How the Irish Saved Civilization was a bestselling book in the mid-1990s.

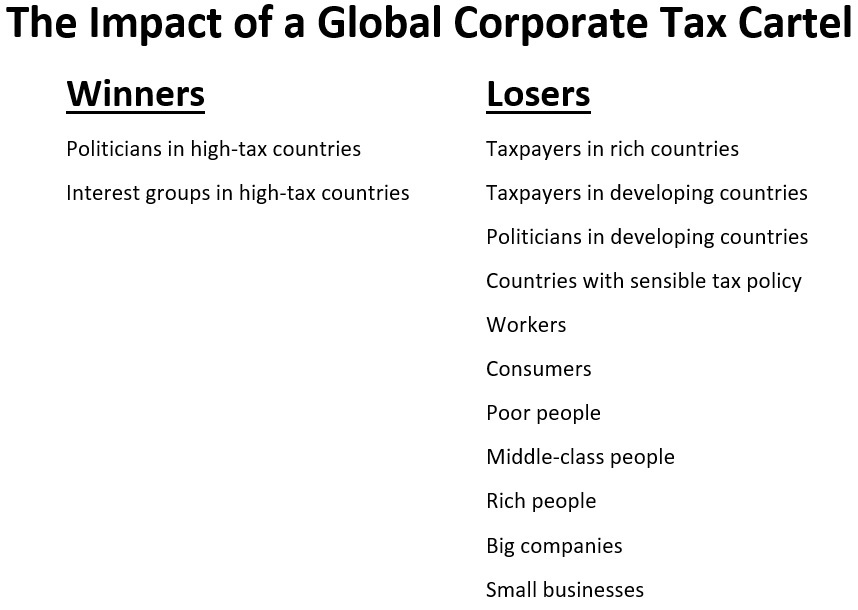

Today, we’re going to consider an updated version, focusing on whether Ireland can save the world economy from Joe Biden’s plan for a global tax cartel.

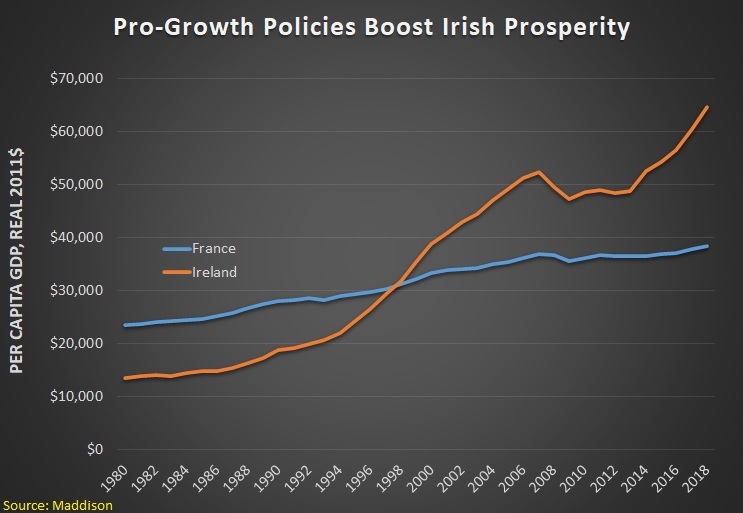

This should be a slam-dunk issue. Ireland transformed itself from “The Sick Man of Europe” to the “Celtic Tiger” in part by adopting a 12.5 percent corporate tax rate.

How much of a tiger? Look at this data comparing per-capita gross domestic product in Ireland and France.

For what it’s worth, the Maddison data on gross domestic product makes Ireland look richer than it actually is (a result driven by largely by all the corporate activity).

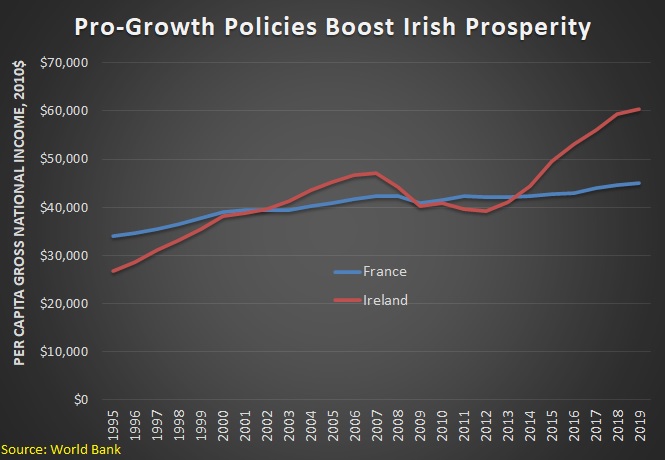

So I also used World Bank data on gross national income to create a chart that tells a similar story, but with numbers that presumably are a closer match to actual economic conditions.

