Way back in 2010, I shared this video explaining how “gross domestic product” and “gross domestic income” are basically the same number, but warning that the former leads to sloppy thinking (including the Keynesian myth that consumer spending drives the economy).

Since President Biden is seeking to resuscitate Keynesian Economics, let’s revisit this topic.

The first thing I want to do is to reassure skeptical readers that there’s nothing remotely controversial about my assertion that GDP and GDI are equivalent measures. It’s simply the common-sense recognition that total spending in a country is going to closely match total income.

If you really want to get into the technical weeds, the Bureau of Economic Analysis has a very detailed document showing how all the measurements fit with each other. Feel free to read that material by clicking here.

But if you don’t have the time or inclination to wade through all that material, here are two charts from the document that capture what’s important, at least for purposes of our discussion about macroeconomic policy.

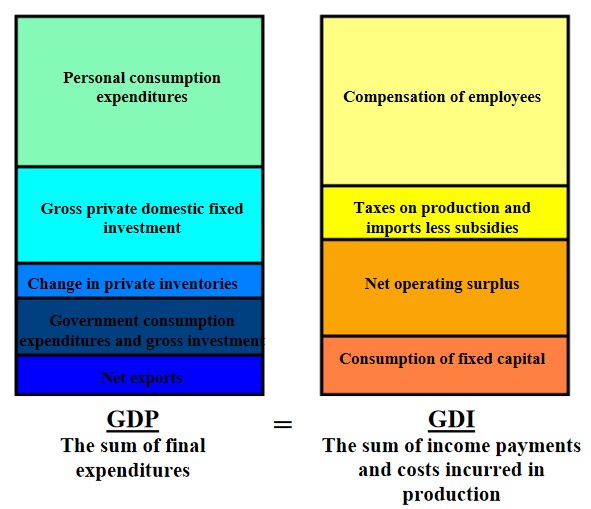

First, here’s a chart showing that GDP and GDI are two ways of arriving at the same number (though never exactly identical because of statistical discrepancies).

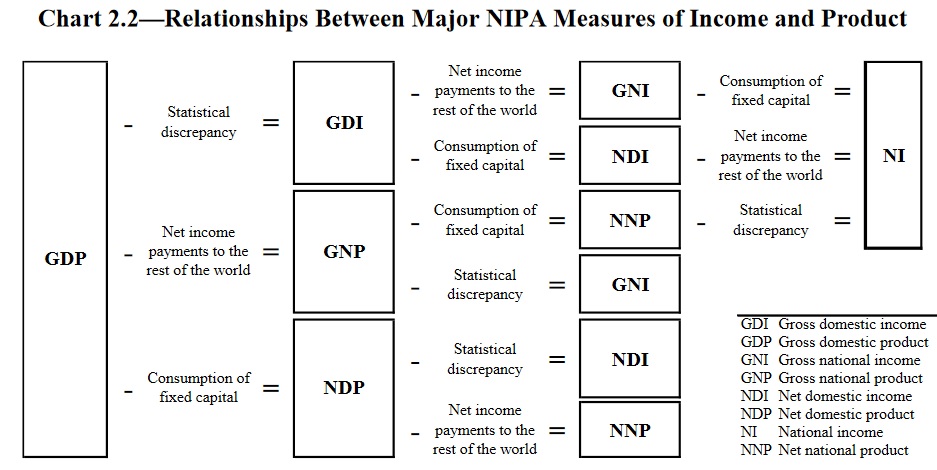

And if you really want to be a wonk, here’s the BEA’s depiction of GDP and GDI, along with a bunch of other measures of economic output.

And if all that boring background doesn’t convince you that it’s okay to equate GDP and GDI, let’s go back to 2018 and look at a column in the Wall Street Journal by Jason Furman, who was Chairman of the Council of Economic Advisers for President Obama

…the data aren’t perfect. …GDP is not measured directly. Instead, the BEA sums up economy-wide expenditures from dozens of data sources, covering consumption, investment, government spending, net exports and more. …the underlying data are noisy and incomplete, meaning that revisions to GDP growth estimates can be large and often confusing. …Drawing on more data can cancel out some of this noise and produce a more accurate figure that requires smaller revisions. Specifically, the BEA separately gauges the size of the economy by adding up all the different sources of income, such as wages and profits. This figure is called gross domestic income, or GDI… Ultimately, GDI should be identical to GDP, since all money spent is money earned.

With all that out of the way, now let’s move to some analysis that actually is controversial (not in my mind, of course, but my left-leaning friends probably won’t agree with me).

As explained in the video, and as I wrote back in 2013, people without much knowledge about economics draw inaccurate conclusions when using data on GDP.

But don’t take my word for it. Professor Alexander William Salter of Texas Tech University described, in an article for National Review, how GDP accounting equations are mistakenly interpreted to justify more government spending.

The most egregious abuses of economics that we see today start with an accounting identity — a true statement or equation — but end with an absurd economic claim. …Here’s an example: If you’ve taken an introductory economics course, this equation is probably familiar to you: Y=C+I+G+(X-IM). In plain English: Gross Domestic Product (GDP, in this equation ‘Y’) is the sum of consumption (C), investment (I), government spending (G), and net exports (X-IM). This is the foundation of national-income accounting, and it’s true by construction. GDP is defined as the sum of these things. Nothing in this equation tells us how the economy actually works. …often it’s misused. Here’s a case from the Left: Because government expenditures enter positively into GDP, increased government spending raises GDP. Simple, right? Not so fast. …Uncle Sam spending more doesn’t increase the size of the economic pie. It just redistributes existing slices to Uncle Sam, or to whomever Uncle Sam finances. More public-sector consumption means less private-sector consumption.

That’s a look at theory.

He also applies theory to reality, most recently in a column for the Wall Street Journal about Biden’s supposed infrastructure plan.

Whether public or private, spending doesn’t cause growth. Mr. Stiglitz and his allies have it backward: Consumption is downstream from production. Growth is about increasing the supply of goods over time; you can’t spend if the goods haven’t been produced. Production grows as technology and production processes improve. Such improvement requires saving and investing rather than consuming. …all the financing in the world won’t boost productivity if it isn’t channeled correctly. More-efficient producers, not partisan spending, create economic flourishing. Though the president’s plans will consume plenty, they’ll produce only disappointment.

That last sentence is an apt summary. A bigger government means a smaller economy.

The empirical evidence shows that nations with smaller fiscal burdens economically out-perform countries with large welfare states. Simply stated, there’s an incentive for efficiency in the private sector, whereas people in Washington are governed by the perverse incentives described by “public choice” theory.

I’ll close with a relevant caveat that was mentioned in the above video. It is possible for a nation to consume more than it produces. But only if it borrows from overseas, and only at the cost of having to sacrifice future income to service the additional debt.

P.S. If you want more information, here’s my video on Keynesian Economics, and here’s my 4-part series on the economics of government spending.

P.P.S. I also wrote about GDP vs. GDI in 2017, in part to debunk some grotesquely dishonest reporting by Time.