Two years ago, I wrote that China needed to choose between “Statism and Stagnation or Reform and Prosperity.”

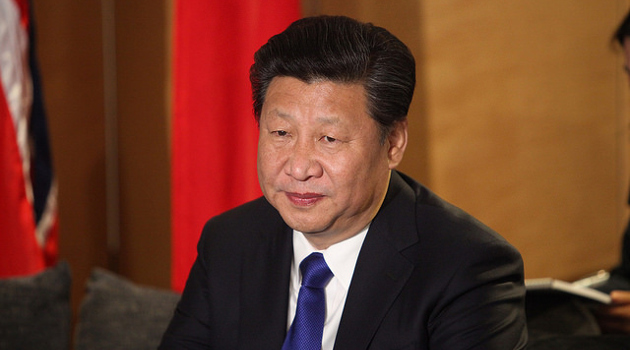

Sadly, as I noted last month in Part I of this series, it seems that President Xi is opting for the former.

Which is unfortunate since China needs a lot more growth to get anywhere near U.S. levels of prosperity.

Yet that’s not very likely when the United States is ranked #6 and China is ranked #116 for economic liberty.

For what it’s worth, China’s score is likely to drop in future years rather than rise, and I’m certainly not the only one to notice that China has economic problems.

Writing for the Atlantic, David Frum looks at the country’s shaky economic outlook.

China’s economic, financial, technological, and military strength is hugely exaggerated by crude and inaccurate statistics. Meanwhile, U.S. advantages are persistently underestimated. The claim that China will “overtake” the U.S. in any meaningful way is polemical and wrong… China misallocates capital on a massive scale. More than a fifth of China’s housing stock is empty—the detritus of a frenzied construction boom that built too many apartments in the wrong places. China overcapitalizes at home because Chinese investors are prohibited from doing what they most want to do: get their money out of China. …More than one-third of the richest Chinese would emigrate if they could, according to research by one of the country’s leading wealth-management firms.

David mentioned “inaccurate statistics,” which is a big problem in China.

But I also worry about bubble statistics, which is an issue the Wall Street Journal editorialized about earlier this year.

…credit has exploded, with total public and private debt expected to exceed 270% of GDP in 2020, up 30 points in one year. Most of that has gone to state-owned firms and exporters. Smaller, more productive private companies that serve the domestic market report credit shortages. This undermines long-term growth… Unless China can unlock and expand its productive private economy, it will never be able to manage the burden of the debt Beijing has created.. China’s unbalanced recovery represents an enormous lost opportunity for the Chinese people.

David Ignatius of the Washington Post opines on President Xi’s embrace of bad policy.

President Xi Jinping has moved down a Maoist path this year toward tighter state control of the economy — including “self-criticism” sessions for Chinese business and political leaders whose crime, it seems, was being too successful. Xi’s leftward turn represents a major change… The result is a severe squeeze on what Xi views as “undisciplined” entrepreneurs. …Xi’s crackdown has rocked the Chinese economy. The top six technology stocks have lost more than $1.1 trillion in value over the past six months… Xi is animated by what he has called his “China Dream,” of a nation of unparalleled wealth and power — and also the egalitarian ideals of socialism.

In a column for the Wall Street Journal, Dennis Kwok and Johnny Patterson warn that private investors should not trust the Chinese government.

Beijing’s crackdown on private businesses has wiped out hundreds of billions of dollars in market value in the past two months. Under the policies of “advancement of the state, and retreat of private enterprises” and “common prosperity,” the state’s tightening of control will increase. …Beijing assails “foreign forces” for seeking to curb China’s rise as a great nation. That refrain is constantly pushed by state media… Investors and shareholders of Wall Street firms must understand that there has been a paradigm shift in Mr. Xi’s China. Long gone are the days of pragmatism. What the Chinese state wants, the Chinese state gets.

In an article for the Atlantic, Michael Schuman explains how China’s heavy subsidies for electric cars haven’t produced vehicles that can compete with Tesla and other western vehicles.

Do Chinese state programs actually work? …bureaucrats have never stopped meddling with markets. State direction, state money, and state enterprises remain core features of the Chinese economic model. President Xi Jinping has even reversed the trend toward greater economic freedom, notably with a hefty dose of state-led programs aimed at accelerating the progress of specific sectors. …China’s industrial program has resulted in a lot of production, but only questionable competitiveness. Even Beijing’s spendthrift bureaucrats seem to have awoken to that—sort of. They’ve been rolling back direct subsidies to carmakers, with an eye on eliminating them.

In other words, industrial policy is backfiring on China.

The former Prime Minister of Australia, Kevin Rudd, opined for the Wall Street Journal about China’s resurgent statism

In recent months Beijing killed the country’s $120 billion private tutoring sector and slapped hefty fines on tech firms Tencent and Alibaba. Chinese executives have been summoned to the capitol to “self-rectify their misconduct” and billionaires have begun donating to charitable causes in what President Xi Jinping calls “tertiary income redistribution.” China’s top six technology stocks have lost more than $1.1 trillion in value in the past six months… Mr. Xi is executing an economic pivot to the party and the state… Demographics is also driving Chinese economic policy to the left. The May 2021 census revealed birthrates had fallen sharply to 1.3—lower than in Japan and the U.S. China is aging fast. The working-age population peaked in 2011… While the politics of his pivot to the state may make sense internally, if Chinese growth begins to stall Mr. Xi may discover he had the underlying economics very wrong.

That final sentence is key.

Free enterprise is only tried-and-true recipe for economic prosperity. Chinese leaders are wrong to think they can get faster growth with more intervention.

Simply stated, China appears to be moving further left on this spectrum when it desperately needs to move to the right.

The bottom line is that I’m not optimistic about the future of China.

The country needs a Reagan-style agenda (the approach used by Singapore, Hong Kong, and Taiwan) to achieve genuine convergence.

P.S. Amazingly, both the IMF and OECD are encouraging more statism in China.

P.P.S. I used to be hopeful about China. During the 1950s, 1960s, and 1970s, China was horrifically impoverished because of socialist policies. According to the Maddison database, the country was actually poorer under communism than it was 1,000 years ago. But there was then a bit of economic liberalization starting in 1979, which generated very positive results. As a result, there was a significant increase in living standards and a huge reduction in poverty. But that progress has ground to a halt.

———

Image credit: Foreign and Commonwealth Office | CC BY 2.0.