More than 10 years ago, I wrote about President Obama’s disingenuous strategy of pretending that spending increases were tax cuts.

Politicians in Washington have come up with something far more impressive than turning lead into gold or water into wine. Using self-serving budget rules, they can increase the burden of government spending and say they are cutting taxes instead. This bit of legerdemain is made possible…by adopting or expanding refundable tax credits. But in this case, “refundable” does not mean the government is returning money to taxpayers. Instead, it means that money is being redistributed to people who do not earn enough to be subject to the income tax. This is hardly a trivial issue. …the amount of income redistribution being laundered through the tax code is now so large that the bottom 40 percent of the population has a negative “effective” income tax rate.

Indeed, the IRS is now the biggest redistribution agency in the world, in charge of giving away a massive amount of money.

Far more than is spent on traditional welfare (what used to be called aid to families with dependent children and was reclassified as temporary aid to needy families), as illustrated by the chart.

The so-called earned income tax credit is the biggest redistribution program, though there’s also a large amount of spending on child credits.

And the cost of the so-called child credits is going to explode if President Biden’s plan for per-child handouts is approved.

Matt Weidinger of the American Enterprise Institute opined on Biden’s version of political alchemy.

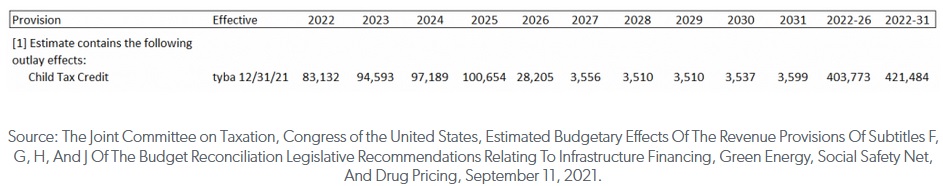

Democrats are fond of saying their massive $3.5 trillion spending bill includes significant “tax cuts.” They are referring to the effects of continuing the expanded child tax credit… President Biden said it was “one of the largest-ever single tax cuts for families with children.” …The facts say otherwise. …Such payments to those who do not owe federal income taxes are known as “refundable” credits, or in budget terms “outlays” — the same as benefits provided under welfare, Medicaid, food stamps, and similar spending programs. The outlay portions of these tax credits are not “tax cuts” for the simple reason that the payments exceed any taxes the recipient owed in the first place. Put another way, it is impossible to “cut taxes” if you do not owe taxes.

And here’s the relevant table from the Joint Committee on Taxation.

By the way, note how the spending estimates decline after 2025.

This is a budget gimmick. To make Biden’s expansion of the welfare state seem less extravagant, supporters designed the proposal so the expanded per-child handouts disappear in 2026.

But they openly argue that they will be extended because of the assumption that many Americans will get hooked on “free” money from Washington.

P.S. I’m not a fan of child credits, even for families that pay taxes. Simply stated, there are other types of tax cuts that will do a much better job of boosting after-tax family income.

———

Image credit: pxhere | CC0 Public Domain.