One reason I’m interested in Chile’s election is that the leftist candidate, Gabriel Boric, wants to eviscerate the nation’s successful private pension system.

Bettina Horst of Libertad Y Desarrollo gave me her analysis.

As an economist and Executive Director of the nation’s pro-market think tank, Ms. Horst understands that Chile’s system has helped workers by giving them real ownership of real assets.

And that’s much better than “pay-as-you-go” systems, like we have in the United States.

Chile’s private retirement accounts have enabled workers to build nest eggs, and the system has also provided a valuable source of capital for the nation’s economy.

So why would Chile’s voters consider a candidate like Boric, who wants to wreck that system?

We’ll find out Sunday night after the votes are counted, but a Boric victory would indicate that Chile’s workers decided to trust the free-lunch promises of a politician.

In a column earlier this year for the Wall Street Journal, another Chilean weighed in on this issue.

Axel Kaiser of the Atlas Research Network wrote that the left has a (long-standing) ideological agenda.

In 1981 Chile became the first country to privatize social security, ending the pay-as-you-go system that had been in place since 1924 and had collapsed. Now Chile’s left wants to resurrect it. …Last year a group of senators even introduced a bill to nationalize the pension funds, as Argentina did in 2008. An expropriation of workers’ savings looks increasingly likely, as the radical left dominates Chile’s recently elected constitutional convention. “The destruction of the AFP system is under way,” a far-left lawmaker recently said. …The attack on the AFP system is all about ideology and power. …Its destruction has long been a goal of the radical left. With the AFP out of the picture, politicians will recover the power they once had over retirees.

That’s Mr. Kaiser’s political analysis.

His column also includes some analysis of the economic benefits of the private system.

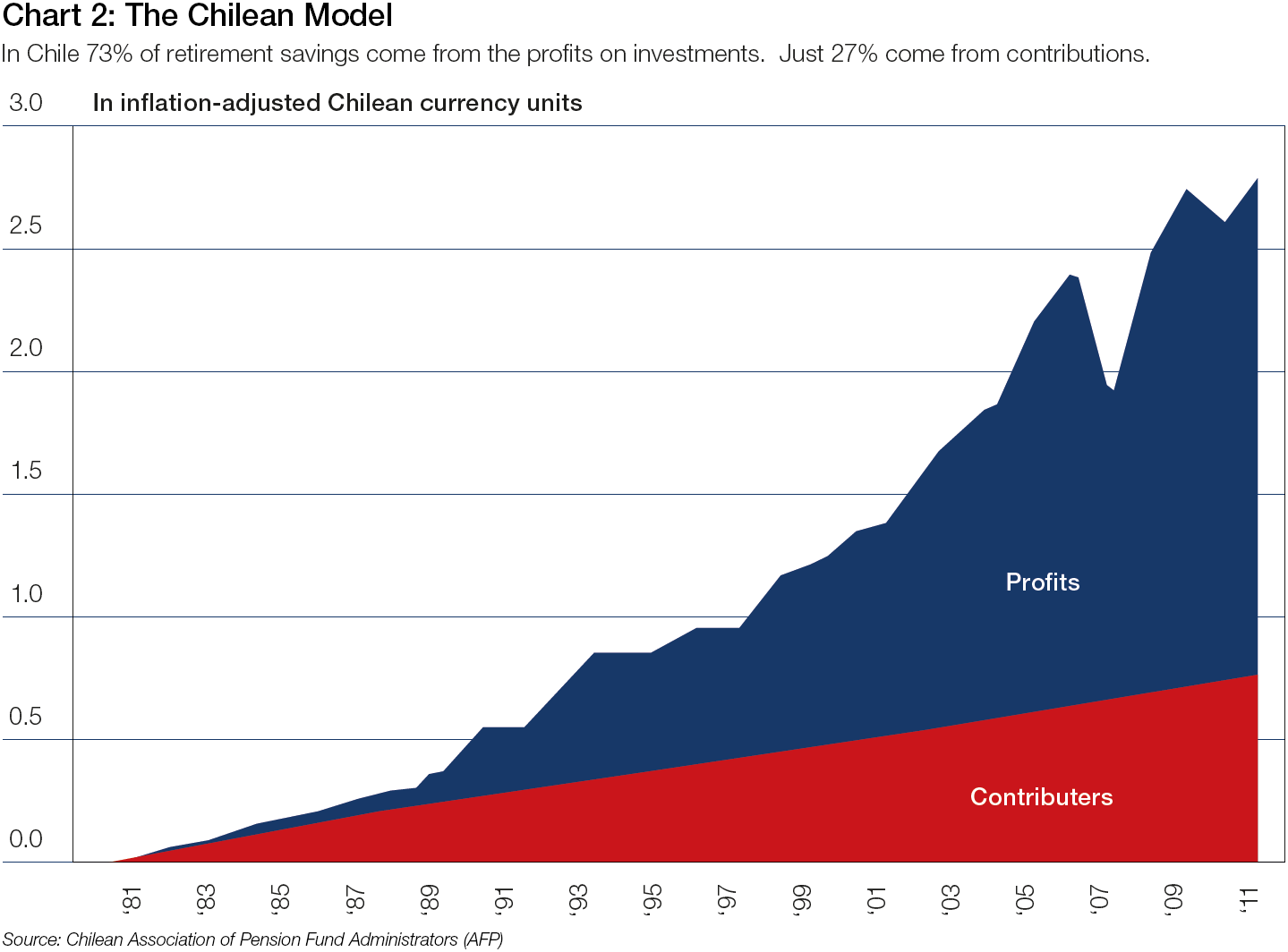

The state-run pension system was plagued by corruption and rent-seeking… Pension privatization reversed this perverse dynamic. Instead of taxing active workers to pay pensioners through the bureaucracy, the new system, created by former Labor Minister José Piñera, established that 10% of the employee’s salary is transferred automatically to an account under his name at one of the Administradoras de Fondos de Pensiones, or AFP. These private pension funds compete to attract workers and invest their pensions for a fee. …By subsequently relying on workers’ own savings to fund their pensions instead of taxing younger workers, privatization of social security ended dependency across generations. …Average pensions are also 41% higher in the AFP system than in the old one, according to the Libertad y Desarrollo research center, even as workers contribute a smaller fraction of their salaries. Between 1981 and 2019, the savings accumulated in workers’ accounts at the AFP reached $218 billion, or around three-quarters of GDP. About 70% of these funds weren’t contributions made by workers but profits generated for them by AFP investments. This accumulation of capital contributed an extra 0.5% of GDP a year to economic growth between 1981 and 2001.

As mentioned in the column, Jose Pinera created Chile’s system of personal retirement accounts.

You can click here to see him describing the case for private accounts, both in Chile and the United States.

———

Image credit: Pedro Ribeiro Simões | CC BY 2.0.