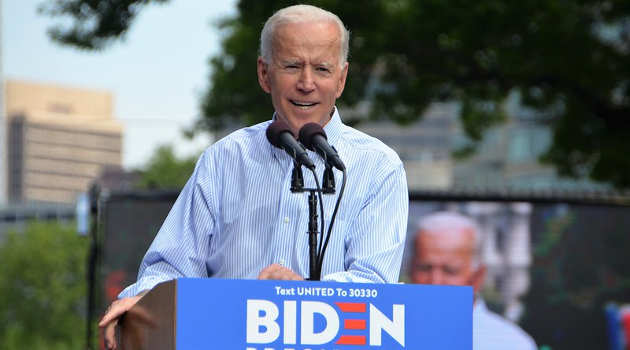

In an interview with Fox Business last week, I touched on three policies (easy money from the Fed, Biden’s class-warfare tax agenda, and the ever-increasing burden of federal spending) that create risks for the economy in 2021.

I didn’t have a chance to elaborate in the interview, but it’s worth noting that Biden will inherit two of the aforementioned problems.

Trump has been profligate with our money, and he was that way even before the coronavirus became an excuse to open the budgetary spigot. Moreover, he was just like Obama in pressuring the Federal Reserve for Keynesian-style monetary policy.

Unfortunately, there’s no reason to think Biden will try to reverse those mistakes.

Indeed, he wants expand the burden of federal spending. And, regarding monetary policy, appointing Janet Yellen as Secretary of Treasury certainly suggests he is comfortable with the current approach.

And to make matters worse, he definitely wants a more punitive tax system. We will shortly learn whether Democrats take control of the Senate, which presumably would give Biden more leeway to enact his class-warfare tax agenda.

take control of the Senate, which presumably would give Biden more leeway to enact his class-warfare tax agenda.

As I said in the interview, that would create economic headwinds.

P.S. I mentioned in the interview that we have “three Americas” with regards to coronavirus. I’m not sure I was completely clear, so here’s what I was trying to get across.

- Tourism-reliant states – They are going to be in bad shape until coronavirus is in the rear-view mirror and people feel comfortable with traveling and socializing.

- Lock-down states – They have higher unemployment rates because more businesses are shut down.

- Laissez-faire states – These are the states that generally allow businesses to remain open and have lower unemployment rates.

For what it’s worth, I think it’s best to let businesses stay open and to allow them and their customers to assess safety risks. It will be interesting to see whether any link is discovered between state policy and coronavirus rates.

P.P.S. At the risk of over-simplification, bad fiscal policy erodes the economy’s long-run growth rate. Bad monetary policy, by contrast, is what causes economic volatility and downturns.