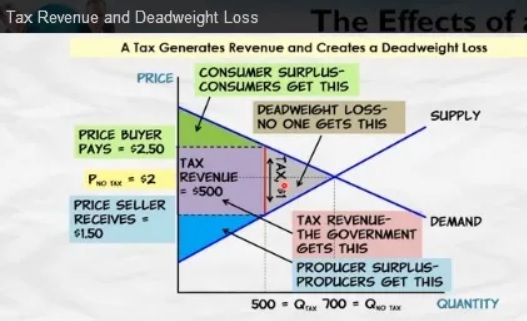

When I discuss class-warfare tax policy, I want people to understand deadweight loss, which is the term for the economic output that is lost when high tax rates discourage work, saving, investment, and entrepreneurship.

And I especially want them to understand that the economic damage grows exponentially as tax rates increase (in other words, going from a 30 percent tax rate to a 40 percent tax rate is a lot more damaging than going from a 10 percent tax rate to a 20 percent tax rate).

But all of this analysis requires a firm grasp of supply-and-demand curves. And most people never learned basic microeconomics, or they forgot the day after they took their exam for Economics 101.

So when I give speeches about the economics of tax policy, I generally forgo technical analysis and instead appeal to common sense.

Part of that often includes showing an image of a “philoso-raptor” pondering whether the principle that applies to tobacco taxation also applies to taxes on work.

Almost everyone gets the point, especially when I point out that politicians explicitly say they want higher taxes on cigarettes because they want less smoking.

And if you (correctly) believe that higher taxes on tobacco lead to less smoking, then you also should understand that higher taxes on work will discourage productive behavior.

Unfortunately, these common-sense observations don’t have much impact on politicians in Washington. Joe Biden and Democrats in Congress are pushing a huge package of punitive tax increases.

Should they succeed, all taxpayers will suffer. But some will suffer more than others. In an article for CNBC, Robert Frank documents what Biden’s tax increase will mean for residents of high-tax states.

Top earners in New York City could face a combined city, state and federal income tax rate of 61.2%, according to plans being proposed by Democrats in the House of Representatives. The plans being proposed include a 3% surtax on taxpayers earning more than $5 million a year. The plans also call for raising the top marginal income tax rate to 39.6% from the current 37%. The plans preserve the 3.8% net investment income tax, and extend it to certain pass-through companies. The result is a top marginal federal income tax rate of 46.4%. …In New York City, the combined top marginal state and city tax rate is 14.8%. So New York City taxpayers…would face a combined city, state and federal marginal rate of 61.2% under the House plan. …the highest in nearly 40 years. Top earning Californians would face a combined marginal rate of 59.7%, while those in New Jersey would face a combined rate of 57.2%.

You don’t have to be a wild-eyed “supply-sider” to recognize that Biden’s tax plan will hurt prosperity.

After all, investors, entrepreneurs, business owners, and other successful taxpayers will have much less incentive to earn and report income when they only get to keep about 40 cents out of every $1 they earn.

Folks on the left claim that punitive tax rates are necessary for “fairness,” yet the United States already has the developed world’s most “progressive” tax system.

I’ll close with the observation that the punitive tax rates being considered will generate less revenue than projected.

Why? Because households and businesses will have big incentives to use clever lawyers and accountants to protect their income.

Looking for loopholes is a waste of time when rates are low, but it’s a very profitable use of time and energy when rates are high.

P.S. Tax rates were dramatically lowered in the United States during the Reagan years, a policy that boosted the economy and led to more revenues from the rich. Biden now wants to run that experiment in reverse, so don’t expect positive results.

P.P.S. Though if folks on the left are primarily motivated by envy, then presumably they don’t care about real-world outcomes.