The bottom line is that Ireland’s policy on corporate taxation has been a success.

But that success has produced envy. High-tax nations such as France are big supporters of Joe Biden’s scheme to force all jurisdictions to have a corporate tax rate of at least 15 percent.

And that minimum rate inevitably will increase if politicians are able to create a cartel (indeed, some nations already are pushing for the rate to be 25 percent or above).

That’s the bad news.

The good news is that Ireland (as well as other nations such as Hungary and Estonia) presumably can block Biden’s tax cartel by using their “national veto” and preventing the European Union from being a participant.

But that means standing up to pressure.

For instance, the Associated Press recently reported on how France is trying to cajole Ireland into joining the cartel.

Emmanuel Macron was in Dublin for a one-day visit on Thursday, his first trip to Ireland since entering office. The State is facing calls from the French government to sign up to global tax reform. The country is one of only a handful of nations not to agree to a major Organisation for Economic Co-operation and Development (OECD) agreement on tax, which is backed by more than 130 countries worldwide, as well as the EU. …At a press conference in Dublin on Thursday, Mr Macron denied that he was putting pressure on the State on the issue. “This is for you to lead. This is not for France to put pressure. But I think the OECD framework works in the context,” Mr Macron said. “It makes sense in terms of co-operation. It makes sense in terms of the EU. …He said that the Irish economy had achieved “tremendous results” in recent decades and acknowledged that a low corporate tax base had been a crucial part of that success. “What you have managed to do in past decades is unique,” Mr Macron said. But he said that things had to change.

Saul Zimet and Dan Sanchez, writing for the Foundation for Economic Education, explained why Ireland should defends its fiscal sovereignty.

132 countries, including the twenty most powerful economies in the world, have all agreed to institute a minimum global corporate tax of 15 percent. …But, one hold-out is threatening to spoil the scheme. …Ireland has long had a 12.5 percent corporate tax… And this relatively low tax rate has drawn Facebook, Apple, Google, Pfizer, and many other corporate giants to set up regional headquarters or manufacturing hubs there instead of in countries with higher tax rates. …the flow of corporate wealth and opportunity into Ireland has resulted in enormous GDP growth and job growth for the nation in recent decades… Lower corporate taxes mean a bigger capital stock which means new jobs, higher wages, and more goods and services. That is why Ireland’s low corporate taxes have not just been good for multinational corporations, but for Irish workers, consumers, and entrepreneurs. …Jurisdictional competition, like market competition, is a good thing. It places a check on how tyrannical a government can be… So kudos to Ireland for bravely refusing to join what amounts to a 132-government tax cartel. By standing up for itself, it stood up for us all.

In a column for the Wall Street Journal, former Congressman Mick Mulvaney also opined in favor of Ireland.

The premise behind the minimum global corporate tax is simple: Most governments around the world are looking to raise money. But they don’t like taxing the middle class, as this tends to result in lost elections, and there aren’t enough rich people to soak to raise the necessary funds. That means that governments have started to look to corporations as piggy banks they can raid. …the Irish…rode a 12.5% corporate tax rate to an economic boom that has left many other European countries green with envy. …The Irish know what should be obvious to everyone: Their OECD partners can’t raise their corporate rates unless low-tax Ireland agrees to give up one of its largest competitive advantages in the global marketplace. …if you are losing a competition, there are two ways you can respond. One is to get better. The other is to prevent the competition from happening. …Ireland is on the front line of that battle today. Should it lose, the fight will be coming to our shores soon.

Mulvaney’s point about competition is spot on.

Joe Biden wants to raise the federal corporate tax rate from 21 percent to 28 percent, a policy that would give the United States (once again) the developed world’s most punitive system.

I don’t know if Biden is cognizant of the consequences, but his Treasury Secretary clearly understands that this means the United States will lose the battle for jobs and investment.

Which explains why the Biden Administration wants “to prevent the competition from happening.”

Let’s hope Ireland holds firm and says no to Biden’s anti-growth tax cartel.

P.S. For what it’s worth, Ireland failed to block the E.U.’s Lisbon Treaty back in 2009.

P.P.S. The current president of Ireland almost surely is on the wrong side, but fortunately he has very little power in the Irish system.

———

Image credit: Joe King | CC BY-SA 3.0.