Trump was a big spender before coronavirus and he became an even-bigger spender once the pandemic began.

But the White House generally didn’t add insult to injury by citing Keynesian economic theory to justify the president’s profligacy .

Prior to the pandemic, the excuse was that more money was needed for defense and that required (from a political perspective) more money for domestic programs.

And once the coronavirus hit, the excuse was that people and businesses needed to be compensated because of government-mandated lockdowns.

I thought the pre-pandemic excuse was pathetic and I’ve been skeptical of the post-pandemic excuse (why, for instance, are bureaucrats getting checks when their comfy jobs aren’t at risk?).

Well, Trump in on the way out and Biden is on the way in, which means one big spender is being replaced by another.

Well, Trump in on the way out and Biden is on the way in, which means one big spender is being replaced by another.

But there will be one difference, at least stylistically. Biden will copy Obama by citing Keynesian theory to justify his spending binges.

Which means heartburn from me because I’ve been trying for years to drive a stake through the heart of this free-lunch concept.

But I obviously need to address the issue again.

To begin, Andy Kessler opines about so-called stimulus in his Wall Street Journal column.

…get ready for the “multipliers.” You know, the idea that a government dollar spent magically turns into multiple dollars in the economy. …Expect more multiplier mumbo jumbo as the Biden administration begins its tax-and-spend fiesta. …during the early days of the Obama administration. The financial crisis team…were “carrying around this list of multipliers”…

Every dollar spent extending unemployment insurance benefits would, the fairy tale went, boost the economy by $1.64. …every dollar spent on food stamps would spur a $1.73 increase in gross domestic product. …“bang for the buck”—the proverbial free lunch. It’s more like “dud for the dollar” because it didn’t work. It never does. Multipliers are a canard, a Keynesian conceit. …The theory of multipliers is based on the Keynesian view that poorer consumers tend to spend a large amount of increased income, and the rich less so. But multipliers are half a story. Someone has to put up the original money that allegedly gets multiplied, taking it away from the private sector and negating whatever dwindling chain of transactions are hypothesized.

Amen.

Kessler is making many of the same points I made in my 2008 video about Keynesian economics, so I obviously agree.

Since Kessler’s column poked holes in the theory, now let’s look at some new evidence.

Former Senator Phil Gramm has a column on this topic in today’s WSJ, co-authored by Mike Solon.

The main takeaway is that Obama did a Keynesian “stimulus” and the economy suffered a weaker-than-normal recovery.

Between the start of the subprime mortgage crisis and the end of the recession in mid-2009, net new spending of $1.6 trillion was enacted. In 2009, federal spending as a share of gross domestic product surged by an unprecedented 4.2 percentage points to reach 24.4%, the highest level since World War II. Spending was 23.3% of GDP in 2010.

…what happened after 2010? …some six months into the Obama administration, the Office of Management and Budget and the Congressional Budget Office both confidently predicted an economic boom, with real GDP growing an average of 3.6% from 2010-13. …Yet…growth from 2010-13 averaged less than 2.1%, half the 4.2% average growth rates in the four-year periods following the previous 10 postwar recessions. The Obama recovery didn’t falter for lack of sustained stimulus; it was shackled from the beginning by his economic program.

I think it’s especially instructive to compare the economy’s weak performance under Obama with the strong recovery we enjoyed under Reagan.

By the way, I think it’s possible to artificially and temporarily boost consumption with so-called stimulus spending, but increasing consumer spending with borrowed money is not the same as boosting national income.

Anyhow, what’s the moral of this story?

Because Mr. Biden’s proposed program is little more than Mr. Obama’s tax, spend and regulate agenda on steroids, and because his appointees are merely grayer retreads of the Obama administration, it is excessively optimistic to believe that his stimulus will do any more good for the economy than Mr. Obama’s did. …How does it end? …it isn’t a question of if government is going to run out of other people’s money, but when.

For what it’s worth, I think the United States could be profligate for decades before we reach some sort of fiscal crisis.

But Gramm and Solon are correct to cite Thatcher’s warning that statists eventually run out of other people’s money.

But Gramm and Solon are correct to cite Thatcher’s warning that statists eventually run out of other people’s money.

P.S. My fingers are crossed that Biden is more like Bill Clinton rather than Barack Obama, but I’m not overly hopeful.

P.P.S. We have a very recent example of Paul Krugman being wrong about Keynesian economics.

P.P.P.S. Even though it’s no longer the right time of year, here’s the satirical commercial for Keynesian Christmas carols.

———

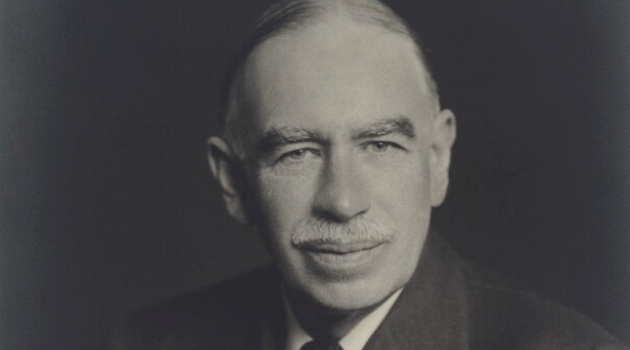

Image credit: National Portrait Gallery | CC BY-NC-ND 3.0.