There are two big policy debates about business profits.

The first is whether profits are good or evil. I pick the former. Profits are something to applaud, assuming they are earned honestly (i.e., not the result of subsidies, industrial policy, protectionism, or other forms of cronyism).

The second is how profits should be taxed, and that’s the focus of today’s column.

My perfect-world answer is that there should be no tax on profits because we have a government that is so small that there’s no need for any type of income tax. But I’m in the United States rather than a fiscal paradise such as Bermuda, Monaco, or the Cayman Islands. So if we start with the assumption that a corporate income tax is going to exist, how should it operate?

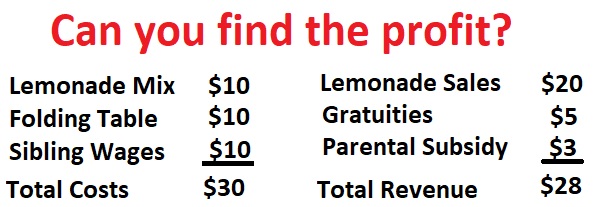

To answer that question, let’s start with this simple example of a kid’s lemonade stand. Here’s how much money it spent and how much revenue it generated (before it was shut down by overzealous bureaucrats).

How much profit did our budding entrepreneur make?

The correct answer, of course, is that the business didn’t earn any profits. Indeed, it lost $2. So there obviously should not be any tax.

But some people don’t understand the difference between taxable income (which is largely based on cash flow in one year) and “book income” (which is largely a backward-looking, accrual-based estimate of profits to help inform shareholders about the overall financial condition of a corporation).

Or, maybe they do understand and simply prefer to engage in dishonest demagoguery. For instance, let’s look at a recent report by Patricia Cohen in the New York Times.

…a new study finds that at least 55 of America’s largest paid no taxes last year on billions of dollars in profits…thanks to a range of legal deductions and exemptions that have become staples of the tax code, according to the analysis. Salesforce, Archer-Daniels-Midland and Consolidated Edison were among those named in the report, which was done by the Institute on Taxation and Economic Policy, a left-leaning research group in Washington. …Twenty-six of the companies listed, including FedEx, Duke Energy and Nike, were able to avoid paying any federal income tax for the last three years even though they reported a combined income of $77 billion. Many also received millions of dollars in tax rebates.

Sounds terrible, right.

Except if you read the fine print, in which case you’ll find out the report discussed in the article isn’t based on company tax returns. Instead, the leftist group, the Institute on Taxation and Economic Policy (ITEP), used financial statements to make up some numbers.

And ITEP’s use of book income meant it didn’t properly measure things such as business investment expenditures and net operating losses, which are necessary to determine whether a company has an actual cash-flow profit.

Ms. Cohen never should have written a story about ITEP’s shoddy and dishonest report, though at least she acknowledged that there are reasons to question the findings.

A provision in the 2017 tax bill allowed businesses to immediately write off the cost of any new equipment and machinery. The $2.2 trillion CARES Act…included a provision that temporarily allowed businesses to use losses in 2020 to offset profits earned in previous years, according to the institute. …many deductions and credits are there for good reason — to encourage research and development, to promote expansion and to smooth the ups and downs of the business cycle, taking a longer view of profit and loss than can be calculated in a single year.

The bottom line is that the ITEP report is garbage.

There’s no reason to expect taxable income to match up with financial statements or “book income.”

Indeed, the differences between those measures is why there are also companies that – according to ITEP’s sloppy methodology – pay tax when they supposedly have losses.

For those who actually care about the truth, the top half of this visual shows how a proper business tax system should work (i.e., one that taxes profits when they actually occur).

P.S. The issue of “depreciation” is probably the main reason why we get all sorts of silly tax controversies, involving everything from corporate jets to ABBA’s stage outfits.