I’ve been warning that the United States should not copy Europe’s fiscal policy, largely because living standards are significantly lower in nations with large welfare states.

That’s true if you look at average levels of consumption in different nations, but the most compelling data is the fact that lower-income people in the United States generally enjoy living standards that are equal to or even higher than those for middle-class people in most European countries.

A bigger burden of government is not just a theoretical concern. President Biden has already pushed through a $1.9 trillion spending bill that includes some temporary provisions – such as per-child handouts – that, if made permanent, could add several trillion dollars to the burden of government spending.

And the White House has signaled support for $3 trillion of additional spending for items such as infrastructure, green energy, and other boondoggles.

This doesn’t even count the cost of other schemes, such as the “public option” that would strangle private health insurance and force more people to rely on an already-costly-and-and bankrupt government program.

So what will it mean for America if our medium-sized welfare state morphs into a European-style large welfare state?

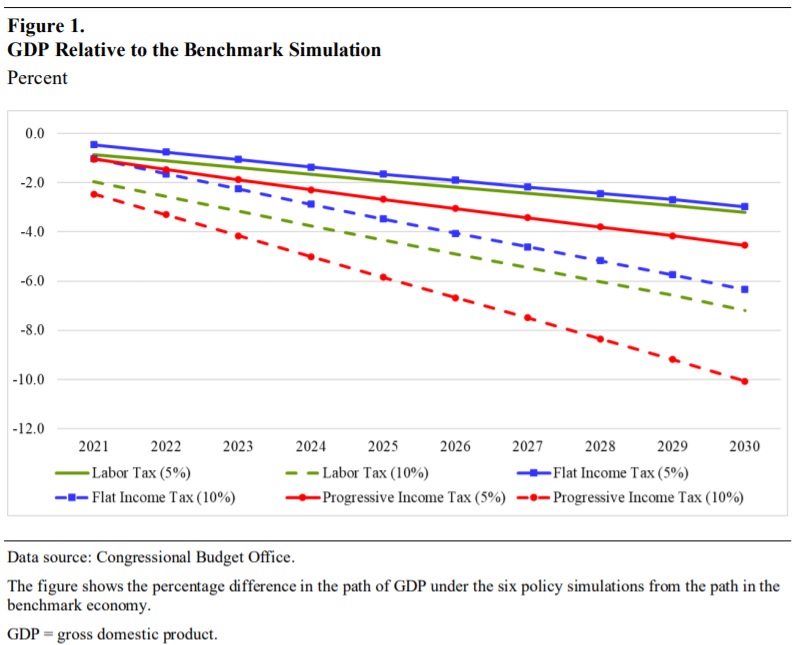

The answer to that question is rather unpleasant, at least if some new research from the Congressional Budget Office is any indication. The study, authored by Jaeger Nelson and Kerk Phillips, considers the impact on growth based on six different scenarios (based on how much the spending burden increases and what taxes are increased).

If permanent spending is financed by new or increased taxes, then those taxes influence people’s decisions about how much to work and save. Those decisions then affect how much the economy produces and businesses invest and, ultimately, how much people can consume. Different types of taxes have different economic effects. Taxes on labor income reduce after-tax wages, so they reduce the return on each additional hour worked. …Higher taxes on capital income, such as dividends and capital gains, lower the average after-tax rate of return on private wealth holdings (or the return on investment), which reduces the incentive to save and invest and leads to reductions in saving, investment, and the capital stock. …we compare the effects of raising additional revenues through three illustrative tax policies: a flat tax on labor income, a flat tax on all income (including both labor and capital income), and a progressive tax on all income. The additional revenues generated by these policies are in addition to the revenues raised by taxes that already exist and are used to finance two specific increases in government spending. The two increases in government spending are set to 5 percent and 10 percent of GDP in 2020.

Here are some of the key results, as illustrated by the chart.

The least-worst result (the blue line) is a decline in GDP of about 3 percent, and that happens if the spending burden expand by 5-percentage points of GDP and is financed by a flat tax.

The worst-worst result (dashed red line) is a staggering decline in GDP of about 10 percent, and that happens if the spending burden climbs by 10-percentage points and is financed by a progressive tax.

Here’s some additional analysis, including a description of why progressive taxes impose the most damage.

This paper shows that flat labor and flat income tax policies have similar effects on output; labor taxes reduce the labor supply more, and income taxes reduce the capital stock more. For all three policies, the decline in income contracts the tax base considerably over time. As a result, to continuously generate enough revenues to finance the increase in government spending in each year, tax rates must steadily increase over time to account for the decline in the tax base. Moreover, labor and capital taxes put upward pressure on interest rates by reducing the capital-to-labor ratio over time… The largest declines in economic activity among the financing methods considered occur with the progressive tax on all income. Those declines occur because high-productivity workers reduce their hours worked and because higher taxes on asset income reduce the incentive to save and invest relatively more than under the two flat taxes.

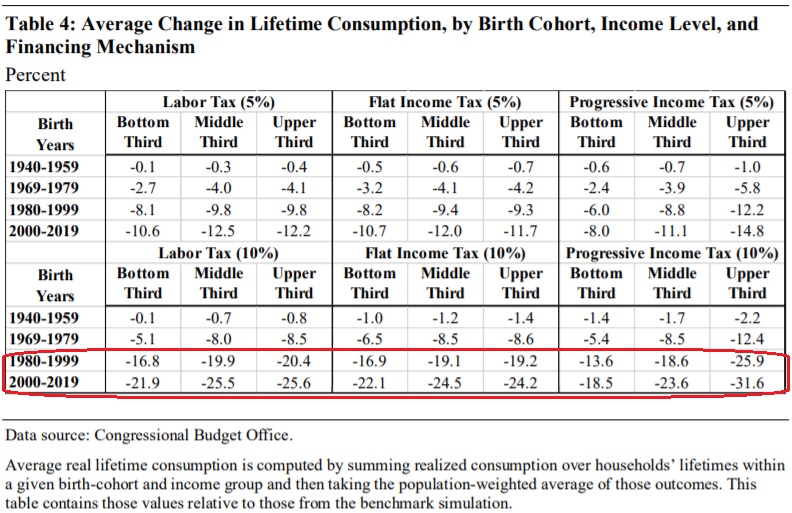

There’s lots of additional information in the study, but I definitely want to draw attention to Table 4 because it shows that lower-income people will suffer big reductions in living standards if there’s an increase in the burden of government spending (circled in red).

What makes these results especially remarkable is that the authors only look at the damage caused by higher taxes.

Yet we know from other research that the economy also will suffer because of the higher spending burden. This is because of the various ways that growth is reduced when resources are diverted from the productive sector to the government.

For background, here’s a video on the theoretical reasons why government spending hinders growth.

And here’s a video with some of the scholarly evidence.

P.S. The CBO study also points out that financing new spending with a value-added tax wouldn’t avert economic damage.

…by reducing the cost of time spent not working for pay relative to other goods, a consumption tax could reduce hours worked through a channel like that of a tax on labor.

For what it’s worth, even the pro-tax International Monetary Fund agrees with this observation.

P.P.S. It’s worth noting that the CBO study also shows that young people will suffer much more than older people.

…older cohorts, on average, experience smaller declines in lifetime consumption than younger cohorts

Which raises an interesting question of why millennials and Gen-Zers don’t appreciate capitalism and instead are sympathetic to the dirigiste ideology that will make their lives more difficult.

———

Image credit: Martin Jacobsen | CC BY-SA 3.0.