I just got back from Medellin, Colombia, where I gave a presentation to the Liberty International World Conference.

My topic was “The Fatal Mix of Demographic Change and the Welfare State” and I made my usual points about how poorly designed entitlement programs are going to wreak havoc, in large part because of demographic change.

Simply stated, tax-and-transfer programs collapse when there are too many beneficiaries and too few taxpayers.

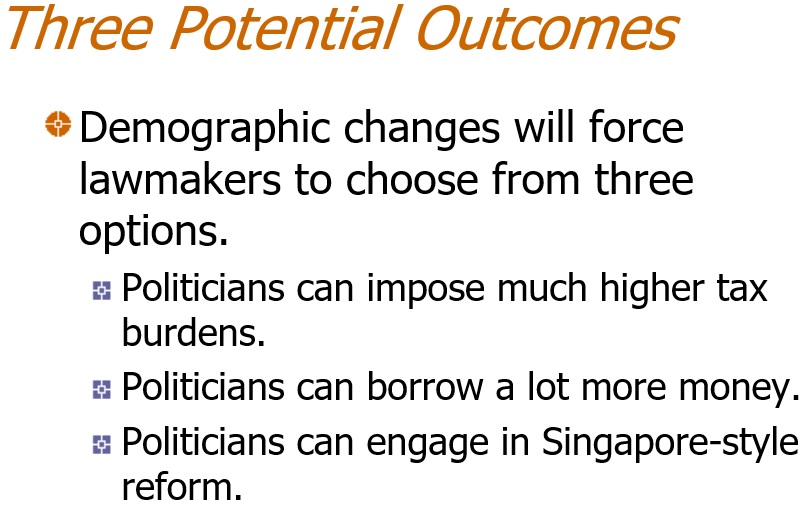

This means politicians will be forced to act and I included this slide to show some of their main options (including my favorite, genuine entitlement reform).

But I noted in my speech that this was just a partial list of how politicians can respond.

- They can also reduce payments to beneficiaries (an option that I view as very unlikely)

- They can also finance promised benefits by printing money (I hope this also is very unlikely).

But there’s another option that I didn’t mention.

Politicians can indirectly finance their vote buying with “financial repression.” If you’re not familiar with that concept, Joseph Sternberg tells you what you need to know in a must-read column in Wall Street Journal.

He starts with some discussion of how repression worked in the past.

Government spending is conventionally understood as a matter of increased taxation and debt, a framing that has the virtue of being true. But that conversation is incomplete without also exploring the concept of financial repression—which ultimately underlies both the taxes and debt. …in spendthrift developing countries. Governments would suppress interest rates on domestic savings to below the rate of inflation to reduce rates on lending. The point was to service government borrowing and subsidize credit to politically favored industries. In the process, they’d create a substantial wealth transfer from private creditors to debtors… Developed economies have deployed this gimmick too. Regulation of the rates banks paid on savings was an important, and not the only, bit of financial repression perpetrated against Americans.

And he warns how repression can work today.

Financial repression nowadays consists of several overlapping phenomena beyond the classic suppression of bank interest rates. A nonexhaustive list: more-intrusive management of assets and credit allocation in the banking system via reserve requirements, capital regulations and the like; a blurring of the line between fiscal and monetary policy such that monetary authorities subsidize the fiscal authority’s borrowing while the fiscal authority creates new credit subsidies for other parties; and any press release from Sen. Elizabeth Warren demanding a new regulation on this sort of lending or that sort of borrowing. …A gaze through the lens of financial repression offers a new view of how dangerous Washington’s spending boondoggles are. …Unfettered government spending also forces voters to pay via inflation and low returns on savings in the here and now. …The redirection of savers’ resources to politically favored “borrowers” (either directly via loan guarantees or more often indirectly via the disbursement of government grants raised via deficit financing) creates inefficiency and waste.

Here’s the bottom line.

…rampant misallocation of capital and the attendant distortions of saving and investment…will create a materially worse future.

In some sense, financial repression is a back-door form of industrial policy since politicians are putting their thumbs on the scale and hindering the efficient allocation of capital.

And that’s why there’s less growth and people wind up with lower living standards as time passes.

If you’re interested in this topic (and you should be), I shared some very worrisome analysis back in 2015.

P.S. If politicians succeed in their “war on cash,” that will give them another tool for financial repression.

P.P.S. History teaches us that there is a way of climbing out of a fiscal hole without using repression.

———

Image credit: Max Pixel | CC0 Public Domain.