Long-time readers know that I periodically pour cold water on the notion that China is an economic superstar.

Yes, China did engage in some economic liberalization late last century, and those reforms should be applauded because they were very successful in reducing severe poverty.

But from a big-picture perspective, all that really happened is that China went from terrible policy (Maoist communism) to bad policy (best described as mass cronyism).

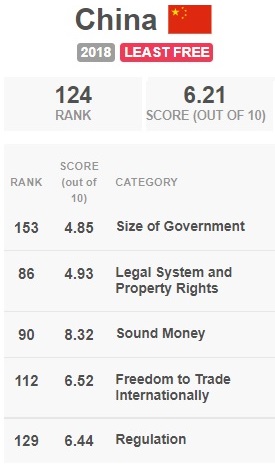

Economic Freedom of the World has the best data. According to the latest edition, China’s score for economic liberty rose from a horrible 3.69 in 1990 to 6.21 in 2018.

That’s a big improvement, but that still leaves China in the bottom quartile (ranking #124 in the world). Better than Venezuela (#162), to be sure, but way behind even uncompetitive welfare states such as Greece (#92), France (#58), and Italy (#51).

And I fear China’s score will get even worse in the near future.

Why? Because it seems President Xi is going to impose class-warfare tax increases.

In an article for the Guardian, Phillip Inman shares some of the details.

China’s president has vowed to “adjust excessive incomes” in a warning to the country’s super-rich that the state plans to redistribute wealth… The policy goal comes amid a sweeping push by Beijing to rein in the country’s largest private firms in industries, ranging from technology to education. …Xi…is expected to expand wealth taxes and raise income tax rates… Some reforms could be far reaching, including higher taxes on capital gains, inheritance and property. Higher public sector wages are also expected to be part of the package.

And here are some excerpts from a report by Jane Li for Quartz.

Chinese president Xi Jinping yesterday sent a stark message to the country’s wealthy: It is time to redistribute their excessive fortunes. …Another reason for the Party’s focus on outsize wealth is to reduce rival centers of power and influence in China, which has also been an impetus for its crackdown on the tech sector… China already has fairly high income tax rates for its wealthiest. That includes a top income tax rate of 45% for those who earn more than 960,000 yuan ($150,000) a year… Upcoming moves could include…a nationwide property tax.

These stories may warm the hearts of Joe Biden and Bernie Sanders, but they help to explain why I’m not optimistic about China’s economy.

If you review the Economic Freedom of the World data, you find that China is especially bad on fiscal policy (“size of government”), ranking #153.

That’s worse than China does even on regulation.

Yet the Chinese government is now going to impose higher taxes to fund even bigger government?!?

Is the goal to be even worse than Venezuela and Zimbabwe?

P.S. Many wealthy people in China (maybe even most of them) achieved their high incomes thanks to government favoritism, so there’s a very strong argument that their riches are undeserved. But the best policy response is getting rid of industrial policy rather than imposing tax increases that will hit both good rich people and bad rich people.

P.P.S. I’ve criticized both the OECD and IMF for advocating higher taxes in China. A few readers have sent emails asking whether those international bureaucracies might be deliberately trying to sabotage China’s economy and thus preserve the dominance of Europe and the United States. Given the wretched track records of the OECD and IMF, I think it’s far more likely that the bureaucrats from those organizations sincerely support those bad policies (especially since they get tax-free salaries and are sheltered from the negative consequences).

———

Image credit: Foreign and Commonwealth Office | CC BY 2.0.