As part of my recent interview about European economic policy with Gunther Fehlinger, I pontificated on issues such as Convergence and Wagner’s Law.

I also explained why a Swiss-style spending cap could have saved Greece and Italy from fiscal crisis. Here’s that part of the discussion.

For those not familiar with spending caps, this six-minute video tells you everything you need to know.

Simply stated, this policy requires politicians to abide by fiscal policy’s Golden Rule, meaning that – on average – government spending grows slower than the private economy.

And that’s a very effective recipe for a lower burden of spending and falling levels of red ink.

One of the points I made in the video is that spending caps would prevented the fiscal mess in Greece and Italy.

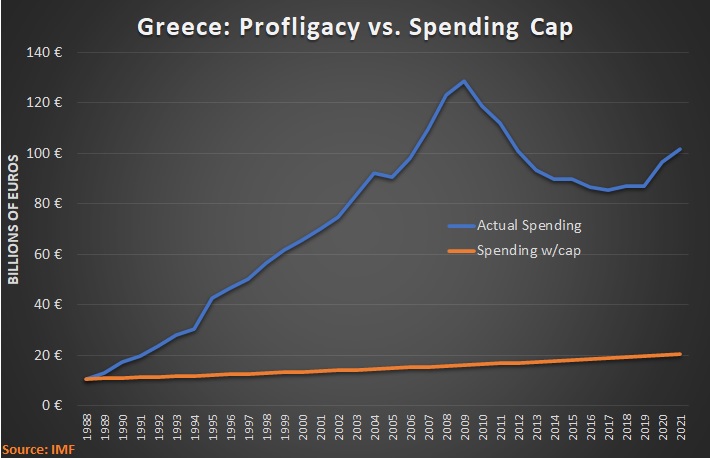

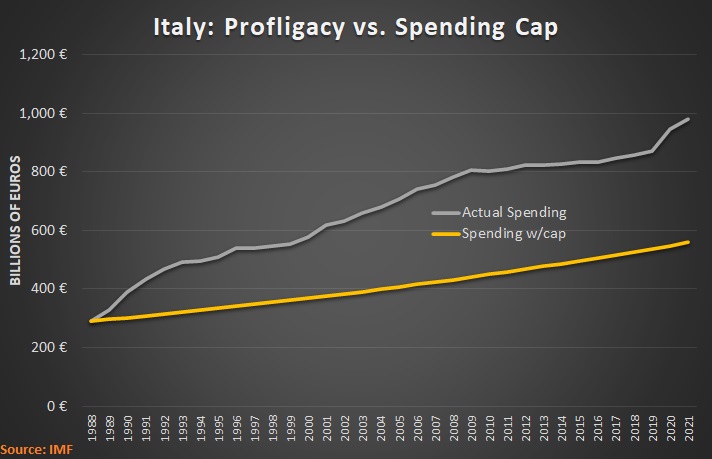

To show what I mean, I went to the International Monetary Funds World Economic Outlook database and downloaded the historical budget data for those two nations. I then created charts showing actual spending starting in 1988 compared to how much spending would have grown if there was a requirement that the budget could only increase by 2 percent each year.

Here are the shocking numbers for Greece.

The obvious takeaway is that there never would have been a fiscal crisis if Greece had a spending cap.

That also would be true even if the spending cap allowed 3-percent budget increases starting in 1998.

And it would be true if the 2-percent spending cap didn’t start until 2000.

There are all sorts of ways of adjusting the numbers. The bottom line is that any reasonable level of spending restraint could have prevented the horrible misery Greece has suffered.

Here are the numbers for Italy.

As you can see, the government budget has not increased nearly as fast in Italy as it did in Greece, but the burden of spending nonetheless has become more onerous – particularly when compared to what would have happened if there was a 2-percent spending cap.

I’ve written many times (here, here, here, and here) about Italy’s looming fiscal crisis. As I said in the interview, I don’t know when the house of cards will collapse, but it won’t be pretty.

And tax reform, while very desirable, is not going to avert that crisis. At least not unless it is combined with very serious spending restraint.

P.S. For those who want information about real-world success stories, I shared three short video presentations back in 2015 about the spending caps in Switzerland, Hong Kong, and Colorado.

P.P.S. It’s also worth noting that the United States would be in a much stronger position today if we had enacted a spending cap a couple of decades ago.

———

Image credit: 401kcalculator.org | CC BY-SA 2.0.