rate back up to 28%, but that’s the least of his proposals. He also wants to add penalties that would make inversions punitive, and he’d impose a global minimum corporate tax of 21%. This would shoot the tax burden on U.S. companies back toward the top of the developed world list. …The larger Biden goal is to end global tax competition… “The United States can lead the world to end the race to the bottom on corporate tax rates,” says the White House fact sheet. Mr. Biden says he wants “other countries to adopt strong minimum taxes on corporations” so nations like Ireland can no longer compete for capital with lower tax rates. This has long been the dream of the French and Germans, working through the Organization for Economic Cooperation and Development. …All of this is in addition to the looming Biden tax increases on dividends, capital gains and other investment income. …Mr. Biden’s corporate tax increases will hit the middle class hard—in the value of their 401(k)s, the size of their pay packets, and what they pay for goods and services.

Amen.

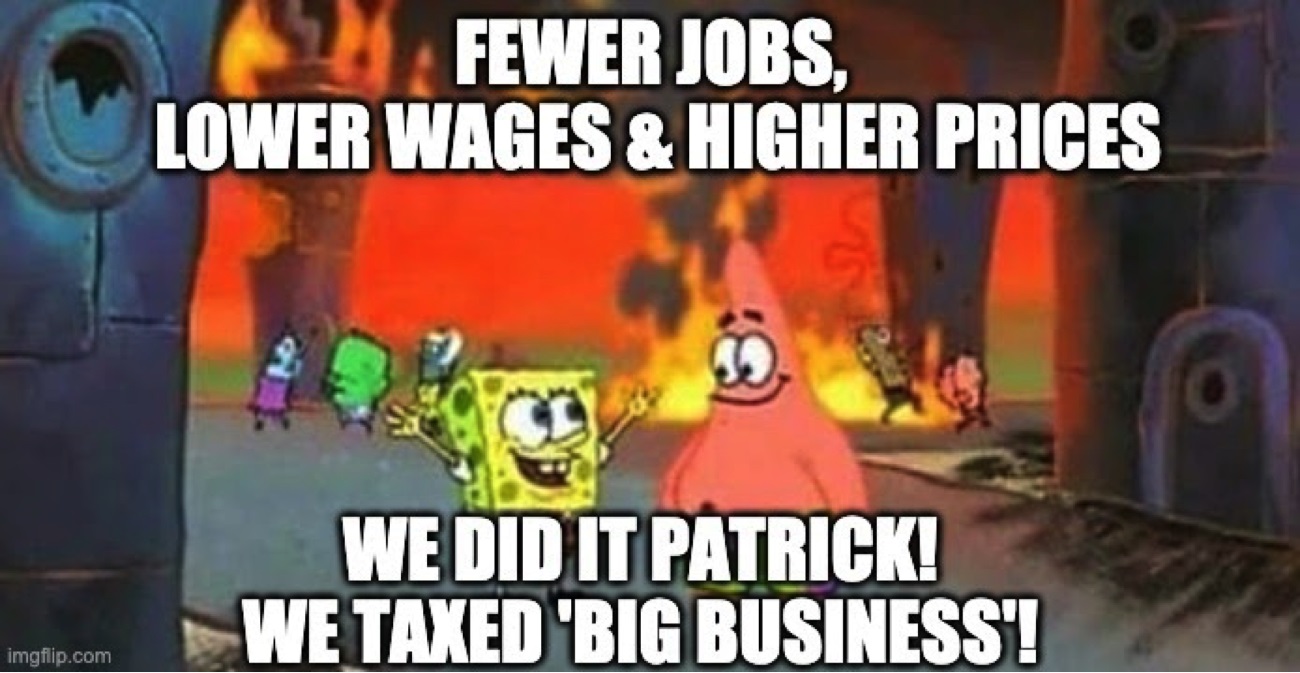

Let’s conclude with some gallows humor.

This meme shows how some of our leftist friends will celebrate if the tax increase is imposed.

P.S. Here’s a depressing final observation. Decades of experience have led me to conclude that many folks on the left support class-warfare tax policy because they are primarily motivated by a spiteful desire to punish success rather than provide upward mobility for the poor.

———

Image credit: geralt | Pixabay License.