I periodically write about the importance of long-run growth and about the importance of convergence (whether poorer countries are catching up with richer countries, as suggested by theory).

This is because such data, especially over decades, teaches us very important lessons about the policies that are most likely to generate prosperity.

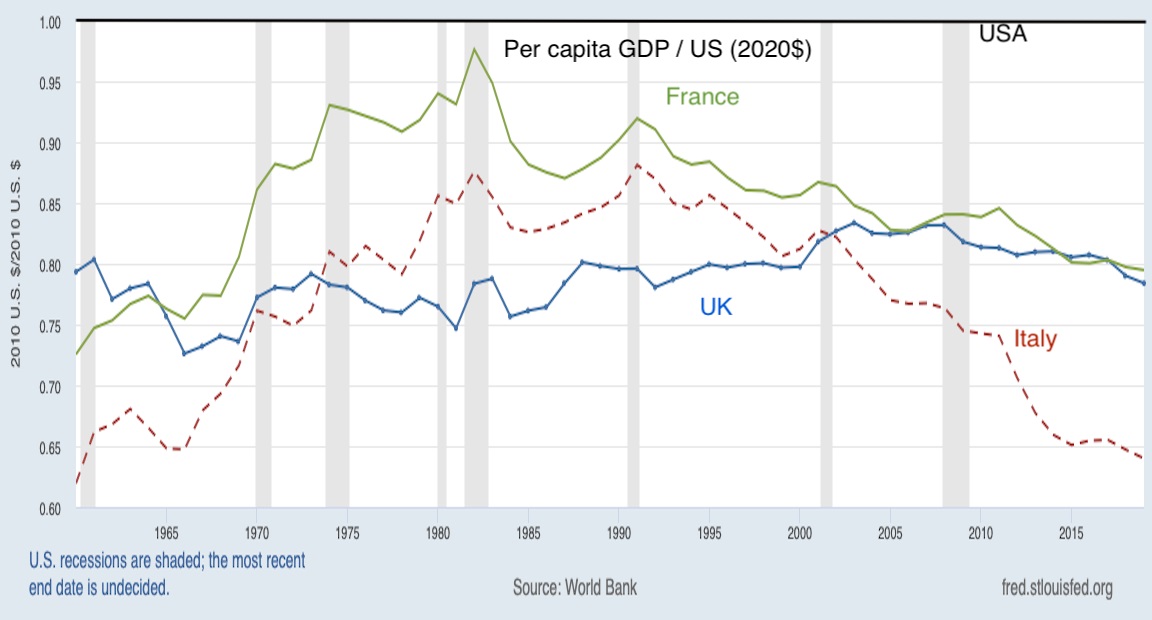

I’m revisiting these issues today because John Cochrane, a Senior Fellow at the Hoover Institution and a former professor of economics at the University of Chicago, recently wrote a column that contains a must-see chart showing how some of the major European nations have been losing ground to the United States over the past several decades.

The main thing to understand is that European nations were catching up to the United States after World War II, which is what one would expect.

But that trend came to a halt about 40 years ago and now these nations are suffering divergence instead of enjoying convergence.

Here’s some of Cochrane’s analysis.

…the US is 54% better off than the UK.. France…50% less than US. …the US is 96% better off than Italy. …And it’s been getting steadily worse. France got almost to the US level in 1980. And then slowly slipped behind. The UK seems to be doing ok, but in fact has lost 5 percentage points since the early 2000s peak. And Italy… Once noticeably better off than the UK, and contending with France, Italy’s GDP per capita is now lower than it was in 2000. GDP per capita is income per capita. The average European is about a third or more worse off than the average American, and it’s getting worse.

What’s most remarkable, as I wrote about back in 2014, is that the gap between the United States and Europe is “getting worse.”

Cochrane wonders if this is evidence against the European Union’s free-trade rules.

This should be profoundly unsettling for economists. Everyone thinks free trade is a good thing. The European union, one big integrated market, was supposed to ignite growth. It did not. The grand failure of the world’s biggest free trade zone really is a striking fact to gnaw on. Sure, other things are not held constant. Perhaps what should have been the world’s biggest free trade zone became the world’s biggest regulatory-stagnation, high-tax, welfare-state disincentive zone. Still, “it would have been even worse” is a hard argument to make.

For what it’s worth, I don’t think it’s “a hard argument to make”. I’ve pointed out – over and over again – that Europe’s reasonably good policies in some areas are more than offset by really bad fiscal policy.

Think of the different types of economic policy as classes for a student. If a kid flunks one class, that’s going to produce a sub-par grade point average even if there was good marks in all the other classes.

That’s what has happened on the other side of the Atlantic Ocean. Europe is suffering the consequences of a stifling tax burden and an onerous burden of government spending.

Besides, I suspect some of the benefits of free trade inside the European Union are offset by the damage of the E.U.’s protectionist barriers against trade with the rest of the world.

P.S. Some people may wonder why Germany was not included in Cochrane’s chart. I assume that’s because the reunification of West Germany and East Germany about 30 years ago creates a massive discontinuity in the data. For those interested, Germany is slightly better off than France and the U.K., according to the Maddison data, but still lagging well behind the United States.

P.P.S. Speaking of Germany, the divergence between East Germany and West Germany teaches an obvious lesson.

P.P.P.S. I don’t think it’s a coincidence that America started out-performing Europe after Reaganomics was implemented.

P.P.P.P.S One obvious takeaway from Cochrane’s data (though not obvious to President Biden) is that the United States should not be copying Europe. Unless, of course, one wants ordinary Americans to be much poorer.