Back in 2013, the Tax Foundation published a report that reviewed 26 academic studies on taxes and growth.

That scholarly research produced a very clear message: The overwhelming consensus was that higher tax rates were bad news for prosperity, especially soak-the-rich tax increases that reduced incentives for productive activities such as work, saving, investment, and entrepreneurship.

That compilation of studies was very useful because then-President Obama was a relentless advocate of class-warfare tax policy.

And he partially succeeded with an agreement on how to deal with the so-called “fiscal cliff.”

Well, as Yogi Berra might say, it’s “deju vu all over again.” Joe Biden is in the White House and he’s proposing a wide range of tax increases.

It’s unclear whether Biden will gain approval for his proposals, but I’ve already produced a four-part series on why they are very misguided.

- In Part I, I showed that the tax code already is biased against upper-income taxpayers.

- In Part II, I explained how the tax hike would have Laffer-Curve implications, meaning politicians would not get a windfall of tax revenue.

- In Part II, I pointed out that the plan would saddle America with the developed world’s highest corporate tax burden.

- In Part IV, I shared data on the negative economic impact of higher taxes on productive behavior.

The bottom line is that the United States should not copy France by penalizing entrepreneurs, innovators, investors, and business owners.

Particularly since the rest of us are usually collateral damage when politicians try to punish successful taxpayers.

So it’s serendipity that the Tax Foundation has just updated it’s list of research with a new report looking at seven new high-level academic studies.

Here’s some of what the report says about class-warfare tax policy.

With the Biden administration proposing a variety of new taxes, it is worth revisiting the literature on how taxes impact economic growth. …we review this new evidence, again confirming our original findings: Taxes, particularly on corporate and individual income, harm economic growth. …We investigate papers in top economics journals and National Bureau of Economic Research (NBER) working papers over the past few years, considering both U.S. and international evidence. This research covers a wide variety of taxes, including income, consumption, and corporate taxation.

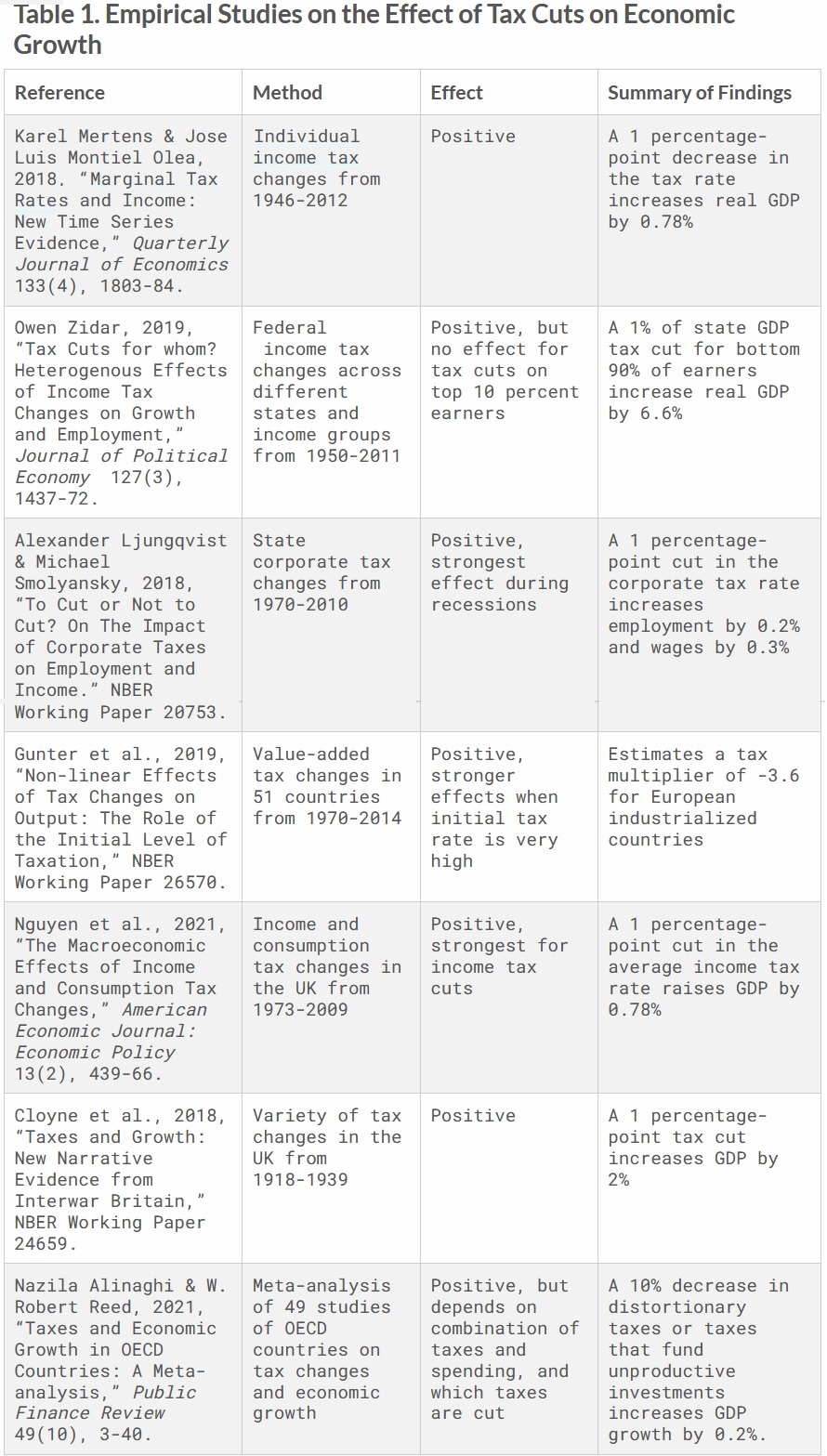

And here’s the table summarizing the impact of lower tax rates on economic performance, so it’s easy to infer what will happen if tax rates are increased instead.

Some of these findings may not seem very significant, such as changes in key economic indicators of 0.2%, 0.78%, or 0.3%.

But remember that even small changes in economic growth can lead to big changes in national prosperity.

P.S. In an ideal world, Washington would be working to boost living standards by adopting a flat tax. In the real world, the best-case scenario is simply avoiding policies that will make America less competitive.