Biden’s tax-and-spend budget plan is based on dishonesty, and I’m just talking about his preposterous claim that a massive expansion of government has “zero cost.”

- On the outlay side of the fiscal ledger, he’s actually proposing to increase the nation’s already-excessive spending burden by more than $5 trillion over the next ten years, not $3.5 trillion.

- Based on dishonest estimates of the “tax gap,” he claims that a massive expansion of IRS staff will allow enough new audits to generate hundreds of billions of extra revenue in the next decade.

- Most shocking, Biden’s budget even tries to mislead people by classifying some expanded welfare payments as tax cuts, simply because the IRS is the bureaucracy redistributing the money.

Today, let’s review another example of Biden’s dodgy approach to budgeting.

If you look at page 53 of his budget, you’ll see that the White House claims it can generate nearly $463 billion of tax revenue by having banks automatically share account information with the IRS.

Which bank accounts?

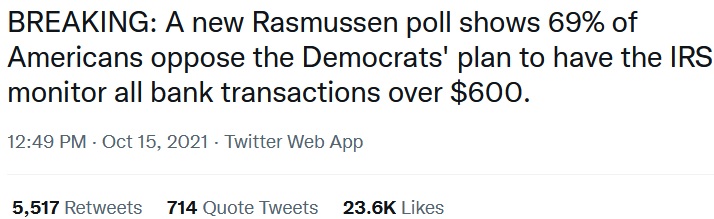

Well, almost all of them. The original proposal would give the IRS automatic access to accounts with as little as $600 of annual turnover.

That number is apparently going to increase, but even a limit of $10,000 would let the IRS snoop on almost every American’s private financial affairs.

At the risk of understatement, the proposal has generated a lot of pushback.

National Review editorialized against the scheme.

…the House reconciliation bill would let the Internal Revenue Service peer into the bank account of virtually every American. …Here’s the proposition: You permanently sacrifice your financial privacy, and the Democrats get a small step closer to funding their agenda. …Treasury secretary Janet Yellen claims the IRS will overcome perennial bureaucratic incompetence and track down “opaque income streams that disproportionately accrue to the top.” …If it’s high earners we’re worried about, why spy on everyone? …The administration is seriously arguing for a new oversight regime that would gather data on nearly every American on the off chance that a billionaire opens several thousand bank accounts. …this move on bank accounts would represent a new, jaw-dropping level of federal intrusiveness and is a power no government should have. Biden officials from Yellen on down have had trouble defending it — because it is literally indefensible.

Writing for the Hill, Thomas Hoenig and Brian Knight of the Mercatus Center pour cold water on the idea of expanding IRS snooping.

…the Biden administration is proposing requiring banks to report individual account transaction flows above $600 to the Internal Revenue Service (IRS). …a significant intrusion of consumer privacy. It’s also cumbersome, unlikely to achieve whatever legitimate goal the administration may have… the breadth of intrusion into the citizenry’s personal accounts is excessive and unwise. …Such a rule would also likely limit people’s access to banks. …Increasing compliance costs for banks will likely lead them to increase minimum balance requirements and fees to keep accounts economically viable, which could in turn force more people outside the banking system.

Here are excerpts from a Wall Street Journal editorial, which expresses similar concerns.

On your next trip to the ATM, imagine that Uncle Sam is looking over your shoulder. As if your annual tax filing wasn’t invasive enough, the Biden Administration would like a look at your checking account. …Ms. Yellen says the reporting will help to catch wealthy tax dodgers. …Casting a wide net over personal finances is a longstanding aim for Democrats and the political left. …the bigger threat of giving the IRS access to the details of your bank account is that politicians will eventually find a way to control how you save and spend your own money. This is a bad idea that deserves to die. …A group of 41 industry groups recently warned congressional leaders that the plan “is not remotely targeted” to detect major tax avoidance. …Twenty-three state treasurers and auditors signed a letter last month opposing the plan, calling it “one of the largest infringements of data privacy in our nation’s history.”

And let’s not forget that the IRS has shown that it is untrustworthy.

The bureaucracy repeatedly has leaked information and used its power to advance the leftist policy agenda.

All of which probably helps to explain why polling data shows overwhelming opposition to this Orwellian scheme.

Let’s close by debunking the White House claim that more IRS snooping on bank accounts will collect more revenue from the rich.

Simply stated, rich people are very clever about legal tax avoidance. They do things like invest in tax-free municipal bonds (which is not good for the economy, but it’s a very effective way of escaping tax).

Or they rely on building wealth with investments, since only the most crazy leftists (like Elizabeth Warren) would support taxes on unrealized capital gains.

So who would be targeted if Congress approves this plan to let the IRS snoop on bank accounts?

Primarily owners of small businesses. The IRS basically adopts the view that all entrepreneurs under report cash income and deduct personal expenses on their business tax returns.

Some of that actually happens, of course, but the best way to improve compliance is lower tax rates, not a massive expansion of the surveillance state.

———

Image credit: EFF Photos | CC BY 2.0.