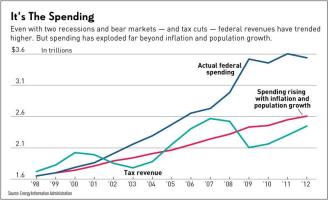

Nearly 10 years ago, I shared some data to show how a Swiss-style spending cap would have prevented some of the excess spending of the Bush and Obama years.

Trillion-dollar deficits would have been avoided. But, more important, the burden of government spending would have been significantly lower.

That would have enabled stronger growth, as confirmed even by researchers from left-leaning bureaucracies such as the OECD and CBO.

I then did the same thing in 2020, showing once again how a spending cap would have produced great results.

And, earlier this year, I crunched the numbers to show how Italy and Greece could have avoided their fiscal nightmares if they had imposed spending caps a couple of decades ago.

Today, let’s look at similar data for Canada.

Except I don’t need to do any work because Livio di Matteo has a new study on tax and expenditure limitations from the Fraser Institute. Here’s some he wrote about the conceptual issues.

Tax and expenditure limits restrict the growth of either revenues or expenditures or both by either setting them at a fixed dollar amount or by limiting the growth rate by linking them to the growth of specific economic variables. …A key perceived benefit of TELs is that they serve as a restraint on politicians and bureaucrats who often have little incentive to restrain spending in response to pressures from interest groups. A second benefit of TELs is that smaller government can be associated with higher rates of economic growth. …One noteworthy type of TEL is a strict restriction on tax or expenditure levels, or, more commonly their rates of growth. This is generally a formula driven approach and the most common mechanism involves restricting expenditure growth to the pace of personal income, GDP, or combined population and inflation growth.

Now let’s look at his numbers for Canada, starting with a look at the the status quo outlook for 2015-2025, which shows that the spending burden will climb by 58 percent over the 10-year period.

Perhaps the best way to illustrate the implementation of a simple TEL and assess its impact and effectiveness is via an example that makes use of recent federal public finance data. …The base scenario…shows revenues rising from…$292.6 billion to $437.7 billion—an increase of 50 percent. …Meanwhile, expenditures rise from $295.4 billion to $466 billion for an increase of 58 percent.

But what if spending was limited so it could only grow at the same rate as population plus inflation?

The spending burden would increase by just 33 percent.

The simulations in this paper…involves a fixed growth rule for expenditures so that they cannot exceed growth in population plus inflation… Under this approach, federal expenditures grow from $295.5 billion in 2015–16 to reach $393.2 billion by 2025–26, which is a much smaller increase in spending relative to the projections contained in Budget 2021. …Expenditures grow from $295.5 billion in 2015–16 to reach $393.2 billion by 2025–26, an

increase of 33 percent.

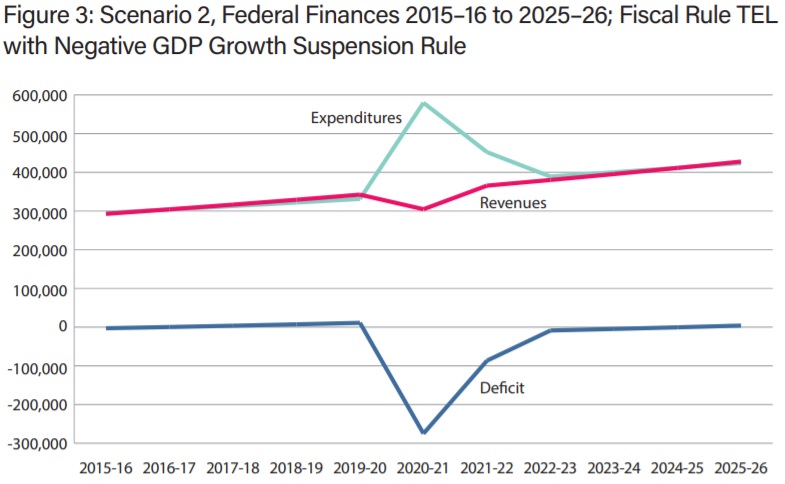

The report also looks at what would happen if there was an opt-out clause to allow emergency spending, specifically the outlays for Canada’s response to the COVID pandemic.

The net result is that spending climbs by 43 percent over the 10-year period.

…In figure 3, a…final scenario is presented that…assumes that the TEL was designed to accommodate the need for an emergency fiscal response… Expenditures are assumed to grow at 2.9 percent annually from 2015–16 to 2019–20 and then from 2023–24 onwards. …The results show that revenues rise from $292.6 billion in 2015–16 to $427.7 billion by 2025–26 for a total increase of 46 percent. Meanwhile, expenditures rise from $295.5 billion in 2015–16 to reach $423.7 billion by 2025–26 for an overall increase of 43 percent.

Here is the aforementioned Figure 3, for those interested.

The main takeaway is that a spending cap can be very successful, even if there’s a provision that allows emergency spending.

Total spending grows by less than total revenue, thus satisfying my Golden Rule. And, as a result, there’s far less government debt.

In other words, even with a TEL as structured under this scenario, it would have been possible for the federal government to deliver the exact same amount of COVID-19 fiscal support as laid out in the 2021 federal spring budget, balance the budget by 2025–26, and only accumulate half the deficits

P.S. Let’s look at a final excerpt from the study. We have reviewed a bunch of data showing how spending caps would be successful.

By contrast, balanced budget requirements do not have a good track record.

Balanced budget legislation is often perceived as a form of TEL but in practice it is considered different in that it simply attempts to achieve budget balance so that debt stops being accumulated. Such legislation is not necessarily designed to constrain the rate of growth of government spending—nor to limit the size of the public sector… Indeed, according to Clemens et al. (2003) the adoption of balanced budget laws in Canada, which by the early 2000s existed in eight out of ten provinces, coincided with increases in government spending and taxation as measured by real per-capita consolidated provincial and municipal spending.

This is not surprising. The cyclical nature of revenues means it is very difficult to maintain a balanced budget rule.

By contrast, the International Monetary Fund (twice!), the European Central Bank, and the Organization for Economic Cooperation and Development (twice!) have acknowledged that spending caps are the most, if not only, effective fiscal rule.

P.P.S. If you want some real-world evidence, Switzerland’s spending cap continues to produce strong outcomes.

———

Image credit: ElasticComputeFarm | Pixabay License.