Having been in Washington for close to 40 years, I’ve seen lots of budget dishonesty, but nothing compares to Joe Biden’s claim that his profligate budget proposals have zero cost.

According to the official numbers, that’s a $3.5 trillion lie.

In reality, as I noted in July, it’s much bigger.

Let’s investigate this issue. I’ll start by noting that I have mixed feelings about the Committee for a Responsible Federal Budget (CRFB). They think controlling red ink should be the main focus of fiscal policy, whereas I think controlling spending should be the top goal.

That being said, CRFB’s staff have a well-deserved reputation for being thorough and careful when producing fiscal analysis.

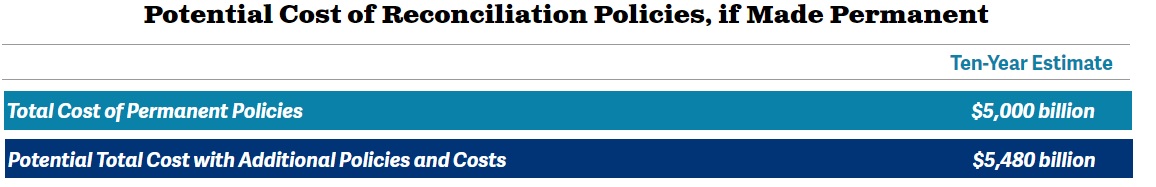

So it’s worth noting that the group estimates that the Biden’s fiscal agenda would actually cost between $5 trillion and $5.5 trillion over 10 years, much higher than the “official” estimate of $3.5 trillion.

Here are some of the bottom-line numbers from their report.

That’s a truncated version of their table. If you want to see all the gory details, click here.

You’ll also be able to read the group’s analysis, including these key excerpts.

While the actual cost of this new legislation will ultimately depend heavily on details that have yet to be revealed, we estimate the policies under consideration could cost between $5 trillion and $5.5 trillion over a decade, assuming they are made permanent. In order to fit these proposals within a $3.5 trillion budget target, lawmakers apparently intend to have some policies expire before the end of the ten-year budget window, using this oft-criticized budget gimmick to hide their true cost. …To fit $5 trillion to $5.5 trillion…into a $3.5 trillion budget, background documents to reporters explain that “the duration of each program’s enactment will be determined based on scoring and Committee input.” In other words, tax credits and spending programs will be set to expire at some point before the end of the decade, in the hope that future lawmakers will extend these programs. …This budget gimmick…would obscure the true cost of the legislation

The Wall Street Journal opined about Biden’s gimmickry.

Democrats are grasping for ways to finance their cradle-to-grave welfare state, with the left demanding what they claim is $3.5 trillion over 10 years. The truth is that even that gargantuan number hides the real cost of their plans. The bills moving through committees are full of delayed starts, phony phase-outs, and cost shifting to states designed to fit $3.5 trillion into a 10-year budget window… Start with the child allowance… Democrats have hidden the real cost by extending the allowance only through 2025. Even if Republicans gain control of Congress and the White House in 2024, Democrats and their media allies will bludgeon them to extend the payments… Democrats are using a different time shift to disguise the cost of their Medicare expansion…delaying the phase-in of the much more expensive dental benefit to 2028. This “saves” $420 billion over 10 years, but the costs explode after that. …the new universal child-care entitlement…gives $90 billion to the states—but only from 2022 to 2027. …The bottom line: $3.5 trillion is merely the first installment of a bill that would put government at the commanding heights of family life and the economy for decades to come. Tax increases will follow as far as the eye can see.

Regarding the final sentence of the above excerpt, the tax increases in Biden’s budget are merely an appetizer.

Ultimately, a European-sized welfare state requires European-style taxes on lower-income and middle-class households.

In other words, a value-added tax, along with higher payroll taxes, higher energy taxes, and higher income tax rates on ordinary workers (with this unfortunate Spaniard being a tragic example).

But we do have a tiny bit of good news.

A small handful of Democrats are resisting Biden’s budget, which means the package presumably will have to shrink in order to get sufficient votes.

But this good news may be fake news if Biden and his allies in Congress simply expand the use of dishonest accounting.

Brian Riedl of the Manhattan Institute documents some of this likely dishonesty in a column for the New York Post.

How does Congress cut a $3.5 trillion spending bill down to $1.5 trillion? By using gimmicks to hide its true cost. …Progressives have been abusing these gimmicks from the start. They began with a reconciliation proposal that would cost nearly $5 trillion over the decade. Then, in order to cut the bill’s “official” cost closer to $4 trillion, the bill’s authors included a December 2025 expiration of the $130 billion annual expansion of the child tax credit… Of course, no one believes that Congress will actually allow the child tax credit to be reduced at the end of 2025… Democrats purposely selected for “expiration” a popular middle-class benefit that they know even a future Republican Congress or president would not dare take away from voters. …expensive child care subsidies, family leave, and “free” community college benefits may also have their full cost hidden with fake expiration dates early into the 10-year scoring window. Lawmakers fully expect to extend these policies later, ultimately raising the cost of the total reconciliation bill closer to the $3.5 trillion target (or even higher). …Progressives are also discussing delaying the proposed new Medicare dental benefits until 2028, which legitimately saves money within the 10-year scoring window but also hides a larger long-term cost.

I realize that it’s not a big revelation to write that politicians are dishonest (Washington, after all, is a “wretched hive of scum and villainy“).

And I also realize that that the main problem with Biden’s plan is the economic damage it will cause, not the reliance on phony accounting.

But truth should matter a little bit, even in a town where lying about fiscal policy is a form of art.

———

Image credit: Marc Nozell | CC BY 2.0.